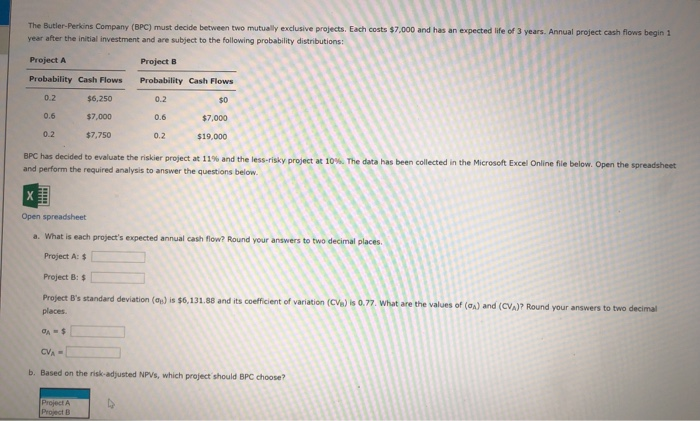

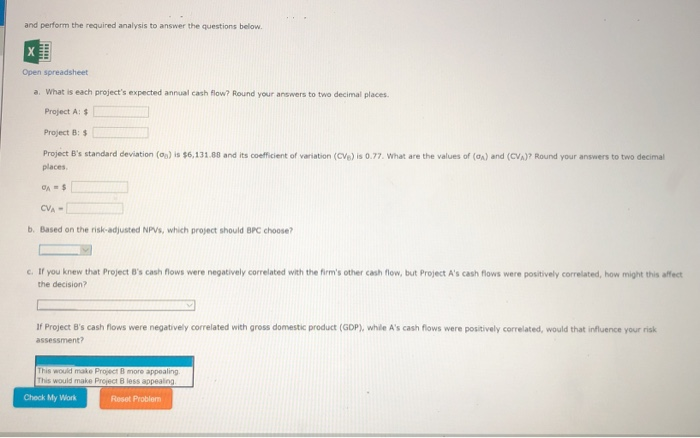

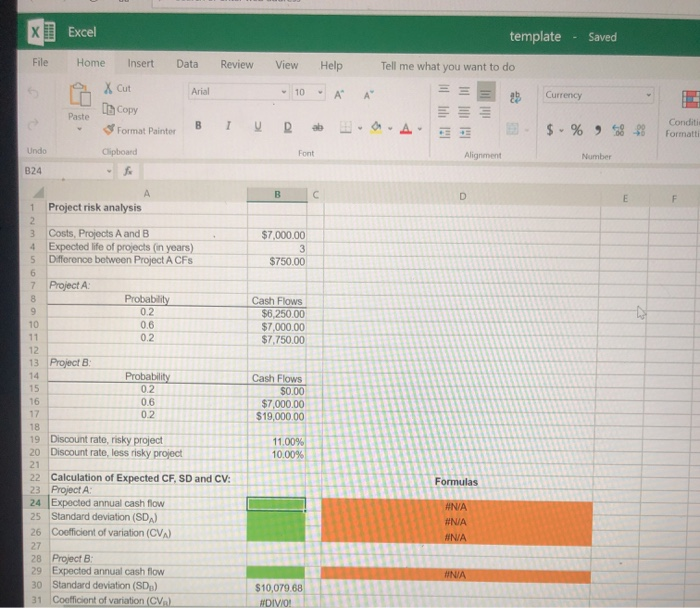

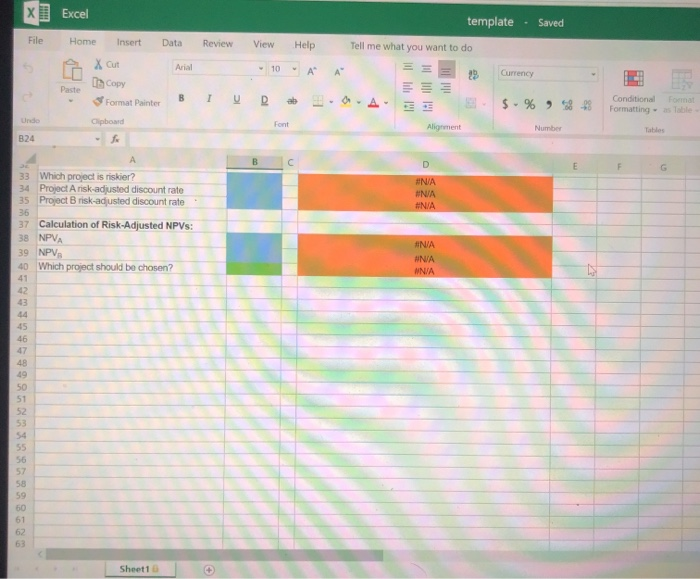

The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $7,000 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows $6.250 $7,000 $7,750 $7,000 0.6 0.2 0.2 $19.000 been collected in the Microsoft Excel Online Ne below Open BPC has decided to evaluate the riskier project at 11% and perform the required analysis to answer the questions below the spreadsheet X1 Open spreadsheet What is each project's expected an cash flow Round and your answers to two decima Project As Project B: $ Project B's standard deviation () is $6,131.88 and its coefficient of variati places the values of (01) and (CVA)? Round your answers to two decimal b. Based on the risk-adjusted NPVs, which project should BPC choose? 6 x] Excel template - Saved File Home Insert Data Review View Help Tell me what you want to do 9 X cut Arial - 10 A A = Currency In Copy Paste Format Painter BIDEA 3 $ -% Undo Clipboard Alignment B24 Conditi 8 Font F 1 Project risk analysis $7,000.00 Costs, Projects A and B Expected life of projects (in years) Difference between Project A CFS $750.00 DO Project A Probability 0.2 06 02 Cash Flows $6,250.00 $7,000.00 $7,750.00 13 Project B Probability 02 0.6 Cash Flows $0.00 $7,000.00 $19,000.00 02 11.00% Discount rate, risky project 20 Discount rate, less risky project 1000 Formulas 22 Calculation of Expected CF, SD and CV: 23 Project A 24 Expected annual cash flow 25 Standard deviation (SDA) 26 Coofficient of variation (CV) #NA #N/A #NA INA 28 Project B 29 Expected annual cash flow 30 Standard deviation (SD) 31 Coefficient of variation (CV) $10,079,68 #DIVO x Excel template - Saved File Review View Help Tell me what you want to do Home A x Insert Data cut Arial Copy Format Painter B 10 A A Currency connat . $. % 9 > 707 Conditional Formatting - 813 pod 24 33 Which project is riskier? 34 Project A risk-adjusted discount rate 35 Project Brisk-adjusted discount rate ENIA UNA ENA UNA 37 Calculation of Risk-Adjusted NPVs: 38 NPVA 39 NPV, 40 Which project should be chosen? Sheet1