Question

The buyer and the seller of a future on Monday with an underlying value of 90,000 are both required to provide an initial margin of

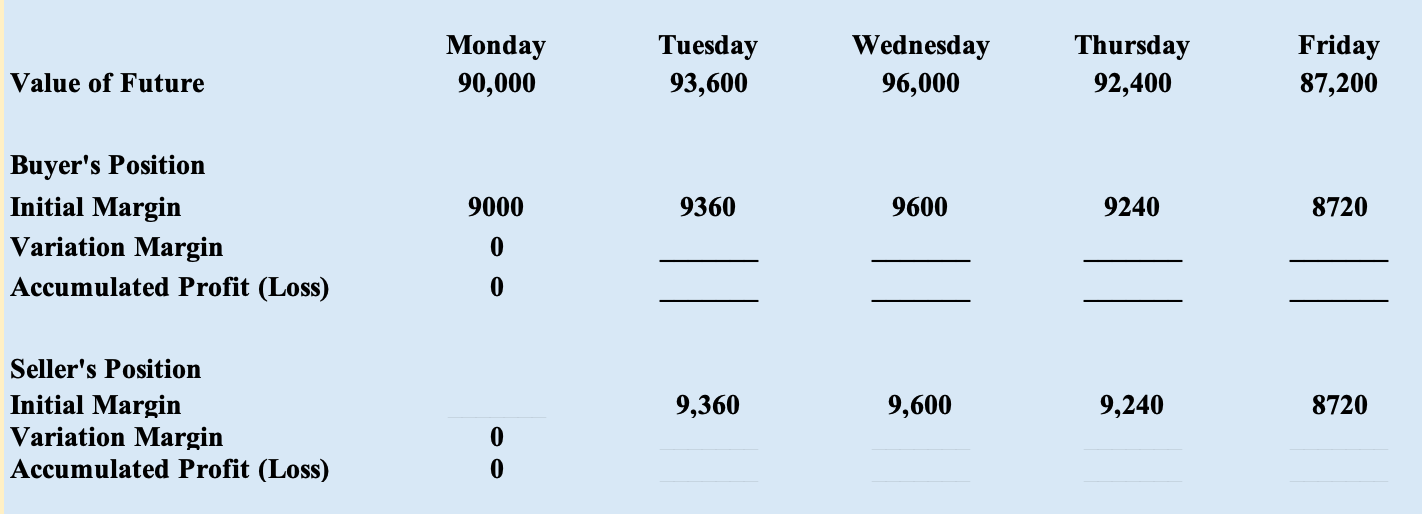

The buyer and the seller of a future on Monday with an underlying value of 90,000 are both required to provide an initial margin of 10 percent, assuming that counterparties have to keep all of the initial margins permanently as a buffer (i.e. the maintenance margin will always be equal to the initial margin).

a. Calculate the variation margins and the accumulated profit/loss if the price of the underlying asset changes as presented in the table.

?

b) Calculate the return and the % return for the holding period (Monday to Friday) for the seller of this future based on the above information.

c) Explain what is meant by 'gearing returns' with reference to this example. (Hint: gearing has the same meaning as leverage, note how the returns in the Imaginationum are amplified in the futures contract and comment on it.)

Value of Future Buyer's Position Initial Margin Variation Margin Accumulated Profit (Loss) Seller's Position Initial Margin Variation Margin Accumulated Profit (Loss) Monday 90,000 9000 0 0 Tuesday 93,600 9360 9,360 Wednesday 96,000 9600 9,600 Thursday 92,400 9240 9,240 Friday 87,200 8720 8720

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the variation margins and accumulated profitloss we need to understand the concept of variation margin Variation margin is the amount of money that needs to be added or subtracted from th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started