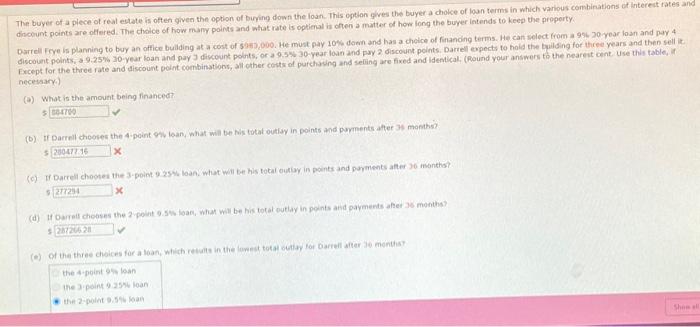

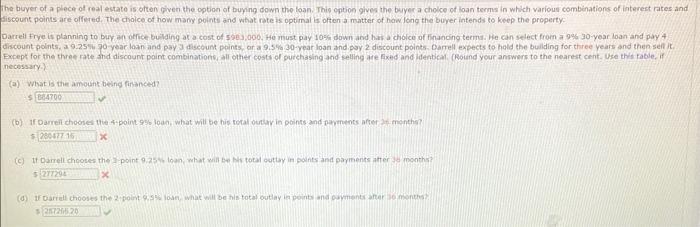

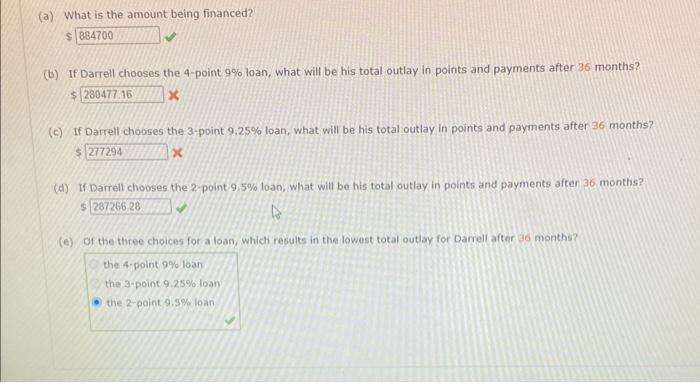

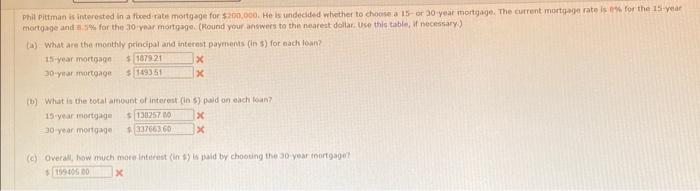

The buyer of a plece of real ectate is often given the option of biping down the loan. This copbon gives the buyer a choke of loan terms in which various combinations of litereit fates allo dincount points are offered. The chaice of how many points and what rate is optienal is often a matter of hor long the buyer intends to keep the property. Darreli Fcye is planning to boy an office bullding at a cost of 53+7,000. He must pay 10% down and has a cheice of finanoing terms. He can select trom a 996 . 20 year loan and pay 4 diccoint points; 39.25% 30-year loan and pay 3 diccount pobits, or a 9.5%30-yeat loan and pay 2 discourt points. Darrell eopects to hoid the tyilding for three years and then seil it. Fxcept for the three rate and discount point combinations, all other conts of purchasing and seling are fixed and lidentical. (found your answers to the neareit cent Use this table, it necesarki) (a) What is the amount being financedt. (b) If pactell chooses the 4-point 9iv loan, what will be Nis totat outioy in points and purments atter 38 months? (c) If Darrell chootes the 3-point 9.25 w loan. what weil bet his total outioy in points and phments anter 36 montho? 3 (d) If oarelf chooses the 2. point 9.5 w loac, what wal be his total outlay in points and payments afee as months? the a-point gwo loan the 3ipoint 9 aski toan the buyer of a plece of real estate is ofton given the option of buying down the loan. This coton gives the buryer a cholce of loan terms in which various combinations of interest rates and discount points are offered. The chaice of how many points and what rote is optimal is often a matter of haw long the buyer intends to keep the property: Darrell frye is planning to buy an ofrice bulding at a cost of 5963,000 , He must pay 1054 down and has a cholce of financing terms. He can select from a gos 30 - yoar loan and pay 4 discount polnts, 19.25%70 year laan and pay 3 diseoumt peints, or a 9.5%. 30 -year loan and poy 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinatione, all other costi of curchssing and selling are fixed and lidentical, (Round your answers to the nearest cent. Use this rable. If necossary-) (a) What is the amount besing financed? (b) If Darrel choones the 4-point gys loan, what wili be his toral outar in points and pepthents after at- menthe? x. (c) It Darrell chooses the 3 point 9.25%, 60 , what will be As total cutlay in points and payments atter ad months?? Th. (d) If oarrall chooses the 2 point 9.9% losh, what will be his total outlay ia poinb ond ouyments aner io montss? (a) What is the amount being financed? (b) If Darrell chooses the 4 -point 9% loan, what will be his total outlay in points and payments after 36 months? (c) If Darrell chooses the 3-point 9.25% loan, what will be his total outlay in points and payments aften 36 months? (d) If Darrell chooses the 2-point 9.5% loan, what will be his total outlay in points and payments after 36 months? (e) Of the three choices for a loan, which resuits in the lowest total outlay for Darrell after 36 months? the 4 -point 9% loan the 3-point 9.25% loan the 2-point 9.5% loan mortgage and 1 . S\%s for the 30 year mortgage. (Round your answers to the nearest doliar. Use this table, if necessary) (a). What are the monthly prinoipal aind interest paymens (in 3) for aach loan? 15 year mortgage 30y ar mortgage (b) What is the toral amount of interest (in 5) pald on each loan? 15 year mortgage 30 year mortgage (c) overall, how much mote interest (in 1 ) is paid by chooting the 30 year inortgsge? s. x