Question

The Calamity Mining Company will cease operations in one year. At the end of the year the firm will liquidate all its assets including any

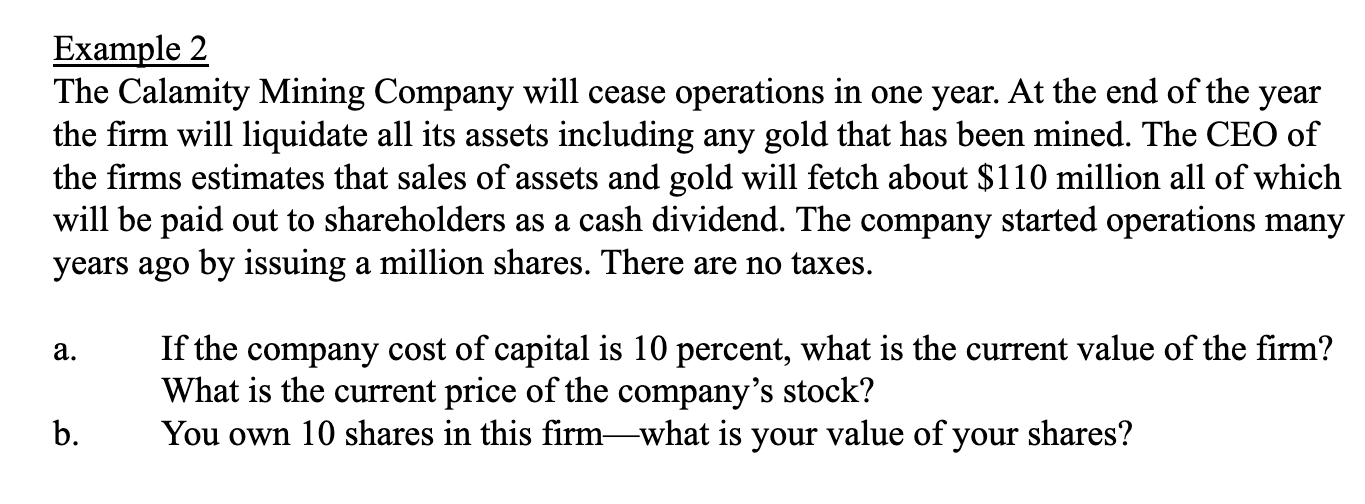

The Calamity Mining Company will cease operations in one year. At the end of the year the firm will liquidate all its assets including any gold that has been mined. The CEO of the firms estimates that sales of assets and gold will fetch about $110 million all of which will be paid out to shareholders as a cash dividend. The company started operations many years ago by issuing a million shares. There are no taxes.

a. If the company cost of capital is 10 percent, what is the current value of the firm? What is the current price of the companys stock?

b. You own 10 shares in this firmwhat is your value of your shares?

Example 2 The Calamity Mining Company will cease operations in one year. At the end of the year the firm will liquidate all its assets including any gold that has been mined. The CEO of the firms estimates that sales of assets and gold will fetch about $110 million all of which will be paid out to shareholders as a cash dividend. The company started operations many years ago by issuing a million shares. There are no taxes. a. If the company cost of capital is 10 percent, what is the current value of the firm? What is the current price of the company's stock? You own 10 shares in this firmwhat is your value of your shares? bStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started