Question

The calculations for this assignment will involve an imaginary investment scenario. The data shown represents outlays (expenses) in red, and inflows (revenues) in green. The

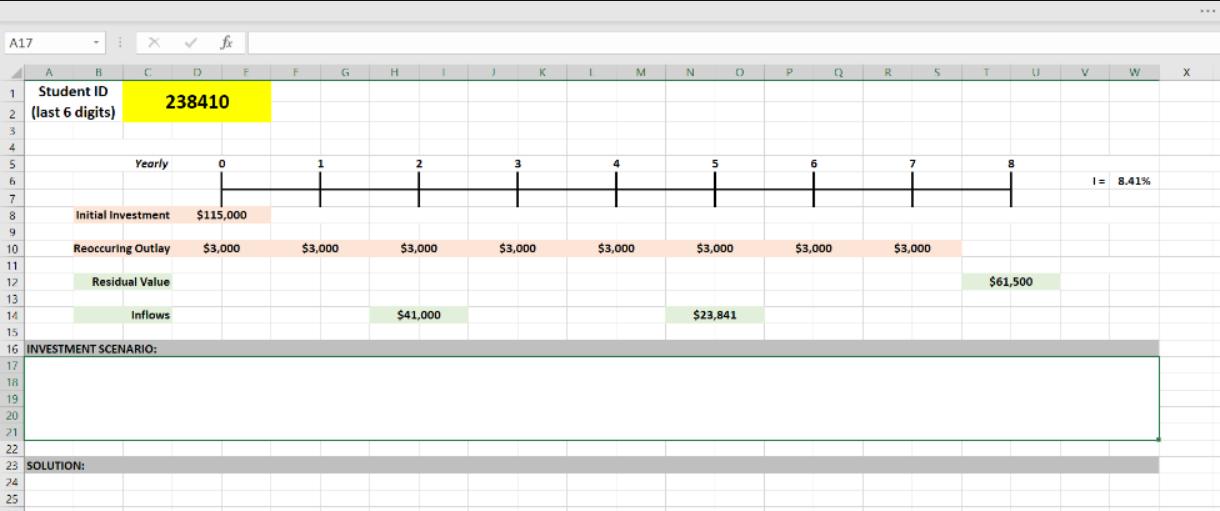

The calculations for this assignment will involve an imaginary investment scenario. The data shown represents outlays (expenses) in red, and inflows (revenues) in green. The interest rate provided is assumed to be a nominal annual rate, compounded annually. This can also be called an IRR (internal rate of return).

Beginning in Cell A17, you will create the problem/investment scenario that corresponds to the timeline generated using your student number. Every student will have a different scenario! Be creative. This scenario should be written in full sentences, using proper grammar and mathematical terminology. The scenario should incorporate all relevant information contained in the timeline. As a guide, think about what you would need to include if the timeline didn't already exist. Do not forget about any information.

You will not be given full marks if you simply state the values in the problem. You must create a realistic scenario on which the numbers could be based.

Step 3: Solve the Investment Problem

Solve the investment problem using Excel. Remember to include ALL work (show all the variables required in Excel), and communicate your process. Your final answer should be clearly visible and a final sentence and investment recommendation should be included.

A17 G M. V X Student ID 238410 2 (last 6 digits) 4 Yearly 3. I= 8.41% 7 8 Initial Investment $115,000 10 Reoccuring Outlay $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 11 12 Residual Value $61,500 13 14 Inflows $41,000 $23,841 15 16 INVESTMENT SCENARIO: 17 18 19 20 21 22 23 SOLUTION: 24 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Please conisder the below situation for the facts of the case I am considering purchasing a computer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started