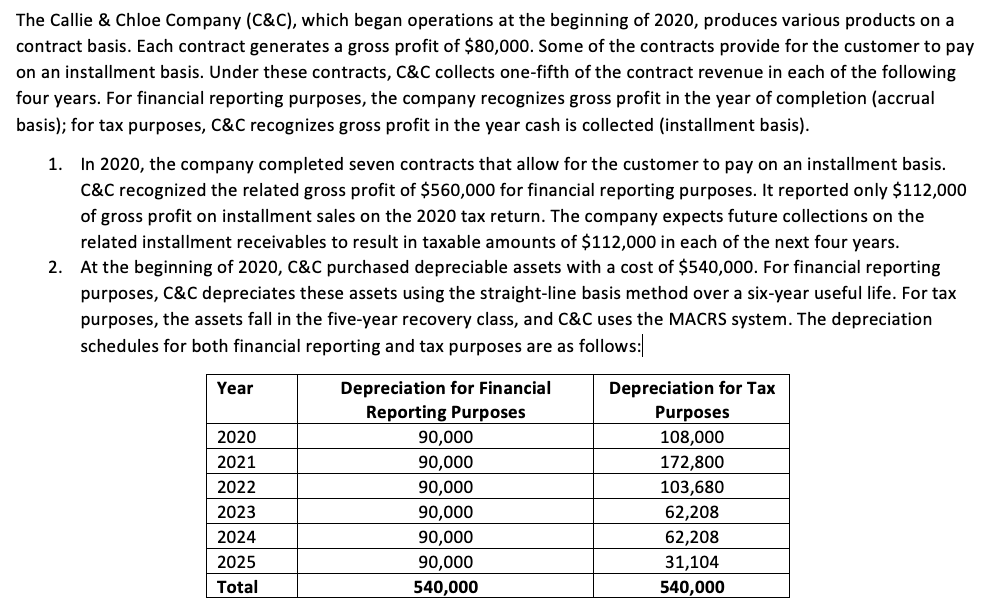

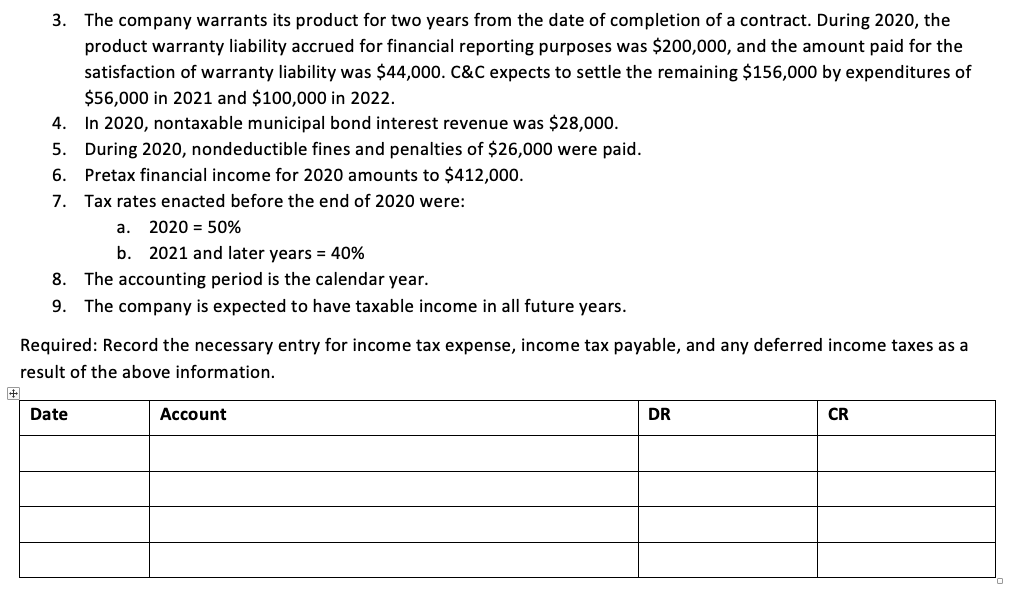

The Callie & Chloe Company (C&C), which began operations at the beginning of 2020, produces various products on a contract basis. Each contract generates a gross profit of $80,000. Some of the contracts provide for the customer to pay on an installment basis. Under these contracts, C&C collects one-fifth of the contract revenue in each of the following four years. For financial reporting purposes, the company recognizes gross profit in the year of completion (accrual basis); for tax purposes, C&C recognizes gross profit in the year cash is collected (installment basis). 1. In 2020, the company completed seven contracts that allow for the customer to pay on an installment basis. C&C recognized the related gross profit of $560,000 for financial reporting purposes. It reported only $112,000 of gross profit on installment sales on the 2020 tax return. The company expects future collections on the related installment receivables to result in taxable amounts of $112,000 in each of the next four years. 2. At the beginning of 2020, C&C purchased depreciable assets with a cost of $540,000. For financial reporting purposes, C&C depreciates these assets using the straight-line basis method over a six-year useful life. For tax purposes, the assets fall in the five-year recovery class, and C&C uses the MACRS system. The depreciation schedules for both financial reporting and tax purposes are as follows: Year 2020 2021 2022 2023 2024 2025 Total Depreciation for Financial Reporting Purposes 90,000 90,000 90,000 90,000 90,000 90,000 540,000 Depreciation for Tax Purposes 108,000 172,800 103,680 62,208 62,208 31,104 540,000 3. The company warrants its product for two years from the date of completion of a contract. During 2020, the product warranty liability accrued for financial reporting purposes was $200,000, and the amount paid for the satisfaction of warranty liability was $44,000. C&C expects to settle the remaining $156,000 by expenditures of $56,000 in 2021 and $100,000 in 2022. 4. In 2020, nontaxable municipal bond interest revenue was $28,000. 5. During 2020, nondeductible fines and penalties of $26,000 were paid. 6. Pretax financial income for 2020 amounts to $412,000. 7. Tax rates enacted before the end of 2020 were: 2020 = 50% b. 2021 and later years = 40% 8. The accounting period is the calendar year. 9. The company is expected to have taxable income in all future years. a. Required: Record the necessary entry for income tax expense, income tax payable, and any deferred income taxes as a result of the above information. Date Account DR CR