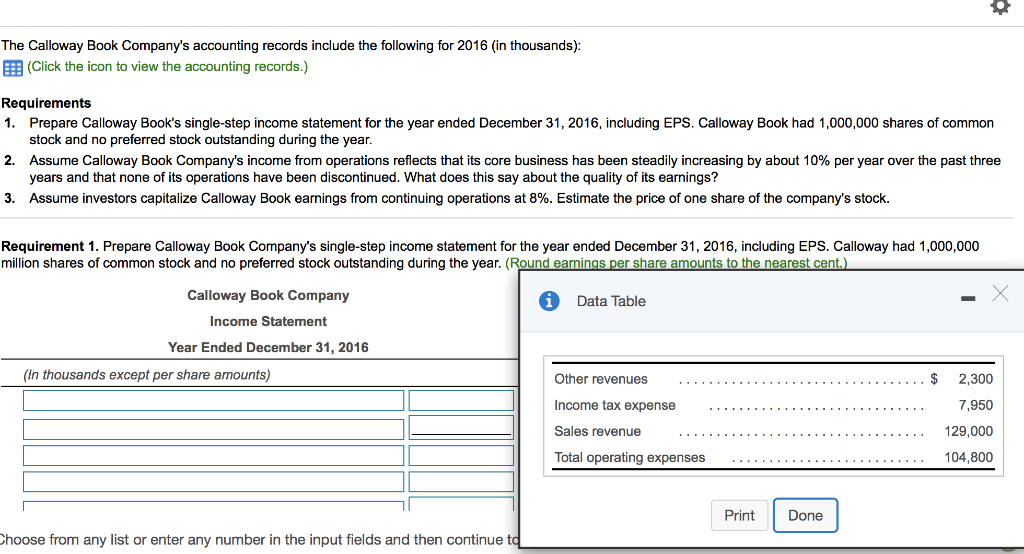

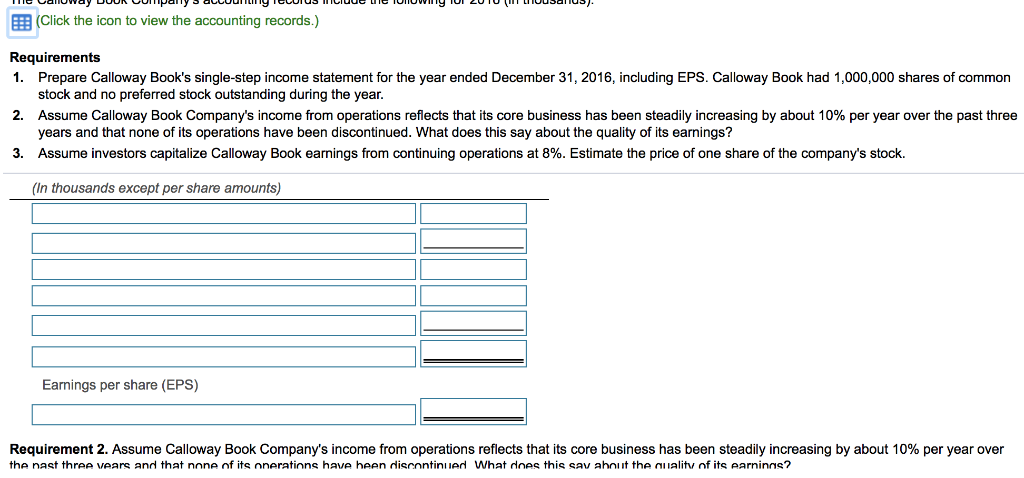

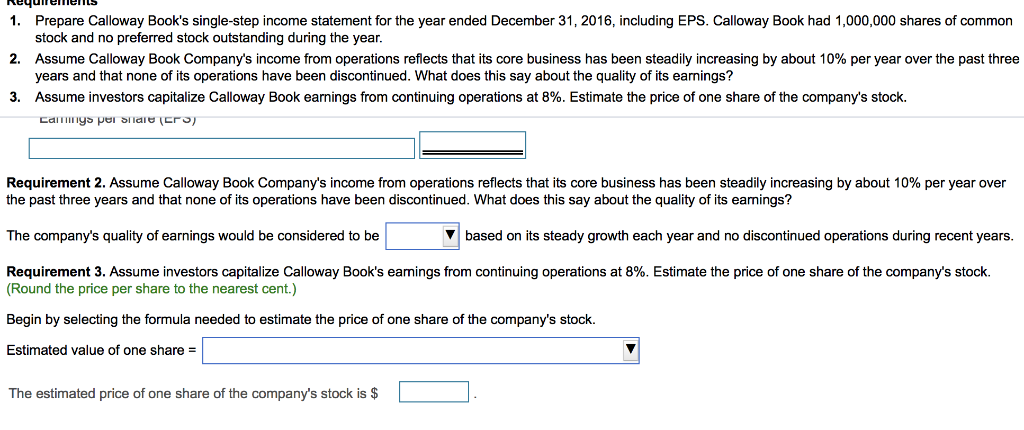

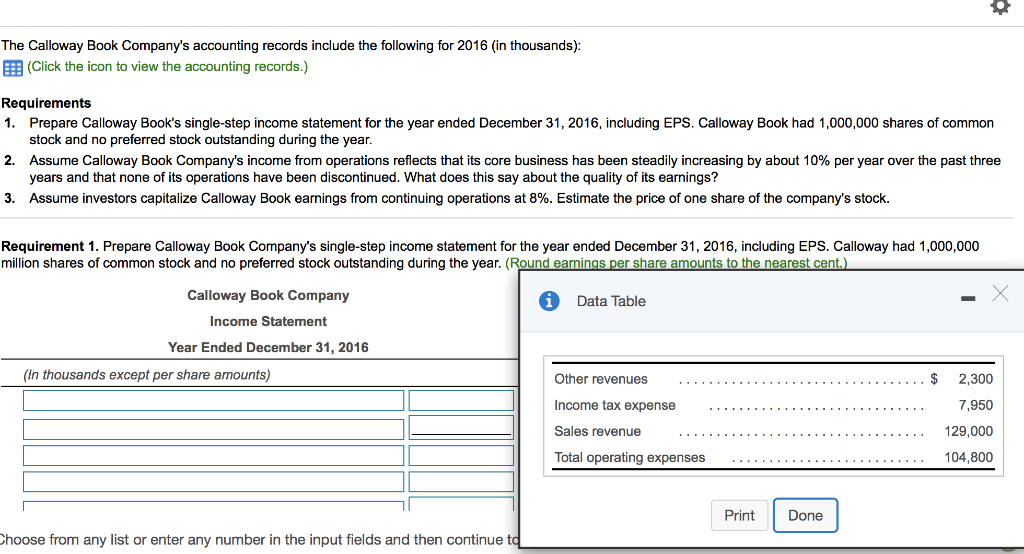

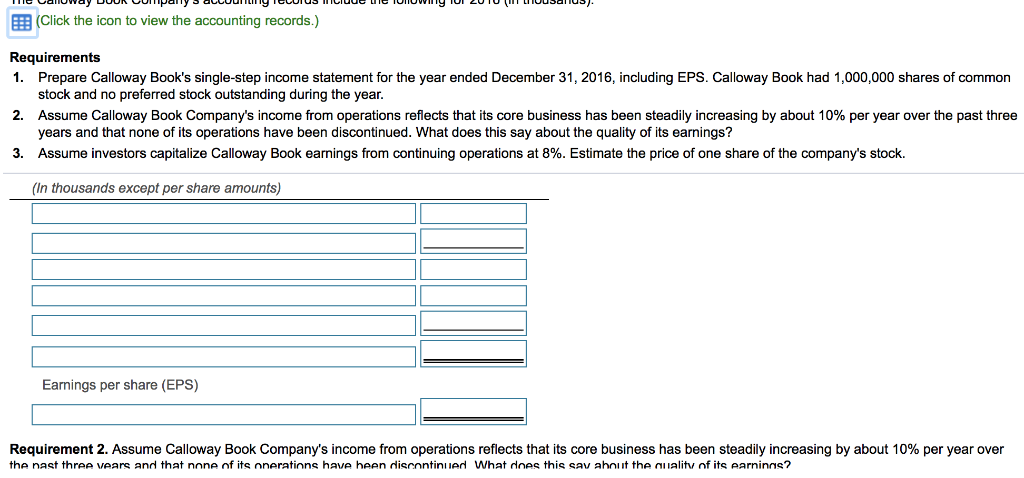

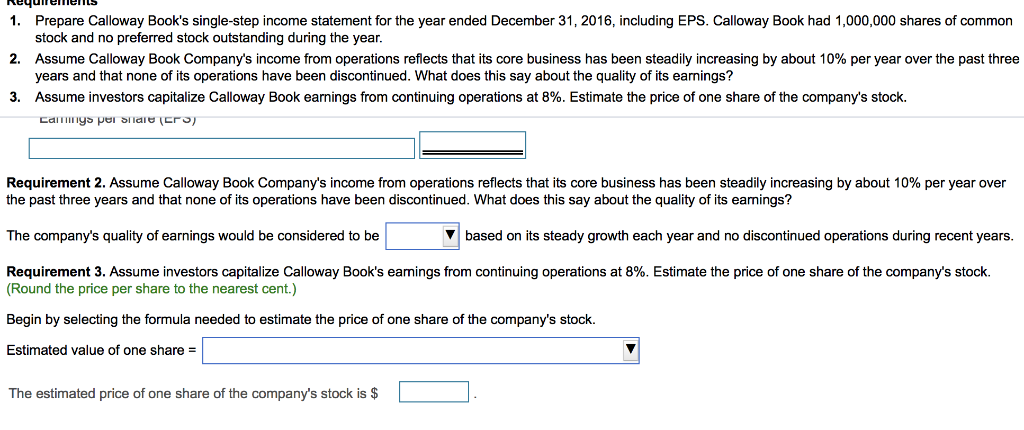

The Calloway Book Company's accounting records include the following for 2016 (in thousands): (Click the icon to view the accounting records.) Requirements 1. Prepare Calloway Book's single-step income statement for the year ended December 31, 2016, including EPS. Calloway Book had 1,000,000 shares of common stock and no preferred stock outstanding during the year. 2. Assume Calloway Book Company's income from operations reflects that its core business has been steadily increasing by about 10% per year over the past three years and that none of its operations have been discontinued. What does this say about the quality of its earnings? 3. Assume investors capitalize Calloway Book earnings from continuing operations at 8%. Estimate the price of one share of the company's stock. Requirement 1. Prepare Calloway Book Company's single-step income statement for the year ended December 31, 2016, including EPS. Calloway had 1,000,000 million shares of common stock and no preferred stock outstanding during the year. (Round earnings per share amounts to the nearest cent. Calloway Book Company i Data Table - X Income Statement Year Ended December 31, 2016 (In thousands except per share amounts) .......$ Other revenues ................... Income tax expense 2,300 7,950 129,000 Sales revenue Total operating expenses 104,800 Print Done Choose from any list or enter any number in the input fields and then continue td HC CalWay DUUR LUMPally SaLLUUITY ICCUIUS MILIU CIUIUWIITY IUI 20IU (IT LIIUUSUTUS). (Click the icon to view the accounting records.) Requirements 1. Prepare Calloway Book's single-step income statement for the year ended December 31, 2016, including EPS. Calloway Book had 1,000,000 shares of common stock and no preferred stock outstanding during the year. 2. Assume Calloway Book Company's income from operations reflects that its core business has been steadily increasing by about 10% per year over the past three years and that none of its operations have been discontinued. What does this say about the quality of its earnings? 3. Assume investors capitalize Calloway Book earnings from continuing operations at 8%. Estimate the price of one share of the company's stock. (In thousands except per share amounts) Earnings per share (EPS) Requirement 2. Assume Calloway Book Company's income from operations reflects that its core business has been steadily increasing by about 10% per year over the nast three Vears and that none of its onerations have been discontinued What does this sav about the quality of its earninns? Neguleerlis 1. Prepare Calloway Book's single-step income statement for the year ended December 31, 2016, including EPS. Calloway Book had 1,000,000 shares of common stock and no preferred stock outstanding during the year. 2. Assume Calloway Book Company's income from operations reflects that its core business has been steadily increasing by about 10% per year over the past three years and that none of its operations have been discontinued. What does this say about the quality of its earnings? 3. Assume investors capitalize Calloway Book earnings from continuing operations at 8%. Estimate the price of one share of the company's stock. Cammys per Share Cro) Requirement 2. Assume Calloway Book Company's income from operations reflects that its core business has been steadily increasing by about 10% per year over the past three years and that none of its operations have been discontinued. What does this say about the quality of its earnings? The company's quality of earnings would be considered to be based on its steady growth each year and no discontinued operations during recent years. Requirement 3. Assume investors capitalize Calloway Book's earnings from continuing operations at 8%. Estimate the price of one share of the company's stock. (Round the price per share to the nearest cent.) Begin by selecting the formula needed to estimate the price of one share of the company's stock. Estimated value of one share = The estimated price of one share of the company's stock is $ L