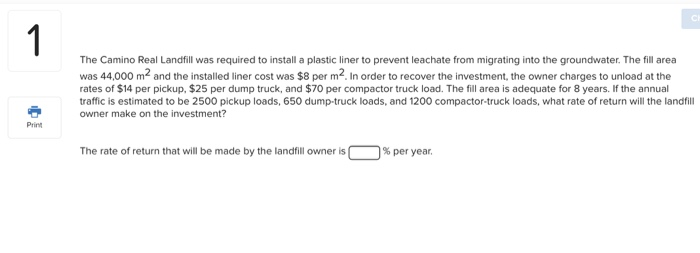

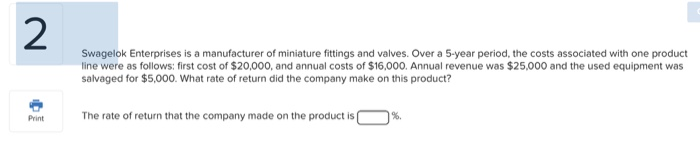

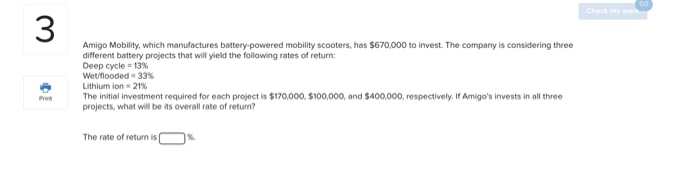

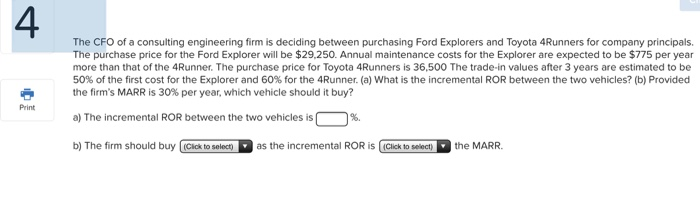

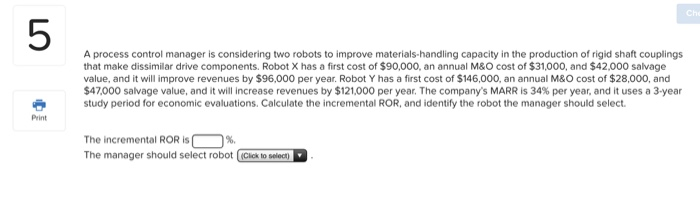

The Camino Real Landfill was required to install a plastic liner to prevent leachate from migrating into the groundwater. The fill area was 44,000 m and the installed liner cost was $8 per m. In order to recover the investment, the owner charges to unload at the rates of $14 per pickup. $25 per dump truck, and $70 per compactor truck load. The fill area is adequate for 8 years. If the annual traffic is estimated to be 2500 pickup loads, 650 dump-truck loads, and 1200 compactor-truck loads, what rate of return will the landfill owner make on the investment? The rate of return that will be made by the landfill owner is % per year. 2 Swagelok Enterprises is a manufacturer of miniature fittings and valves. Over a 5-year period, the costs associated with one product line were as follows: first cost of $20,000, and annual costs of $16,000. Annual revenue was $25,000 and the used equipment was salvaged for $5,000. What rate of return did the company make on this product? Print The rate of return that the company made on the product is %. CWO Amigo Mobility, which manufactures battery powered mobility scooters, has $670,000 to invest. The company is considering three different battery projects that will yield the following rates of return: Deep cycle 13% Wetlooded-33% Lithium ion 21% The initial investment required for each project is $170,000 $100,000, and $400,000, respectively. If Amigo's Invests in all three projects, what will be its overall rate of return? The rate of return is % The CFO of a consulting engineering firm is deciding between purchasing Ford Explorers and Toyota 4Runners for company principals. The purchase price for the Ford Explorer will be $29,250. Annual maintenance costs for the Explorer are expected to be $775 per year more than that of the 4Runner. The purchase price for Toyota 4Runners is 36,500 The trade-in values after 3 years are estimated to be 50% of the first cost for the Explorer and 60% for the 4Runner. (a) What is the incremental ROR between the two vehicles? (b) Provided the firm's MARR is 30% per year, which vehicle should it buy? Print a) The incremental ROR between the two vehicles is %. b) The firm should buy (Click to select as the incremental ROR is (Click to select the MARR Che A process control manager is considering two robots to improve materials-handling capacity in the production of rigid shaft couplings that make dissimilar drive components. Robot X has a first cost of $90,000, an annual M&O cost of $31,000, and $42.000 salvage value, and it will improve revenues by $96,000 per year. Robot Y has a first cost of $146,000, an annual M&O cost of $28,000, and $47.000 salvage value, and it will increase revenues by $121,000 per year. The company's MARR is 34% per year, and it uses a 3-year study period for economic evaluations. Calculate the incremental ROR, and identify the robot the manager should select. The incremental RORISC %. The manager should select robot (Click to select)