Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The campus issued a $15,000,000 term bond that pays a coupon of 3% and matures in 30 years. Coupon payments will be made semi-annually,

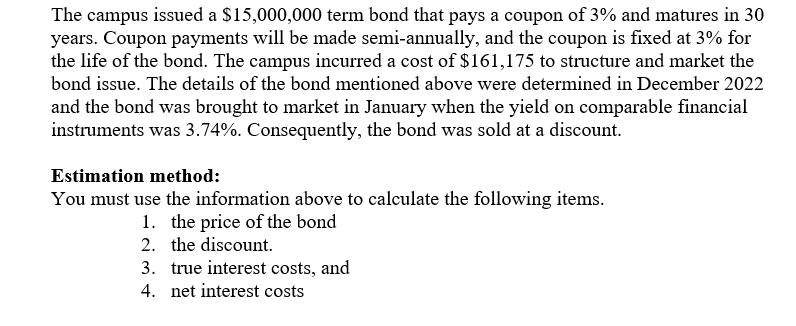

The campus issued a $15,000,000 term bond that pays a coupon of 3% and matures in 30 years. Coupon payments will be made semi-annually, and the coupon is fixed at 3% for the life of the bond. The campus incurred a cost of $161,175 to structure and market the bond issue. The details of the bond mentioned above were determined in December 2022 and the bond was brought to market in January when the yield on comparable financial instruments was 3.74%. Consequently, the bond was sold at a discount. Estimation method: You must use the information above to calculate the following items. 1. the price of the bond 2. the discount. 3. true interest costs, and 4. net interest costs

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 The price of the bond can be calculated using the formula Price of bond Coupon payment 1 Yieldn Coupon payment 1 Yieldn1 Coupon payment Face value 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started