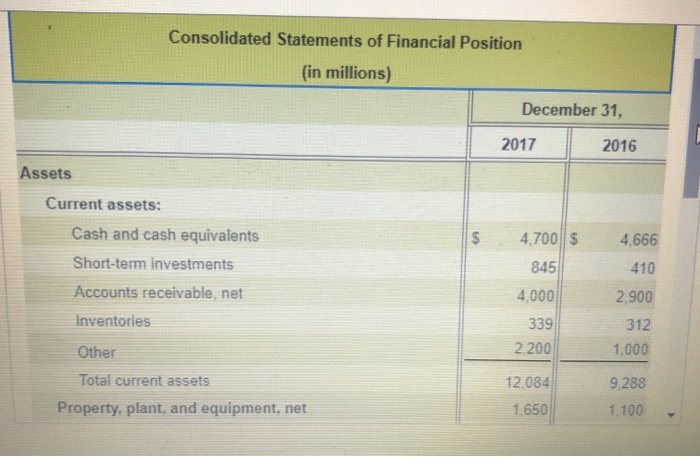

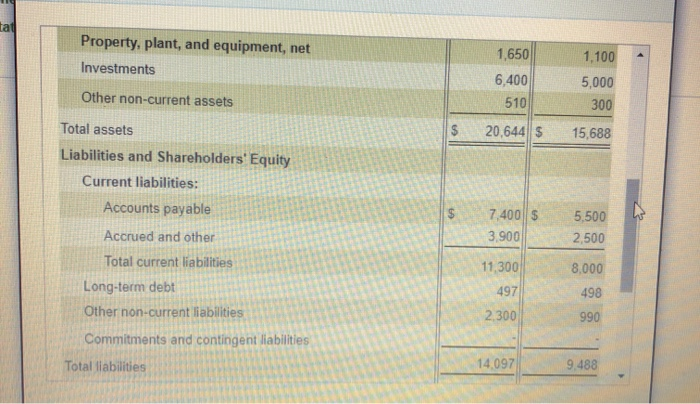

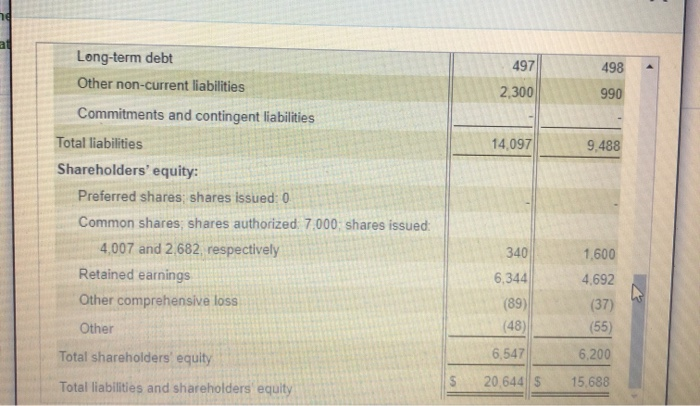

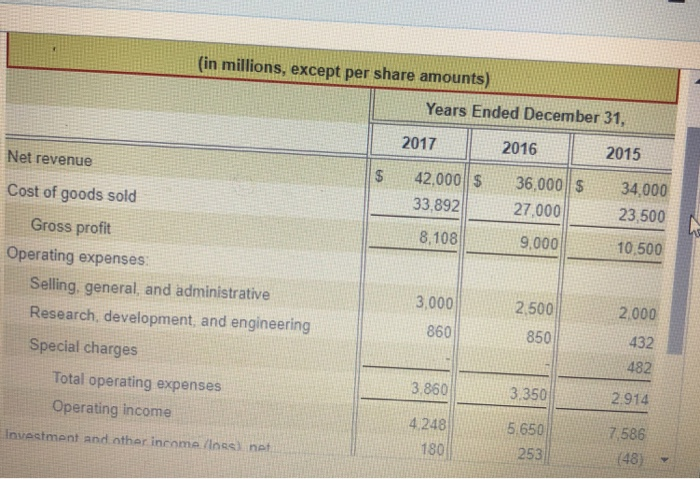

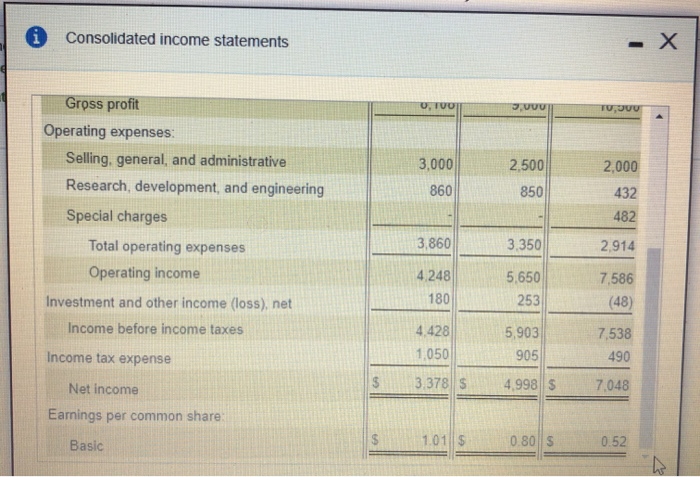

The Canada Technology Corporation (CTC) financial statements follow (Click the icon to view the consolidated balance sheets.) (Click the icon to view the consolidated income statements.) CTC's quick (acid-test) ratio at year-end 2017 is closest to O A. $9.545 million OB. 0.68 OC. 0.84 OD. 0.49 Consolidated Statements of Financial Position (in millions) December 31, 2017 2016 Assets CA 4,700 $ 4,666 Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories 845 410 4.000 2.900 339 2.200 312 1,000 Other Total current assets 12.084 9.288 Property, plant, and equipment, net 1.650 1.100 tat Property, plant, and equipment, net Investments 1,650 6,400 510 1,100 5,000 300 Other non-current assets $ 20,644||$ 15,688 $ 7.400$ 3,900 5,500 2,500 Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued and other Total current liabilities Long-term debt Other non-current liabilities Commitments and contingent liabilities Total liabilities 11,300 497 2.300 8,000 498 990 14.097 9.488 al 497 498 2,300 990 14.097 9.488 Long-term debt Other non-current liabilities Commitments and contingent liabilities Total liabilities Shareholders' equity: Preferred shares; shares issued: 0 Common shares shares authorized: 7.000 shares issued: 4,007 and 2.682, respectively Retained earnings Other comprehensive loss Other Total shareholders' equity 340 1.600 4.692 6,344 (89) (48) (37) (55) 6,547 6.200 CA Total liabilities and shareholders equity 20.6445 15.688 (in millions, except per share amounts) Years Ended December 31, 2017 Net revenue 2016 2015 $ 42,000 $ 33,892 36,000 $ 27,000 34,000 23,500 8,108 9,000 10,500 Cost of goods sold Gross profit Operating expenses Selling, general, and administrative Research, development, and engineering Special charges 3,000 2.500 860 850 2.000 432 482 3.860 3.350 Total operating expenses Operating income Investment and other income lines) net 2.914 4.248 180 5.650 253 7,586 748) 0 Consolidated income statements - X U, TUUT JUUU TUJU 3,000 2.500 860 850 Gross profit Operating expenses: Selling, general, and administrative Research, development, and engineering Special charges Total operating expenses Operating income Investment and other income (loss), net Income before income taxes 2,000 432 482 3,860 3.350 2,914 4.248 5,650 253 180 7,586 (48) 4.428 1.050 5,903 905 7,538 490 Income tax expense $ 3.378 $ 4,998 $ 7,048 Net income Earnings per common share: Basic 1.01$ 0.80$ 0.52