Answered step by step

Verified Expert Solution

Question

1 Approved Answer

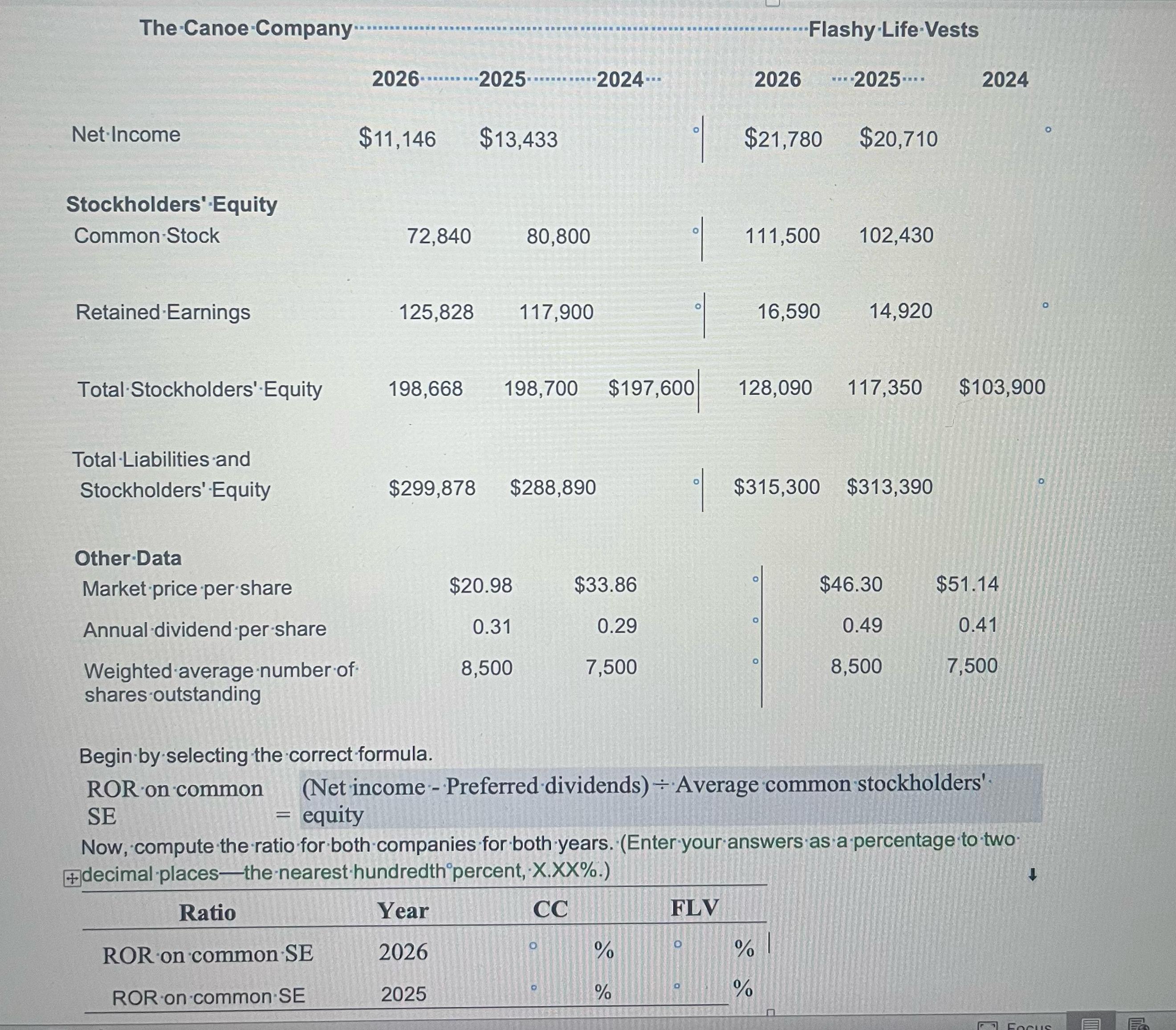

The Canoe Company... Net Income 2026 2025 2024-.- $11,146 $13,433 Flashy Life Vests 2026 ....2025.... 2024 $21,780 $20,710 Stockholders' Equity Common Stock 72,840 80,800

The Canoe Company... Net Income 2026 2025 2024-.- $11,146 $13,433 Flashy Life Vests 2026 ....2025.... 2024 $21,780 $20,710 Stockholders' Equity Common Stock 72,840 80,800 111,500 102,430 Retained Earnings 125,828 117,900 0 16,590 14,920 Total Stockholders' Equity 198,668 198,700 $197,600 128,090 117,350 $103,900 Total Liabilities and Stockholders' Equity $299,878 $288,890 Other Data Market price per share $20.98 $33.86 Annual dividend per share 0.31 0.29 Weighted average number of 8,500 7,500 shares outstanding $315,300 $313,390 O 0 O $46.30 $51.14 0.49 0.41 8,500 7,500 o Begin by selecting the correct formula. ROR on common (Net income - Preferred dividends) Average common stockholders' SE = equity Now, compute the ratio for both companies for both years. (Enter your answers as a percentage to two decimal places-the-nearest hundredth percent, X.XX%.) Ratio Year ROR on common SE 2026 ROR on common SE 2025 CC FLV O % 0 % 200 % a % Focus T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the Return on Common Stockholders Equity ROE using the given formula R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started