Answered step by step

Verified Expert Solution

Question

1 Approved Answer

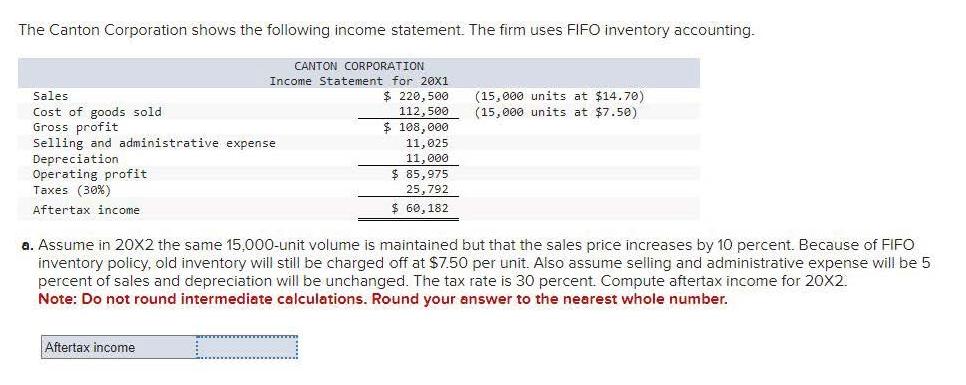

The Canton Corporation shows the following income statement. The firm uses FIFO inventory accounting. Sales Cost of goods sold CANTON CORPORATION Income Statement for

The Canton Corporation shows the following income statement. The firm uses FIFO inventory accounting. Sales Cost of goods sold CANTON CORPORATION Income Statement for 20X1 $ 220,500 112,500 $ 108,000 11,025 (15,000 units at $14.70) (15,000 units at $7.50) Gross profit Selling and administrative expense Depreciation Operating profit Taxes (30%) Aftertax income 11,000 $ 85,975 25,792 $ 60,182 a. Assume in 20X2 the same 15,000-unit volume is maintained but that the sales price increases by 10 percent. Because of FIFO inventory policy, old inventory will still be charged off at $7.50 per unit. Also assume selling and administrative expense will be 5 percent of sales and depreciation will be unchanged. The tax rate is 30 percent. Compute aftertax income for 20X2. Note: Do not round intermediate calculations. Round your answer to the nearest whole number. Aftertax income _

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started