Answered step by step

Verified Expert Solution

Question

1 Approved Answer

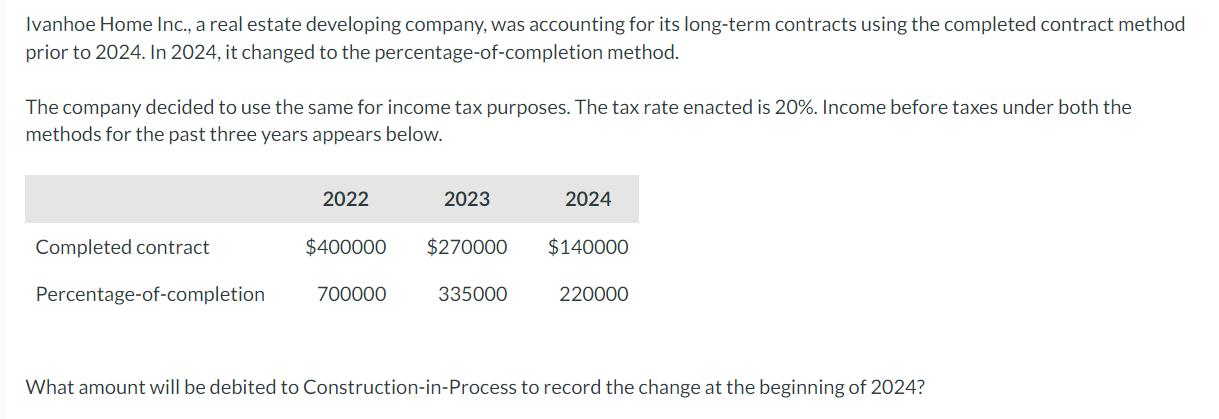

Ivanhoe Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2024. In 2024,

Ivanhoe Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2024. In 2024, it changed to the percentage-of-completion method. The company decided to use the same for income tax purposes. The tax rate enacted is 20%. Income before taxes under both the methods for the past three years appears below. 2022 2023 2024 Completed contract $400000 $270000 $140000 Percentage-of-completion 700000 335000 220000 What amount will be debited to Construction-in-Process to record the change at the beginning of 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The amount debited to ConstructioninProcess CIP to record the change in accounting method in 2024 re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started