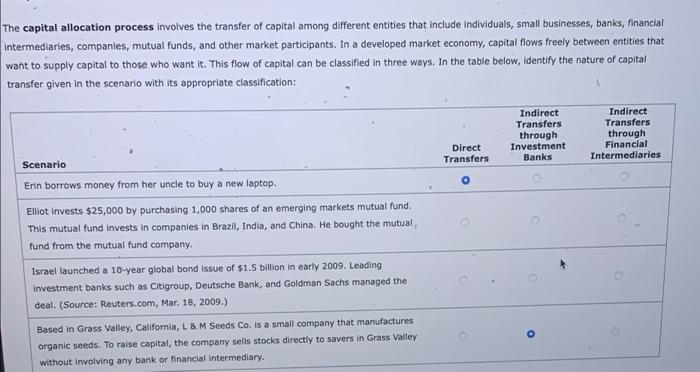

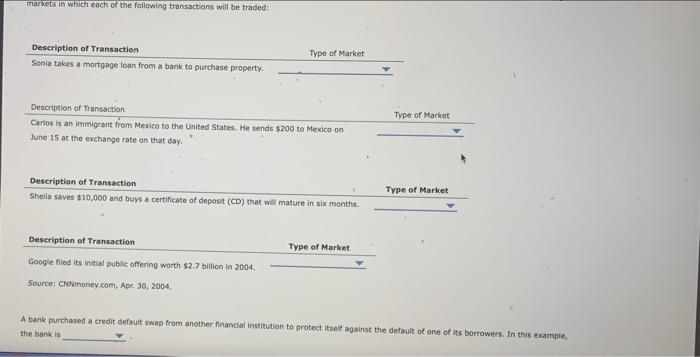

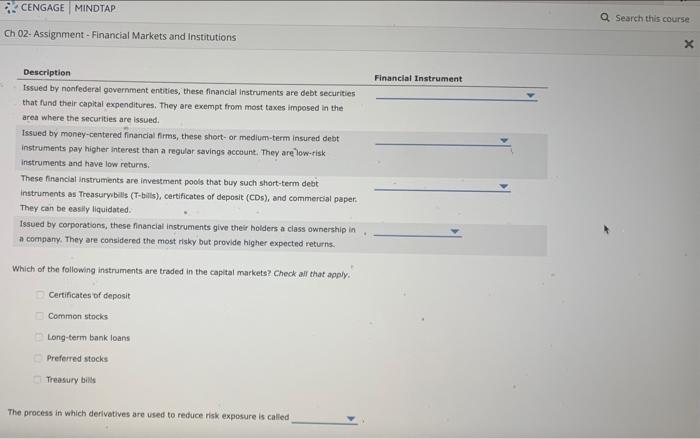

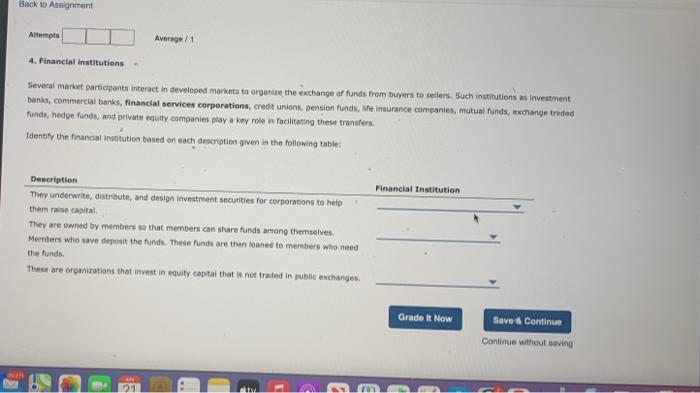

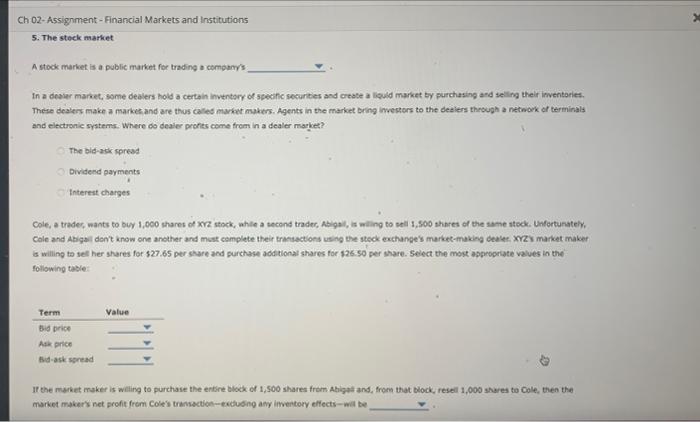

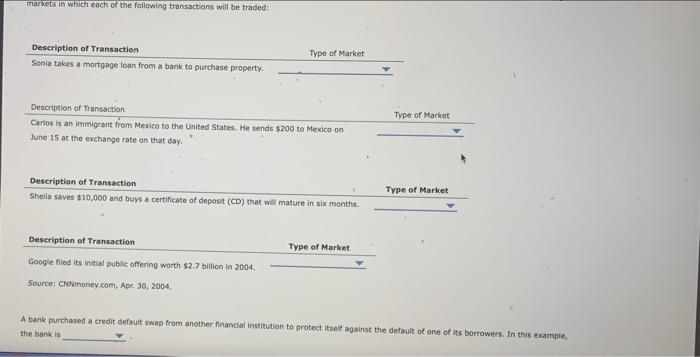

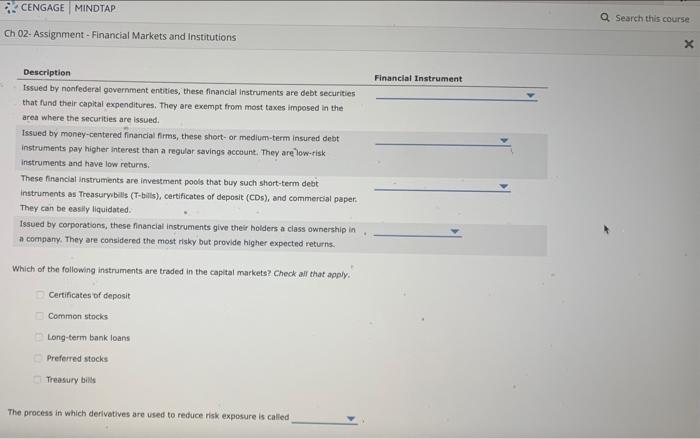

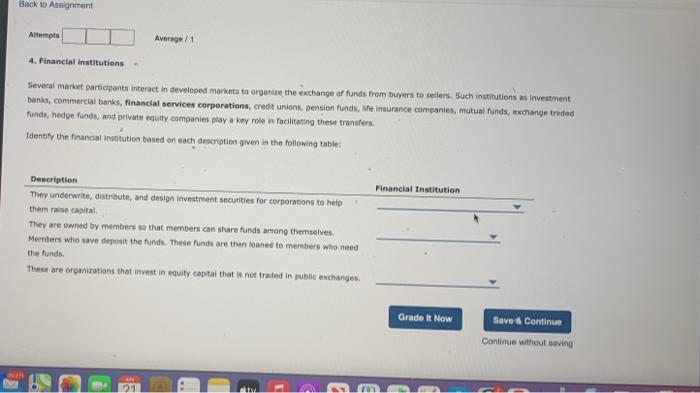

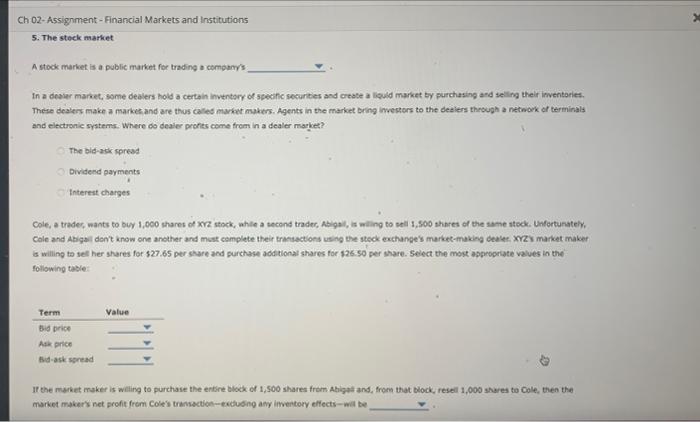

The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial Intermediaries, companles, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries Direct Transfers Scenario Erin borrows money from her uncle to buy a new laptop. Elliot invests $25,000 by purchasing 1,000 shares of an emerging markets mutual fund. This mutual fund invests in companies in Brazil, India, and China. He bought the mutual fund from the mutual fund company. Israel launched a 10-year global bond issue of $1.5 billion in early 2009. Leading investment banks such as Citigroup, Deutsche Bank, and Goldman Sachs managed the deal. (Source: Reuters.com, Mar. 18, 2009.) Based in Grass Valley, California, L&M Seeds Co. is a small company that manufactures organic seeds. To raise capital, the company sells stocks directly to savers in Grass Valley without involving any bank or financial intermediary. markets in which each of the following transactions will be traded: Description of Transaction Sonia takes a mortgage loan from a bank to purchase property. Type of Market Type of Market Description of Transaction Carlos is an immigrant from Mexico to the United States. He sends $200 to Mexico on June 15 at the exchange rate on that day. Description of Transaction Shella saves $10,000 and buys a certificate of deposit (CD) that will mature in six months. Type of Market Description of Transaction Type of Market Google fled its initial public offering worth $2.7 billion in 2004 Source: CNNMoney.com, Apr 30, 2004 A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. In this example, the bank is CENGAGE MINDTAP Search this course Ch 02. Assignment - Financial Markets and Institutions Financial Instrument Description Issued by nonfederal government entities, these financial instruments are debt securities that fund their capital expenditures. They are exempt from most taxes imposed in the area where the securities are issued. Issued by money-centered financial firms, these short-or medium-term Insured debt instruments pay higher interest than a regular savings account. They are low-risk Instruments and have low returns. These financial instruments are investment pools that buy such short-term debt Instruments as Treasury bills (T-bills), certificates or deposit (CDs), and commercial paper. They can be easily liquidated Issued by corporations, these financial instruments give their holders a class ownership in a company. They are considered the most risky but provide higher expected returns. Which of the following instruments are traded in the capital markets? Check all that apply. Certificates of deposit Common stocks Long-term bank loans Preferred stocks Treasury bills The process in which derivatives are used to reduce risk exposure is called Back to Assignment Attempts Average / 1 4. Financial institutions Several market participants interact in developed markets to organize the exchange of funds from buyers to sellers. Such institutions as investment banks, commercial banks, financial services corporations, credit unions, pension funds, the insurance companies, mutual funds, exchange traded funds, hedge funds, and private equity companies play a key role in facilitating these transfers. Identity the financial instution based on each description given in the following tablet Financial Institution Description They underwrite, distribute, and design investment secunities for corporations to help ther raise capital They are owned by members so that members can share funds among themselves. Members who save deposit the funds. These funds are the loaned to members who need the funds. These are organizations that invest in equity capital that not traded in puble exchanges. Grade It Now Save & Continue Continue without saving 21 Ch 02-Assignment - Financial Markets and Institutions 5. The stock market A stock market is a public market for trading company's In a dealer marvet, some dealers hold a certain inventory of specific securities and create a liquid market by purchasing and selling their inventories. These dealers make a market and are thus called market makers, Agents in the market bring investors to the dealers through a network of terminals and electronic systems. Where do dealer profits come from in a dealer market? The bid-ask spread Dividend payments Interest charges Cole, a trader, wants to buy 1,000 shares of XYZ stock, white a second trader, Abigai, is willing to sell 1,500 shares of the same stock. Unfortunately, Cole and Abigail don't know one another and must complete their transactions using the stock exchange's market-making dealer. XY2x market maket swelling to set her shares for $27.65 per share and purchase additional shares for $26.50 per share. Select the most appropriate values in the following table: Value Term Bid price Ak price Bidas spread It the market maker is willing to purchase the entire block of 1,500 shares from Abigat and, from that block, resell 1,000 shares to Cole, then the market maker's net profit from Cole's transaction-exduong any inventory effects-will be The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial Intermediaries, companles, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries Direct Transfers Scenario Erin borrows money from her uncle to buy a new laptop. Elliot invests $25,000 by purchasing 1,000 shares of an emerging markets mutual fund. This mutual fund invests in companies in Brazil, India, and China. He bought the mutual fund from the mutual fund company. Israel launched a 10-year global bond issue of $1.5 billion in early 2009. Leading investment banks such as Citigroup, Deutsche Bank, and Goldman Sachs managed the deal. (Source: Reuters.com, Mar. 18, 2009.) Based in Grass Valley, California, L&M Seeds Co. is a small company that manufactures organic seeds. To raise capital, the company sells stocks directly to savers in Grass Valley without involving any bank or financial intermediary. markets in which each of the following transactions will be traded: Description of Transaction Sonia takes a mortgage loan from a bank to purchase property. Type of Market Type of Market Description of Transaction Carlos is an immigrant from Mexico to the United States. He sends $200 to Mexico on June 15 at the exchange rate on that day. Description of Transaction Shella saves $10,000 and buys a certificate of deposit (CD) that will mature in six months. Type of Market Description of Transaction Type of Market Google fled its initial public offering worth $2.7 billion in 2004 Source: CNNMoney.com, Apr 30, 2004 A bank purchased a credit default swap from another financial institution to protect itself against the default of one of its borrowers. In this example, the bank is CENGAGE MINDTAP Search this course Ch 02. Assignment - Financial Markets and Institutions Financial Instrument Description Issued by nonfederal government entities, these financial instruments are debt securities that fund their capital expenditures. They are exempt from most taxes imposed in the area where the securities are issued. Issued by money-centered financial firms, these short-or medium-term Insured debt instruments pay higher interest than a regular savings account. They are low-risk Instruments and have low returns. These financial instruments are investment pools that buy such short-term debt Instruments as Treasury bills (T-bills), certificates or deposit (CDs), and commercial paper. They can be easily liquidated Issued by corporations, these financial instruments give their holders a class ownership in a company. They are considered the most risky but provide higher expected returns. Which of the following instruments are traded in the capital markets? Check all that apply. Certificates of deposit Common stocks Long-term bank loans Preferred stocks Treasury bills The process in which derivatives are used to reduce risk exposure is called Back to Assignment Attempts Average / 1 4. Financial institutions Several market participants interact in developed markets to organize the exchange of funds from buyers to sellers. Such institutions as investment banks, commercial banks, financial services corporations, credit unions, pension funds, the insurance companies, mutual funds, exchange traded funds, hedge funds, and private equity companies play a key role in facilitating these transfers. Identity the financial instution based on each description given in the following tablet Financial Institution Description They underwrite, distribute, and design investment secunities for corporations to help ther raise capital They are owned by members so that members can share funds among themselves. Members who save deposit the funds. These funds are the loaned to members who need the funds. These are organizations that invest in equity capital that not traded in puble exchanges. Grade It Now Save & Continue Continue without saving 21 Ch 02-Assignment - Financial Markets and Institutions 5. The stock market A stock market is a public market for trading company's In a dealer marvet, some dealers hold a certain inventory of specific securities and create a liquid market by purchasing and selling their inventories. These dealers make a market and are thus called market makers, Agents in the market bring investors to the dealers through a network of terminals and electronic systems. Where do dealer profits come from in a dealer market? The bid-ask spread Dividend payments Interest charges Cole, a trader, wants to buy 1,000 shares of XYZ stock, white a second trader, Abigai, is willing to sell 1,500 shares of the same stock. Unfortunately, Cole and Abigail don't know one another and must complete their transactions using the stock exchange's market-making dealer. XY2x market maket swelling to set her shares for $27.65 per share and purchase additional shares for $26.50 per share. Select the most appropriate values in the following table: Value Term Bid price Ak price Bidas spread It the market maker is willing to purchase the entire block of 1,500 shares from Abigat and, from that block, resell 1,000 shares to Cole, then the market maker's net profit from Cole's transaction-exduong any inventory effects-will be