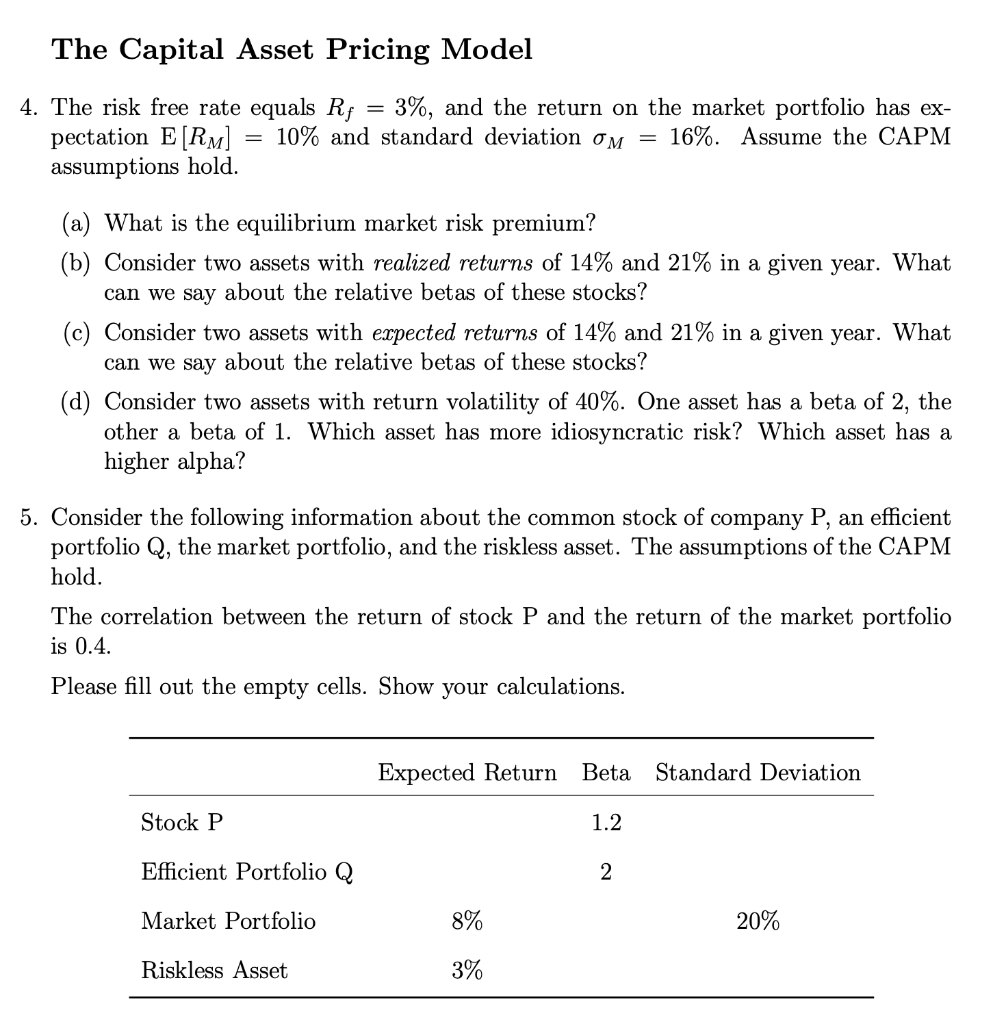

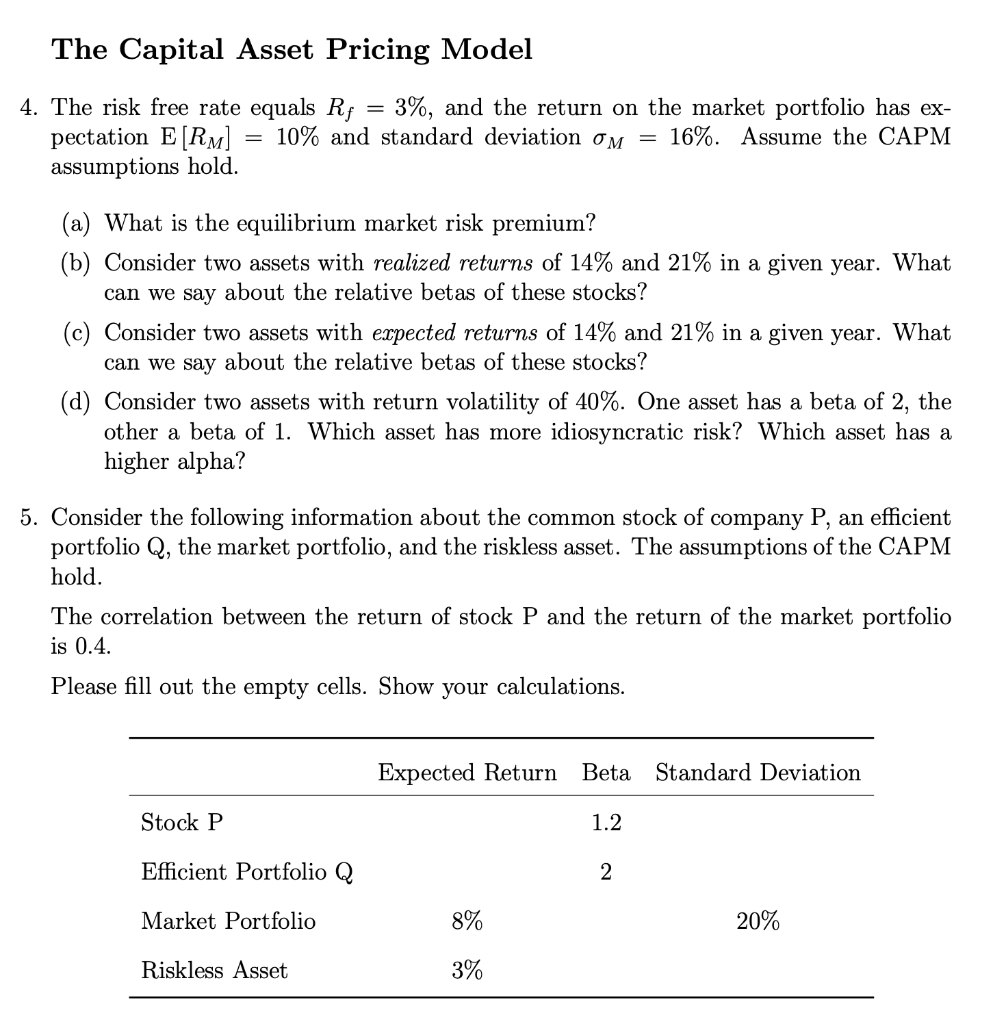

The Capital Asset Pricing Model 4. The risk free rate equals Rf = 3%, and the return on the market portfolio has ex- pectation E[RM] = 10% and standard deviation om = 16%. Assume the CAPM assumptions hold. (a) What is the equilibrium market risk premium? (b) Consider two assets with realized returns of 14% and 21% in a given year. What can we say about the relative betas of these stocks? (c) Consider two assets with expected returns of 14% and 21% in a given year. What can we say about the relative betas of these stocks? (d) Consider two assets with return volatility of 40%. One asset has a beta other a beta of 1. Which asset has more idiosyncratic risk? Which asset has a higher pha? 2, the 5. Consider the following information about the common stock of company P, an efficient portfolio Q, the market portfolio, and the riskless asset. The assumptions of the CAPM hold. The correlation between the return of stock P and the return of the market portfolio is 0.4. Please fill out the empty cells. Show your calculations. Expected Return Beta Standard Deviation Stock P 1.2 Efficient Portfolio Q 2 Market Portfolio 8% 20% Riskless Asset 3% The Capital Asset Pricing Model 4. The risk free rate equals Rf = 3%, and the return on the market portfolio has ex- pectation E[RM] = 10% and standard deviation om = 16%. Assume the CAPM assumptions hold. (a) What is the equilibrium market risk premium? (b) Consider two assets with realized returns of 14% and 21% in a given year. What can we say about the relative betas of these stocks? (c) Consider two assets with expected returns of 14% and 21% in a given year. What can we say about the relative betas of these stocks? (d) Consider two assets with return volatility of 40%. One asset has a beta other a beta of 1. Which asset has more idiosyncratic risk? Which asset has a higher pha? 2, the 5. Consider the following information about the common stock of company P, an efficient portfolio Q, the market portfolio, and the riskless asset. The assumptions of the CAPM hold. The correlation between the return of stock P and the return of the market portfolio is 0.4. Please fill out the empty cells. Show your calculations. Expected Return Beta Standard Deviation Stock P 1.2 Efficient Portfolio Q 2 Market Portfolio 8% 20% Riskless Asset 3%