Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Capital Asset Pricing Model relates the returns of an asset, given by RA, to the returns of the market, RM through a linear regression

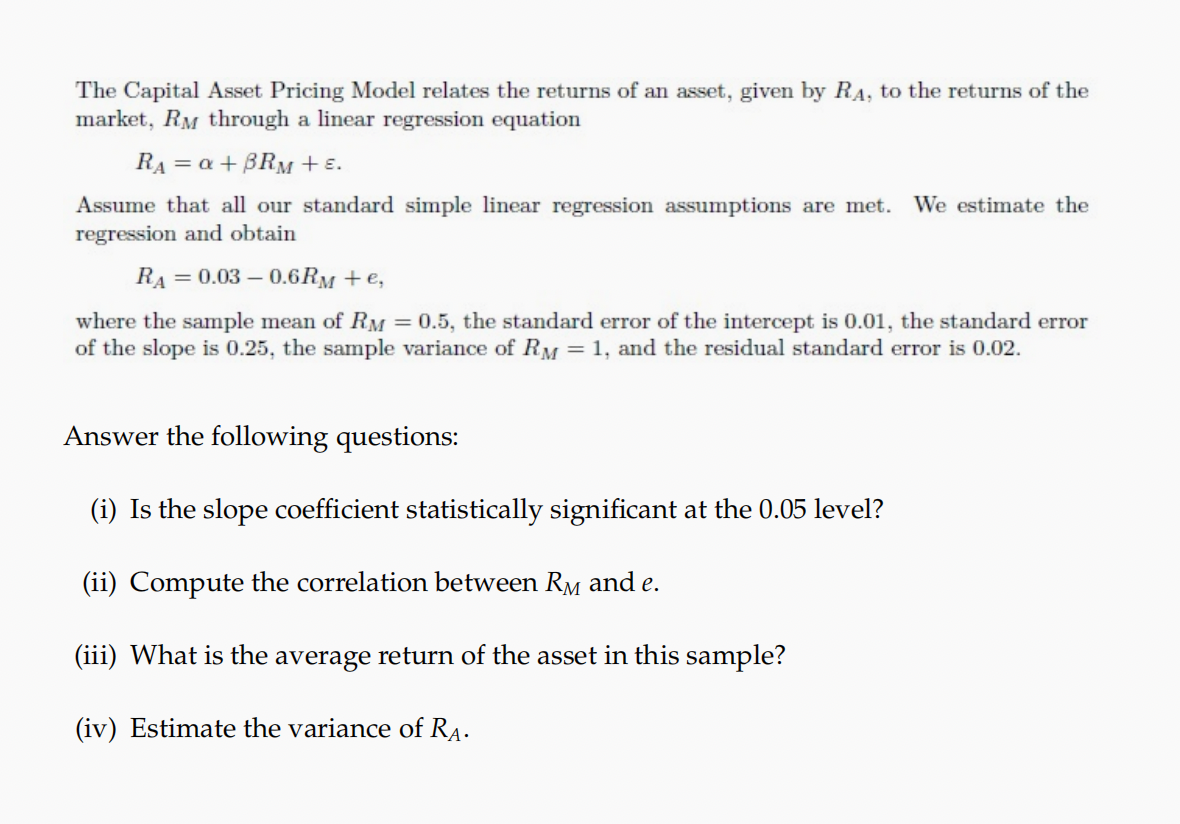

The Capital Asset Pricing Model relates the returns of an asset, given by RA, to the returns of the market, RM through a linear regression equation RA=+RM+ Assume that all our standard simple linear regression assumptions are met. We estimate the regression and obtain RA=0.030.6RM+e where the sample mean of RM=0.5, the standard error of the intercept is 0.01 , the standard error of the slope is 0.25 , the sample variance of RM=1, and the residual standard error is 0.02 . Answer the following questions: (i) Is the slope coefficient statistically significant at the 0.05 level? (ii) Compute the correlation between RM and e. (iii) What is the average return of the asset in this sample? (iv) Estimate the variance of RA

The Capital Asset Pricing Model relates the returns of an asset, given by RA, to the returns of the market, RM through a linear regression equation RA=+RM+ Assume that all our standard simple linear regression assumptions are met. We estimate the regression and obtain RA=0.030.6RM+e where the sample mean of RM=0.5, the standard error of the intercept is 0.01 , the standard error of the slope is 0.25 , the sample variance of RM=1, and the residual standard error is 0.02 . Answer the following questions: (i) Is the slope coefficient statistically significant at the 0.05 level? (ii) Compute the correlation between RM and e. (iii) What is the average return of the asset in this sample? (iv) Estimate the variance of RA Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started