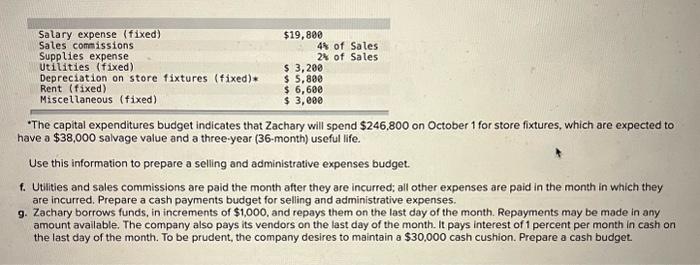

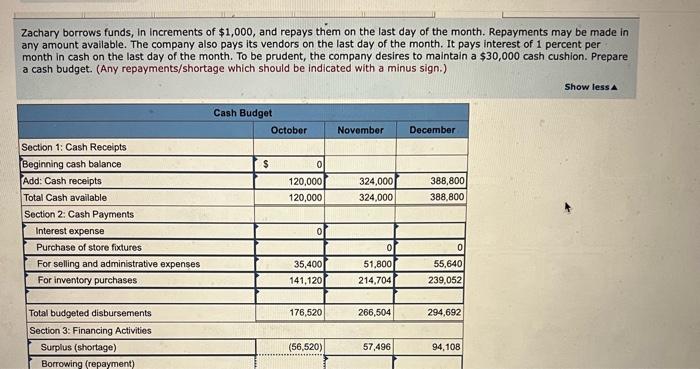

"The capital expenditures budget indicates that Zachary will spend $246,800 on October 1 for store fixtures, which are expected to have a $38,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilies and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Zachary borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $30.000 cash cushion. Prepare a cash budget. Zachary borrows funds, In increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $30,000 cash cushion. Prepare a cash budget. (Any repayments/shortage which should be indicated with a minus sign.) "The capital expenditures budget indicates that Zachary will spend $246,800 on October 1 for store fixtures, which are expected to have a $38,000 salvage value and a three-year (36-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilies and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Zachary borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $30.000 cash cushion. Prepare a cash budget. Zachary borrows funds, In increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount available. The company also pays its vendors on the last day of the month. It pays interest of 1 percent per month in cash on the last day of the month. To be prudent, the company desires to maintain a $30,000 cash cushion. Prepare a cash budget. (Any repayments/shortage which should be indicated with a minus sign.)