Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The capital structure of Glam Marketing Inc. at December 31,2022 , included 52,000$0.75 preferred shares and 82,000 common shares. The 52,000 preferred shares were issued

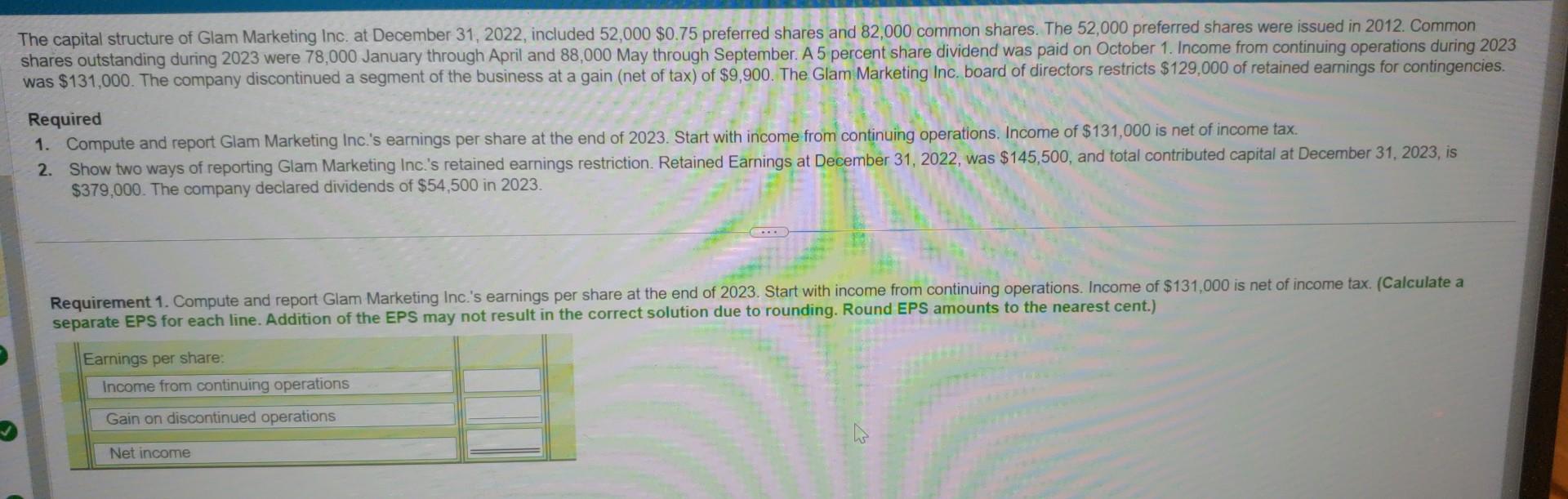

The capital structure of Glam Marketing Inc. at December 31,2022 , included 52,000$0.75 preferred shares and 82,000 common shares. The 52,000 preferred shares were issued in 2012 . Common shares outstanding during 2023 were 78,000 January through April and 88,000 May through September. A 5 percent share dividend was paid on October 1 . Income from continuing operations during 202 was $131,000. The company discontinued a segment of the business at a gain (net of tax) of $9,900. The Glam Marketing Inc. board of directors restricts $129,000 of retained earnings for contingencies Required 1. Compute and report Glam Marketing Inc.'s earnings per share at the end of 2023. Start with income from continuing operations. Income of $131,000 is net of income tax. 2. Show two ways of reporting Glam Marketing Inc.'s retained earnings restriction. Retained Earnings at December 31,2022 , was $145,500, and total contributed capital at December 31,2023 , is $379,000. The company declared dividends of $54,500 in 2023. Requirement 1. Compute and report Glam Marketing Inc.'s earnings per share at the end of 2023. Start with income from continuing operations. Income of $131,000 is net of income tax. (Calculate a separate EPS for each line. Addition of the EPS may not result in the correct solution due to rounding. Round EPS amounts to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started