Question

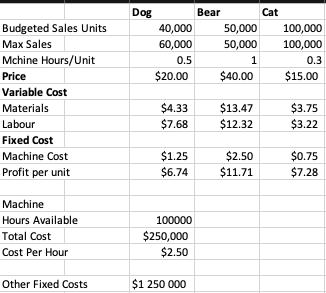

The Car Quirk Company manufactures three solar powered bobblehead figures. The budgeted sales and costs for these three products and their details appear below Machine

The Car Quirk Company manufactures three solar powered bobblehead figures. The budgeted sales and costs for these three products and their details appear below

Machine costs are allocated to each product based on its use of machine time. Other fixed costs are factory related costs. The budgeted sales units were developed by assigning available capacity to each product based on the product’s profit per unit. For example, since the Bear product has the highest budgeted profit per unit, it was allocated available capacity to produce to the maximum demand. The same approach was used for the second and third allocations of capacity to the Cat and Dog products respectively.

Question 1: Assuming that the sales mix is held constant, and the company faces a tax rate of 30%, how many total units and how many units of the Dog product must be sold for AAD to achieve an after tax income of $200,000?

Budgeted Sales Units Max Sales Mchine Hours/Unit Price Variable Cost Materials Labour Fixed Cost Machine Cost Profit per unit Machine Hours Available Total Cost Cost Per Hour Other Fixed Costs Dog 40,000 60,000 0.5 $20.00 $4.33 $7.68 $1.25 $6.74 100000 $250,000 $2.50 $1 250 000 Bear 50,000 100,000 50,000 100,000 1 0.3 $40.00 $13.47 $12.32 Cat $2.50 $11.71 $15.00 $3.75 $3.22 $0.75 $7.28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started