Question

You follow the equity index HSI using an index fund in Hong Kong. You have signed an interest rate swap to exchange the capital

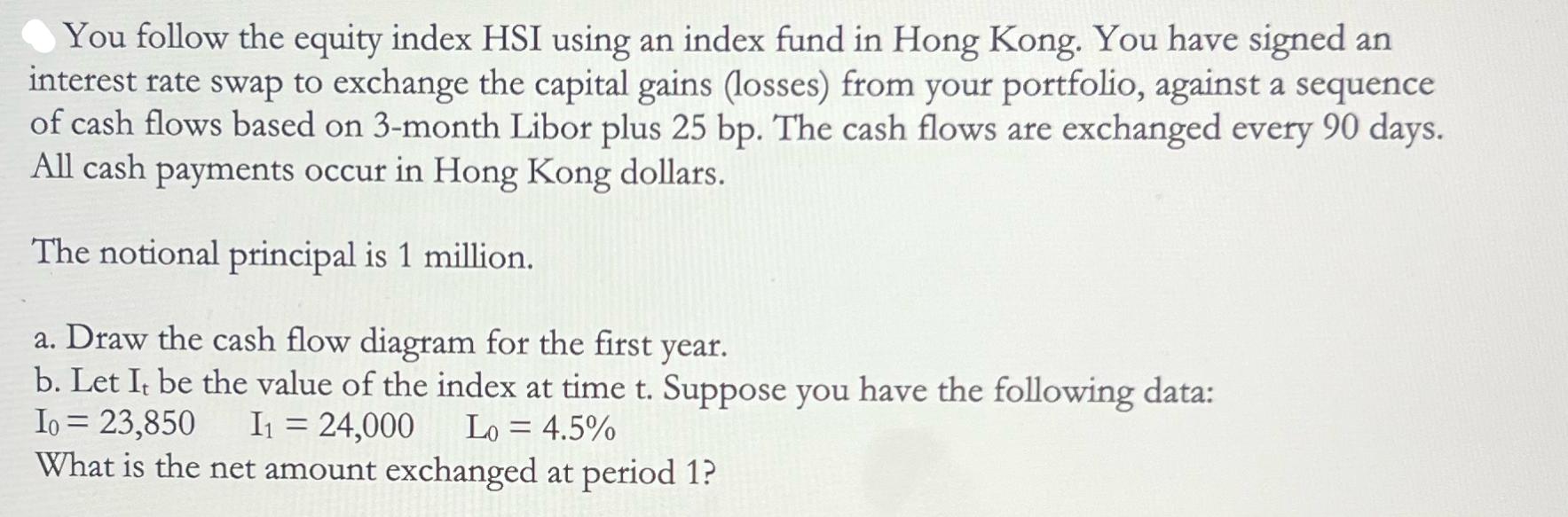

You follow the equity index HSI using an index fund in Hong Kong. You have signed an interest rate swap to exchange the capital gains (losses) from your portfolio, against a sequence of cash flows based on 3-month Libor plus 25 bp. The cash flows are exchanged every 90 days. All cash payments occur in Hong Kong dollars. The notional principal is 1 million. a. Draw the cash flow diagram for the first year. b. Let It be the value of the index at time t. Suppose you have the following data: Io = 23,850 I = 24,000 Lo = 4.5% What is the net amount exchanged at period 1?

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Lets begin by addressing part a You will need to create a cash flow diagram to represent the payouts and inflows over the course of the first year for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Bank Management

Authors: Timothy W. Koch, S. Scott MacDonald

8th edition

1133494684, 978-1305177239, 1305177231, 978-1133494683

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App