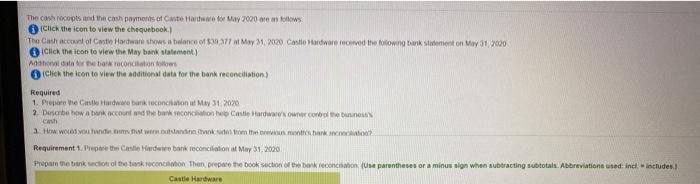

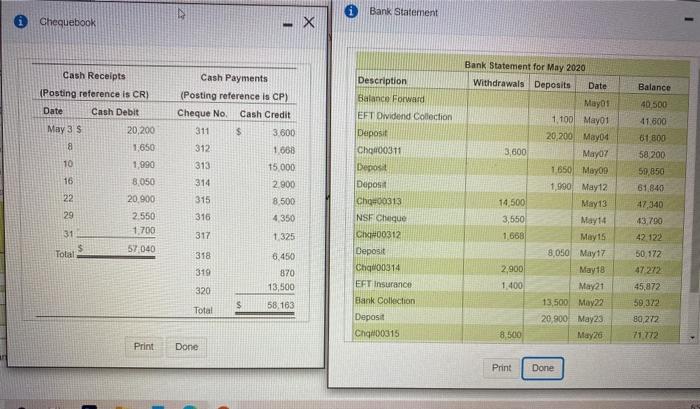

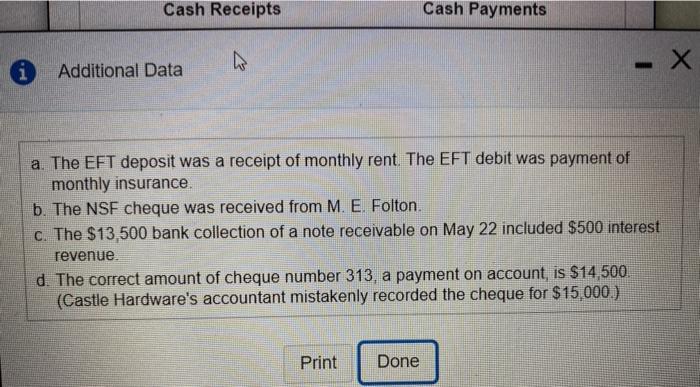

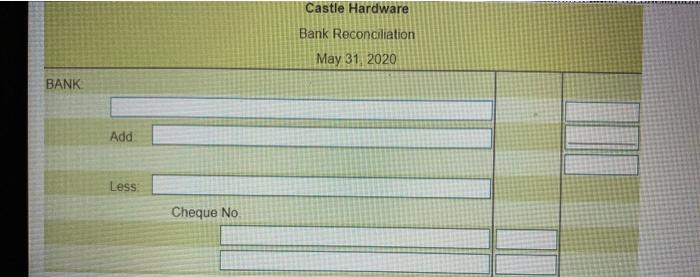

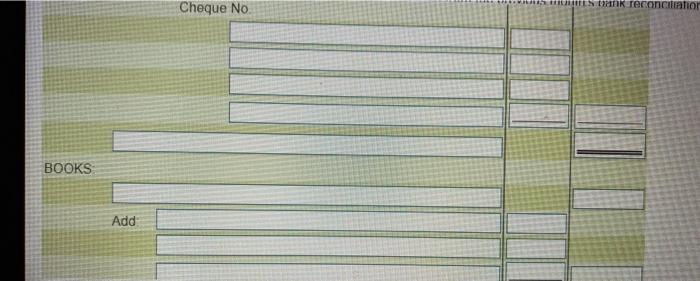

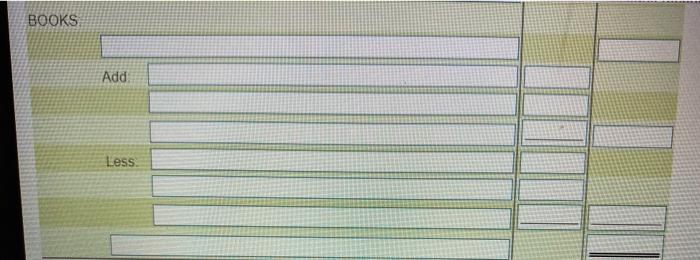

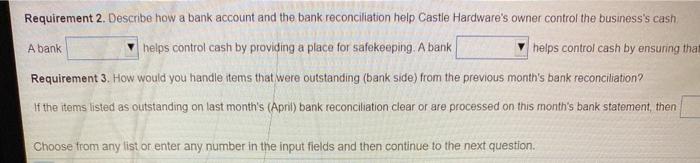

The casa rocopts and the cash payments at ito Haw for May 2000 are follows Click the icon to view the chequebook The Cash account of Citie Hardware shows a balance of 530377 May 31, 2020 Castle adware loved the following bank on May 31,2000 Click the icon to view the Maybank statement) Alebo reconditions Click the icon to view the additional data for the bank reconciliation Required 1. Prophe Calle de bank reconcion at May 31 2020 2. Desobe how a tank account and the bank reconcion Castle Hardware owner Combol business cash 3. How we had at the month Requirement 1. Prepet Custo Her bank reconciliation at May 31.2020 Prepar mention of the reconcion Than prepare the book section of concion (Use parentheses or a minus sign when subtracting subtotals Abbreviations used ind includes Castle Hardware Bank Statement Chequebook - X Description Balance Forward Cash Receipts (Posting reference is CR) Date Cash Debit May 35 20,200 8 1,650 10 1.990 Balance 40,500 41.500 Cash Payments (Posting reference is CP) Cheque No Cash Credit 311 $ 3.600 312 1 668 313 15.000 314 2.900 315 8.500 316 4350 317 1.325 16 EFT Dividend Collection Deposit Chou00311 Deposit Deposit Ch 00313 NSF Chique Ch 00312 Deposit Chad00314 8,050 20.900 2.550 1.700 22 29 Bank Statement for May 2020 Withdrawals Deposits Date Mayof 1.100 Mayo1 20,200 May04 3,600 Mayz 1 650) May 1.990 May12 14 500 May 13 3,550 May 14 1.668 May 15 8,050 May 17 2,900 May 18 1.400 May21 13,500 May22 20,900 May23 8.500 May20 31 61 800 58.200 50 850 61 840 47,340 43.790 42 122 50 572 47 272 45,872 59 372 80,272 71772 57,040 Total 318 319 6.450 870 13,500 58,183 320 $ Total EFT Insurance Bank Collection Deposit Ch#00315 Print Done Print Done Cash Receipts Cash Payments N - Additional Data a. The EFT deposit was a receipt of monthly rent. The EFT debit was payment of monthly insurance b. The NSF cheque was received from M. E. Folton. c. The $13,500 bank collection of a note receivable on May 22 included $500 interest revenue d. The correct amount of cheque number 313, a payment on account is $14,500. (Castle Hardware's accountant mistakenly recorded the cheque for $15,000.) Print Done Castle Hardware Bank Reconciliation May 31, 2020 BANK Add Less: Cheque No Cheque No. hank reconciliation BOOKS Add BOOKS Add Less More when gorda get me the band to Regiment. Howwe i govom the school Choose yumber in the outs and then this Requirement 2. Describe how a bank account and the bank reconciliation help Castle Hardware's owner control the business's cash Abank helps control cash by providing a place for safekeeping. A bank helps control cash by ensuring that Requirement 3. How would you handle items that were outstanding (bank side) from the previous month's bank reconciliation If the items listed as outstanding on last month's (April) bank reconciliation clear or are processed on this month's bank statement then Choose from any list or enter any number in the input fields and then continue to the next question. ptice for saloping Abank helps control cash by ensuring that the company accounts for all its cash transactions and that the bank and book records of cash are correct or outstanding bank from the previous month's bank reconciliation? barroconciliation or are procesed on this month's bank statement then mput fields and then continue to the next