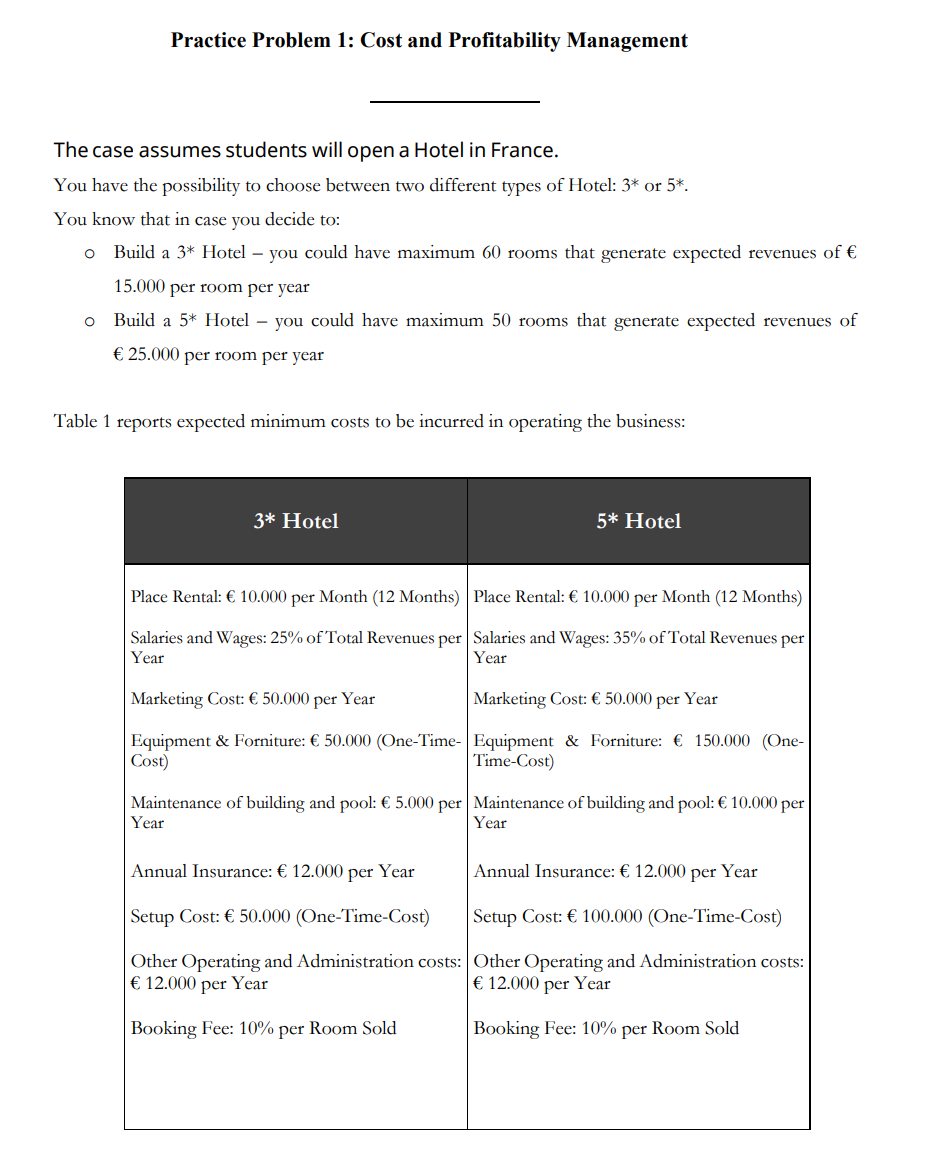

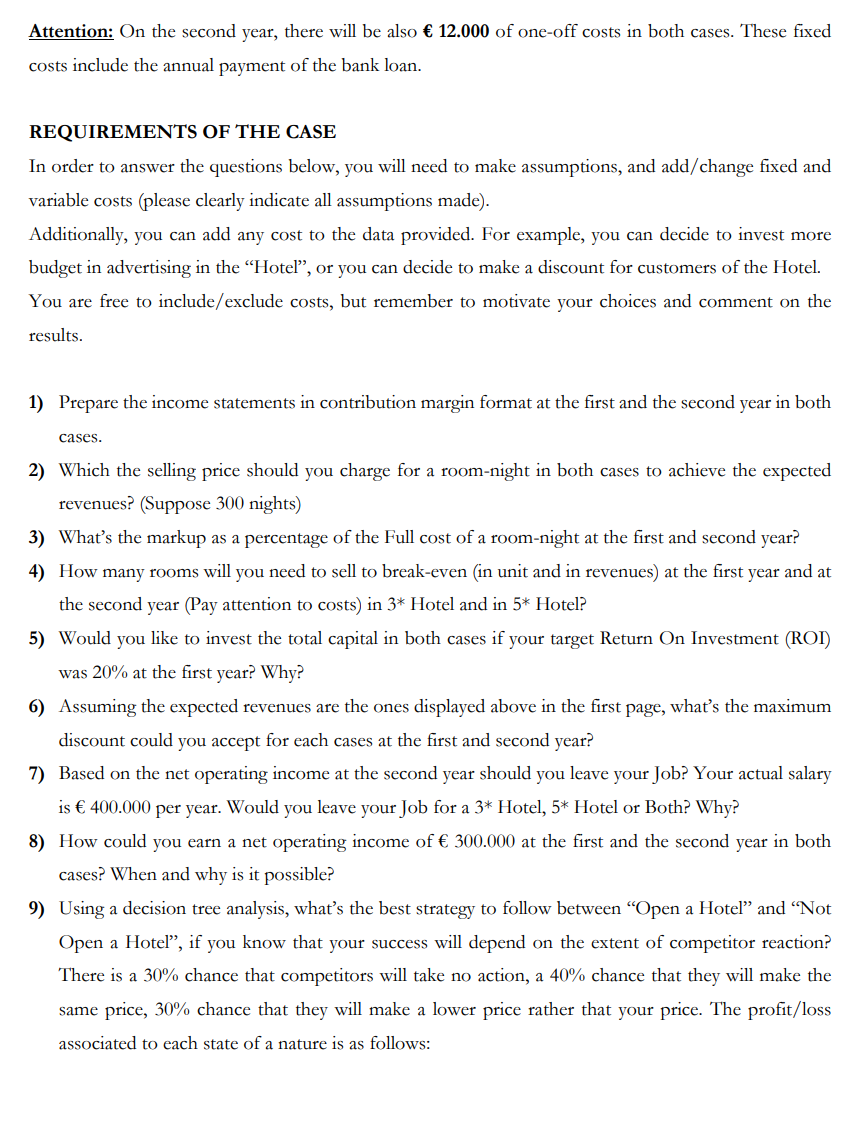

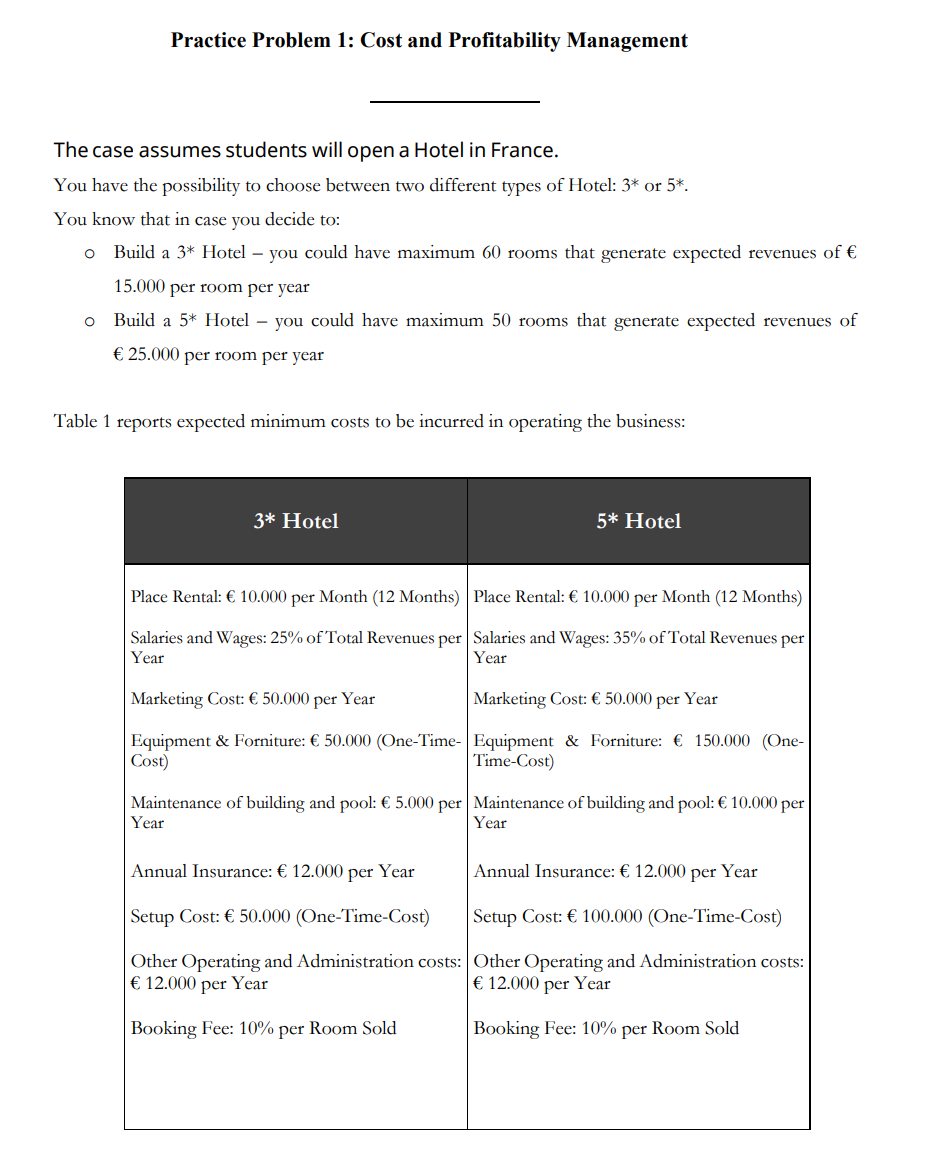

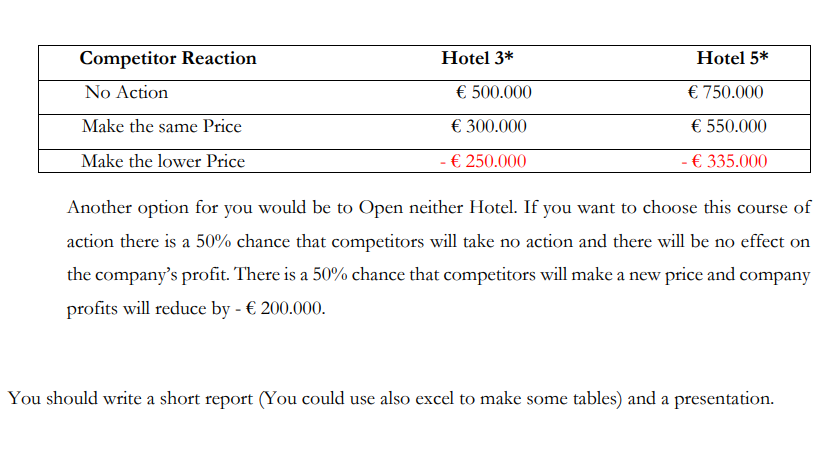

The case assumes students will open a Hotel in France. You have the possibility to choose between two different types of Hotel: 3* or 5. You know that in case you decide to: Build a 3* Hotel - you could have maximum 60 rooms that generate expected revenues of 15.000 per room per year - Build a 5* Hotel - you could have maximum 50 rooms that generate expected revenues of 25.000 per room per year Table 1 reports expected minimum costs to be incurred in operating the business: Attention: On the second year, there will be also 12.000 of one-off costs in both cases. These fixed costs include the annual payment of the bank loan. REQUIREMENTS OF THE CASE In order to answer the questions below, you will need to make assumptions, and add/change fixed and variable costs (please clearly indicate all assumptions made). Additionally, you can add any cost to the data provided. For example, you can decide to invest more budget in advertising in the "Hotel", or you can decide to make a discount for customers of the Hotel. You are free to include/exclude costs, but remember to motivate your choices and comment on the results. 1) Prepare the income statements in contribution margin format at the first and the second year in both cases. 2) Which the selling price should you charge for a room-night in both cases to achieve the expected revenues? (Suppose 300 nights) 3) What's the markup as a percentage of the Full cost of a room-night at the first and second year? 4) How many rooms will you need to sell to break-even (in unit and in revenues) at the first year and at the second year (Pay attention to costs) in 3 Hotel and in 5 Hotel? 5) Would you like to invest the total capital in both cases if your target Return On Investment (ROI) was 20% at the first year? Why? 6) Assuming the expected revenues are the ones displayed above in the first page, what's the maximum discount could you accept for each cases at the first and second year? 7) Based on the net operating income at the second year should you leave your Job? Your actual salary is 400.000 per year. Would you leave your Job for a 3 Hotel, 5 Hotel or Both? Why? 8) How could you earn a net operating income of 300.000 at the first and the second year in both cases? When and why is it possible? 9) Using a decision tree analysis, what's the best strategy to follow between "Open a Hotel" and "Not Open a Hotel", if you know that your success will depend on the extent of competitor reaction? There is a 30% chance that competitors will take no action, a 40% chance that they will make the same price, 30% chance that they will make a lower price rather that your price. The profit/loss associated to each state of a nature is as follows: Another option for you would be to Open neither Hotel. If you want to choose this course of action there is a 50% chance that competitors will take no action and there will be no effect on the company's profit. There is a 50% chance that competitors will make a new price and company profits will reduce by 200.000. ou should write a short report (You could use also excel to make some tables) and a presentation