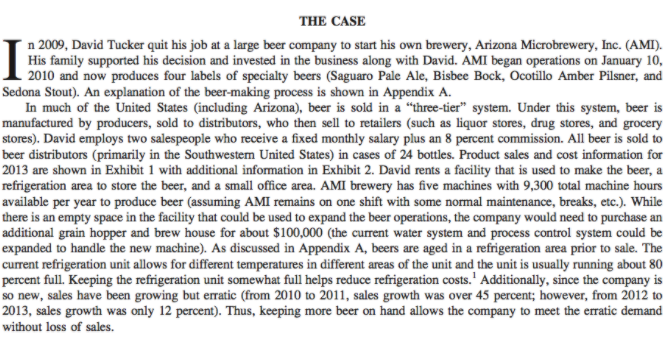

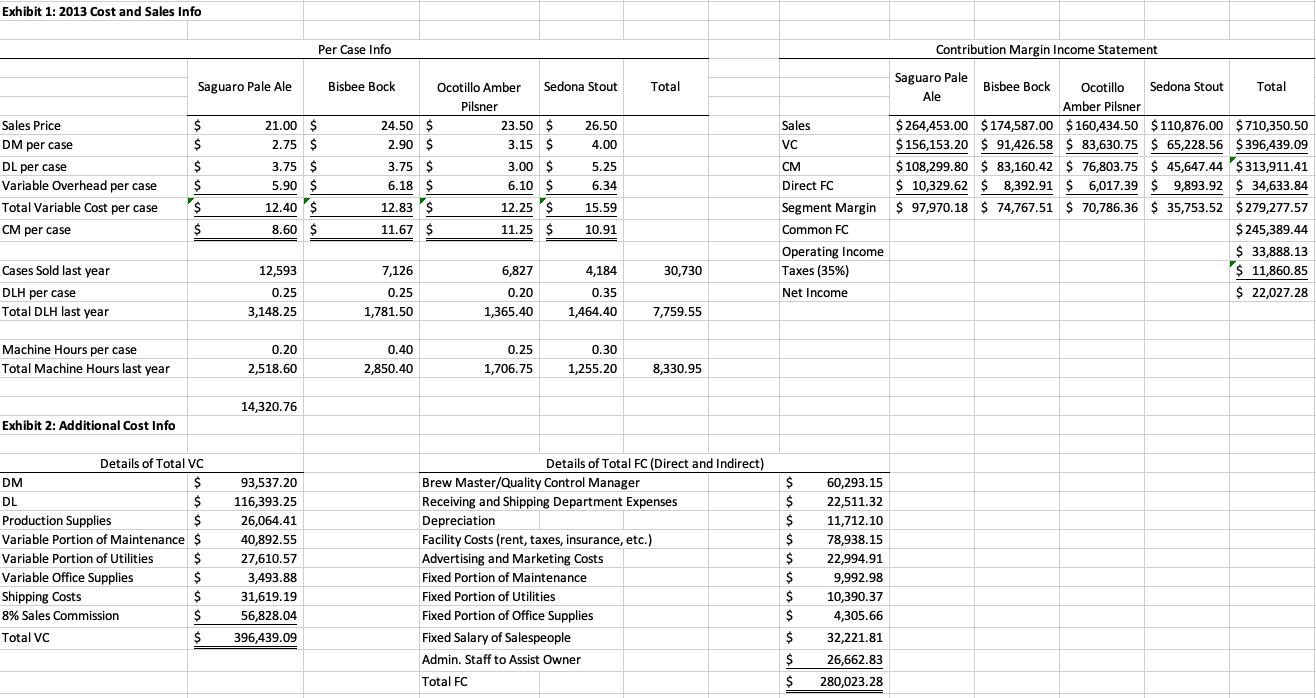

THE CASE n 2009, David Tucker quit his job at a large beer company to start his own brewery, Arizona Microbrewery, Inc. (AMI). His family supported his decision and invested in the business along with David. AMI began operations on January 10, 2010 and now produces four labels of specialty beers (Saguaro Pale Ale, Bisbee Bock, Ocotillo Amber Pilsner, and Sedona Stout). An explanation of the beer-making process is shown in Appendix A. In much of the United States (including Arizona), beer is sold in a "three-tier" system. Under this system, beer is manufactured by producers, sold to distributors, who then sell to retailers (such as liquor stores, drug stores, and grocery stores). David employs two salespeople who receive a fixed monthly salary plus an 8 percent commission. All beer is sold to beer distributors (primarily in the Southwestern United States) in cases of 24 bottles. Product sales and cost information for 2013 are shown in Exhibit 1 with additional information in Exhibit 2. David rents a facility that is used to make the beer, a refrigeration area to store the beer, and a small office area. AMI brewery has five machines with 9,300 total machine hours available per year to produce beer (assuming AMI remains on one shift with some normal maintenance, breaks, etc.). While there is an empty space in the facility that could be used to expand the beer operations, the company would need to purchase an additional grain hopper and brew house for about $100,000 (the current water system and process control system could be expanded to handle the new machine). As discussed in Appendix A, beers are aged in a refrigeration area prior to sale. The current refrigeration unit allows for different temperatures in different areas of the unit and the unit is usually running about 80 percent full. Keeping the refrigeration unit somewhat full helps reduce refrigeration costs. Additionally, since the company is so new, sales have been growing but erratic (from 2010 to 2011, sales growth was over 45 percent; however, from 2012 to 2013, sales growth was only 12 percent). Thus, keeping more beer on hand allows the company to meet the erratic demand without loss of sales.Exhibit 1: 2013 Cost and Sales Info Per Case Info Contribution Margin Income Statement Saguaro Pale Ale Bisbee Bock Ocotillo Amber Sedona Stout Total Saguaro Pale Ale Bisbee Bock Ocotillo Sedona Stout Total Pilsner Amber Pilsner Sales Price 21.00 $ 24.50 $ 23.50 $ 26.50 Sales $ 264,453.00 $ 174,587.00 $ 160,434.50 $ 110,876.00 $710,350.50 DM per case 2.75 2.90 3.15 $ 4.00 VC $ 156,153.20 $ 91,426.58 $ 83,630.75 $ 65,228.56 $ 396,439.09 DL per case 3.75 $ 3.75 $ 3.00 $ 5.25 CM $ 108,299.80 $ 83,160.42 $ 76,803.75 $ 45,647.44 $ 313,911.41 Variable Overhead per case 5.90 S 6.18 6.10 S 6.34 Direct FC $ 10,329.62 $ 8,392.91 $ 6,017.39 $ 9,893.92 $ 34,633.84 Total Variable Cost per case 12.40 $ 12.83 $ 12.25 $ 15.59 Segment Margin $ 97,970.18 $ 74,767.51 $ 70,786.36 $ 35,753.52 $ 279,277.57 CM per case 8.60 $ 11.67 11.25 10.91 Common FC $ 245,389.44 Operating Income $ 33,888.13 Cases Sold last year 12,593 7,126 6,827 4,184 30,730 Taxes (35%) $ 11,860.85 DLH per case 0.25 0.25 0.20 0.35 Net Income $ 22,027.28 Total DLH last year 3,148.25 1,781.50 1,365.40 1,464.40 7,759.55 Machine Hours per case 0.20 0.40 0.25 0.30 Total Machine Hours last year 2,518.60 2,850.40 1,706.75 1,255.20 8,330.95 14,320.76 Exhibit 2: Additional Cost Info Details of Total VC Details of Total FC (Direct and Indirect) DM 93,537.20 Brew Master/Quality Control Manager 60,293.15 DL 116,393.25 Receiving and Shipping Department Expenses 22,511.32 Production Supplies 26,064.41 Depreciation 11,712.10 Variable Portion of Maintenance 40,892.55 Facility Costs (rent, taxes, insurance, etc.) 78,938.15 Variable Portion of Utilities 27,610.57 Advertising and Marketing Costs 22,994.91 Variable Office Supplies 3,493.88 Fixed Portion of Maintenance 9,992.98 Shipping Costs 31,619.19 Fixed Portion of Utilities 10,390.37 8% Sales Commission 56,828.04 Fixed Portion of Office Supplies 4,305.66 Total VC 396,439.09 Fixed Salary of Salespeople 32,221.81 Admin. Staff to Assist Owner 26,662.83 Total FC 280,023.28