Question

The case study OPEC Plastics: Growing with Vietnam completed by The University of Hong Kong Asia Case Research Centre is focused on the actual company.

The case study "OPEC Plastics: Growing with Vietnam" completed by The University of Hong Kong Asia Case Research Centre is focused on the actual company. Though the case study is not provided, the financial documents have been included and the company website is accessible.

The following questions need to be answered with an explaination of why the answers are the best answers.

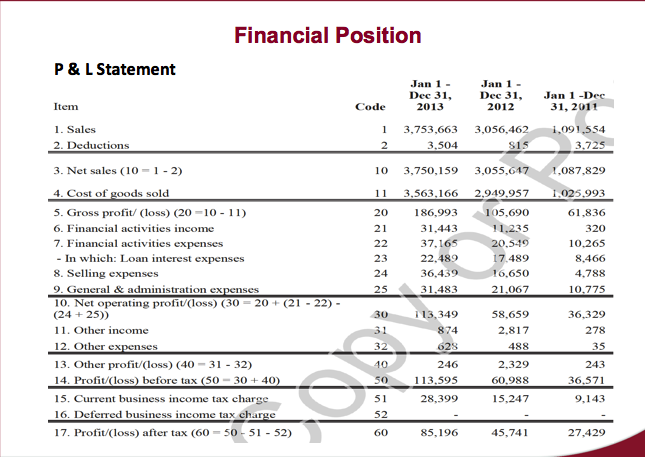

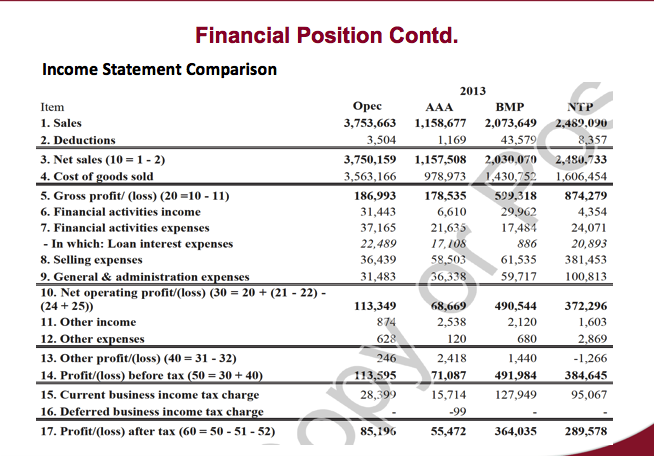

1) View the financial statements provided. Based on the information, was Opec Plastics in a financial position to achieve expansion goals? Why?

2) Based on the financial standing, how might erratic oil prices affect Opec Plastics' capabilities to achieve financial success and exploit opportunities? Why?

3) How would free trade agreements being negotiated by Vietnam create challenges and opportunities for a company like Opec Plastics? Why?

Financial Position P & L Statement Jan 1 Jan 1 Dec 31 Dec 31 Jan 1 -Den 2013 2012 Item Code 31, 2011 1. Sales 1 3,753,663 3.056.462 i ,091,554 2. Ded 3.504 3.725 uctions 3. Net sales (10- 1 2) l o 3,750,159 3,055,647 1,087,829 4. Cost of ds sold 11 3.563.166 2.949.957 025.993 20 186,993 5. Gross profit/ (loss) (20 10 11) 61,836 105,690 6. Financial activities i 21 31.443 11.235 320 540 7. Financial activities expenses 22 37.165 10.265 In which: Loan interest expenses 23 22.489 17.489 8.466 36.439 8. Selling expenses 24 16.650 4.788 9. General & administrat 25 31.483 21,067 0,775 10. Net operating profit/doss) (30 20 (21 22) 430 13,349 36.329 25)) 58,659 11. Other income 874 2.817 278 12. Other ex 32 62S 488 35 13. Other profit/loss (40 31-32) 246 2,329 243 40 113.595 14. Profit/(loss) before tax (50 30 40) 60.988 36,571 15,247 9,143 15. Current business income tax charge 51 28,399 16. Deferred bus ncome tax ch 52 17. Profit/(loss) after tax (60 50 51 52) 85,196 45,741 27,429Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started