Answered step by step

Verified Expert Solution

Question

1 Approved Answer

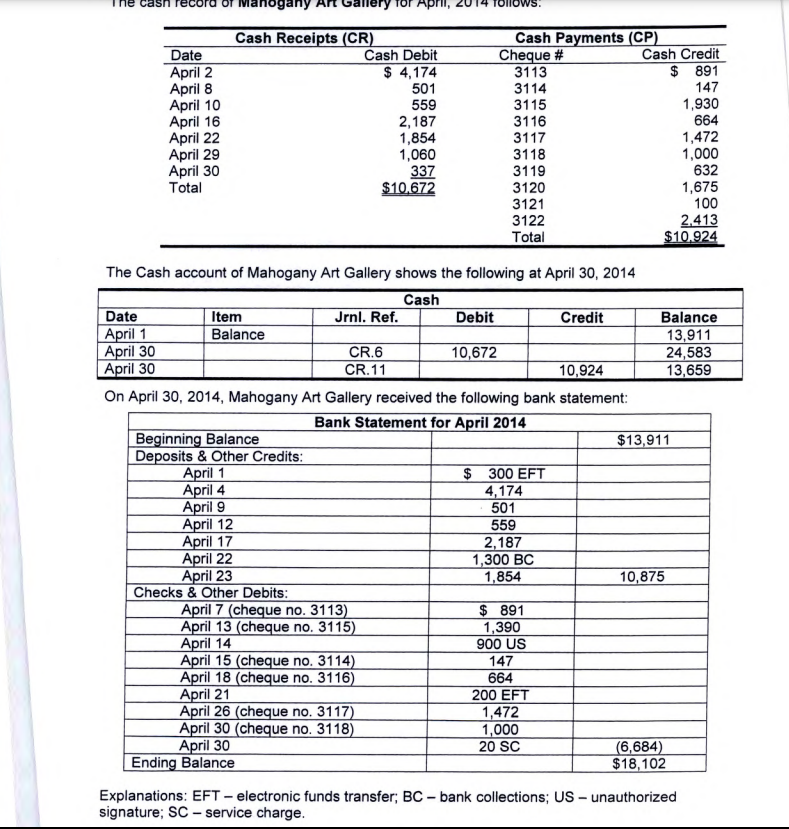

The Cash account of Mahogany Art Gallery shows the following at April 30, 2014 On April 30, 2014, Mahogany Art Gallery received the following bank

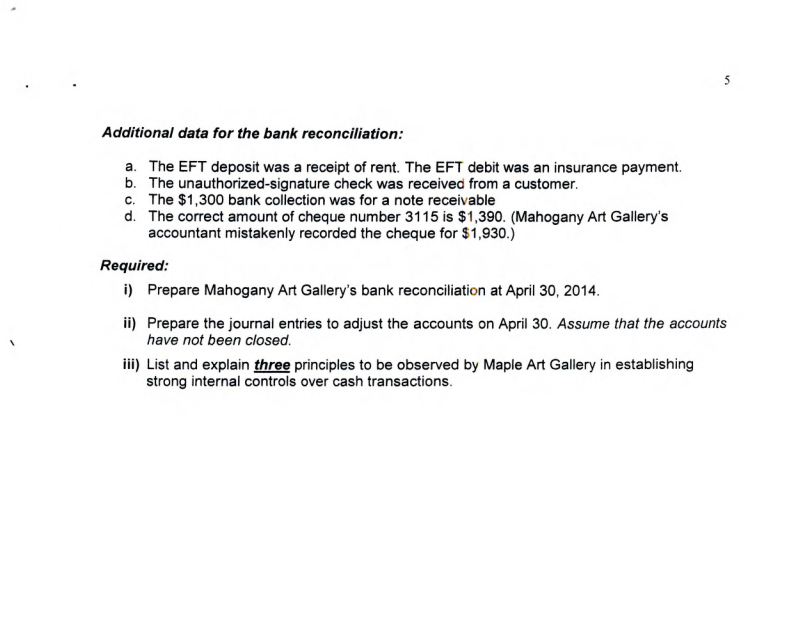

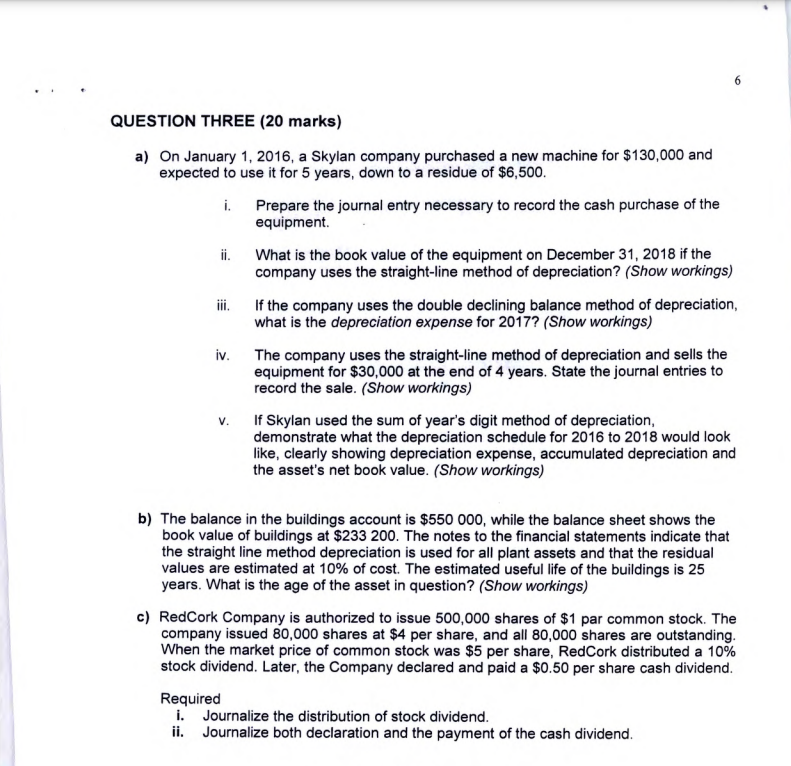

The Cash account of Mahogany Art Gallery shows the following at April 30, 2014 On April 30, 2014, Mahogany Art Gallery received the following bank statement: Explanations: EFT - electronic funds transfer; BC - bank collections; US - unauthorized signature; SC - service charge. Additional data for the bank reconciliation: a. The EFT deposit was a receipt of rent. The EFT debit was an insurance payment. b. The unauthorized-signature check was received from a customer. c. The $1,300 bank collection was for a note receivable d. The correct amount of cheque number 3115 is $1,390. (Mahogany Art Gallery's accountant mistakenly recorded the cheque for $1,930.) Required: i) Prepare Mahogany Art Gallery's bank reconciliation at April 30, 2014. ii) Prepare the journal entries to adjust the accounts on April 30. Assume that the accounts have not been closed. iii) List and explain three principles to be observed by Maple Art Gallery in establishing strong internal controls over cash transactions. UESTION THREE (20 marks) a) On January 1, 2016, a Skylan company purchased a new machine for $130,000 and expected to use it for 5 years, down to a residue of $6,500. i. Prepare the journal entry necessary to record the cash purchase of the equipment. ii. What is the book value of the equipment on December 31, 2018 if the company uses the straight-line method of depreciation? (Show workings) iii. If the company uses the double declining balance method of depreciation, what is the depreciation expense for 2017 ? (Show workings) iv. The company uses the straight-line method of depreciation and sells the equipment for $30,000 at the end of 4 years. State the journal entries to record the sale. (Show workings) v. If Skylan used the sum of year's digit method of depreciation, demonstrate what the depreciation schedule for 2016 to 2018 would look like, clearly showing depreciation expense, accumulated depreciation and the asset's net book value. (Show workings) b) The balance in the buildings account is $550000, while the balance sheet shows the book value of buildings at $233200. The notes to the financial statements indicate that the straight line method depreciation is used for all plant assets and that the residual values are estimated at 10% of cost. The estimated useful life of the buildings is 25 years. What is the age of the asset in question? (Show workings) c) RedCork Company is authorized to issue 500,000 shares of $1 par common stock. The company issued 80,000 shares at $4 per share, and all 80,000 shares are outstanding. When the market price of common stock was $5 per share, RedCork distributed a 10% stock dividend. Later, the Company declared and paid a $0.50 per share cash dividend. Required i. Journalize the distribution of stock dividend. ii. Journalize both declaration and the payment of the cash dividend

The Cash account of Mahogany Art Gallery shows the following at April 30, 2014 On April 30, 2014, Mahogany Art Gallery received the following bank statement: Explanations: EFT - electronic funds transfer; BC - bank collections; US - unauthorized signature; SC - service charge. Additional data for the bank reconciliation: a. The EFT deposit was a receipt of rent. The EFT debit was an insurance payment. b. The unauthorized-signature check was received from a customer. c. The $1,300 bank collection was for a note receivable d. The correct amount of cheque number 3115 is $1,390. (Mahogany Art Gallery's accountant mistakenly recorded the cheque for $1,930.) Required: i) Prepare Mahogany Art Gallery's bank reconciliation at April 30, 2014. ii) Prepare the journal entries to adjust the accounts on April 30. Assume that the accounts have not been closed. iii) List and explain three principles to be observed by Maple Art Gallery in establishing strong internal controls over cash transactions. UESTION THREE (20 marks) a) On January 1, 2016, a Skylan company purchased a new machine for $130,000 and expected to use it for 5 years, down to a residue of $6,500. i. Prepare the journal entry necessary to record the cash purchase of the equipment. ii. What is the book value of the equipment on December 31, 2018 if the company uses the straight-line method of depreciation? (Show workings) iii. If the company uses the double declining balance method of depreciation, what is the depreciation expense for 2017 ? (Show workings) iv. The company uses the straight-line method of depreciation and sells the equipment for $30,000 at the end of 4 years. State the journal entries to record the sale. (Show workings) v. If Skylan used the sum of year's digit method of depreciation, demonstrate what the depreciation schedule for 2016 to 2018 would look like, clearly showing depreciation expense, accumulated depreciation and the asset's net book value. (Show workings) b) The balance in the buildings account is $550000, while the balance sheet shows the book value of buildings at $233200. The notes to the financial statements indicate that the straight line method depreciation is used for all plant assets and that the residual values are estimated at 10% of cost. The estimated useful life of the buildings is 25 years. What is the age of the asset in question? (Show workings) c) RedCork Company is authorized to issue 500,000 shares of $1 par common stock. The company issued 80,000 shares at $4 per share, and all 80,000 shares are outstanding. When the market price of common stock was $5 per share, RedCork distributed a 10% stock dividend. Later, the Company declared and paid a $0.50 per share cash dividend. Required i. Journalize the distribution of stock dividend. ii. Journalize both declaration and the payment of the cash dividend Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started