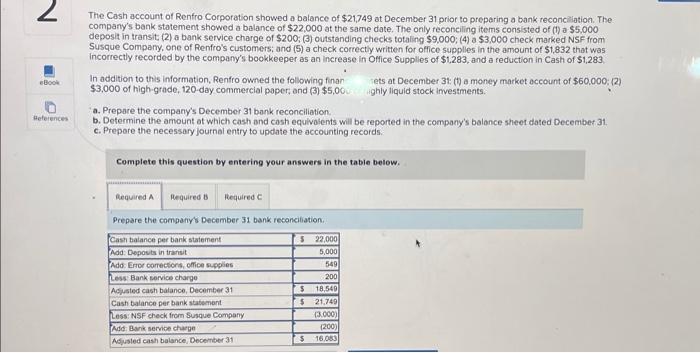

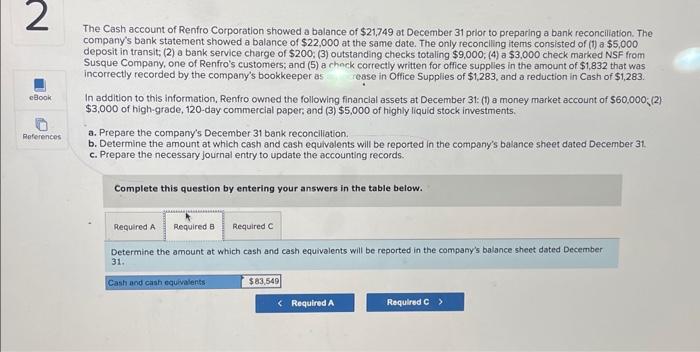

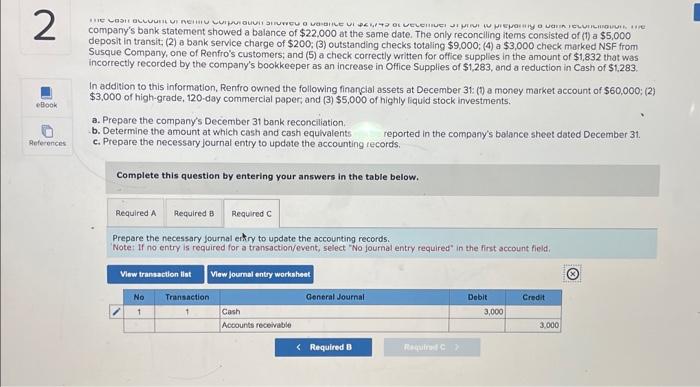

The Cash account of Renfro Corporation showed a balance of $21,749 at December 31 prior to preparing a bank reconciliation. The company's bank statement showed a balance of $22,000 at the same date. The only reconcling iterns consisted of (1) a $5,000 deposit in transit; (2) a bank service charge of $200; (3) outstanding checks totaling $9,000;(4) a $3,000 check marked NSF from Susque Company, one of Renfro's customers; and (5) a check correctly written for office supplles in the amount of $1,832 that was incorrectly recorded by the company's bookkeeper as. rease in Office Supplies of $1,283, and a reduction in Cash of $1,283. In addition to this information, Renfro owned the following financial assets at December 31: (1) a money market account of $60,000;(2) $3,000 of high-grade, 120 -day commercial paper, and (3) $5,000 of highly liquid stock investments. a. Prepare the company's December 31 bank reconcliation. b. Determine the amount at which cash and cash equivalents will be reported in the company's balance sheet dated December 31 . c. Prepare the necessary journal entry to update the accounting records. Complete this question by entering your answers in the table below. Determine the amount at which cash and cash equivalents will be reported in the company's balance sheet dated December 31 . company's bank statement showed a balance of $22,000 at the same date. The only reconciling items consisted of (1) a $5,000 deposit in transit; (2) a bank service charge of $200;(3) outstanding checks totaling $9,000;(4) a $3,000 check marked NSF from Susque Company, one of Renfro's customers; and (5) a check correctly written for office supplies in the amount of $1,832 that was incorrectly recorded by the company's bookkeeper as an increase in Office Supplies of $1,283, and a reduction in Cash of $1,283. In addition to this information, Renfro owned the following financial assets at December 31: (1) a money market account of $60,000; (2) $3,000 of high-grade, 120 -day commercial paper; and (3) $5,000 of highly liquid stock investments. a. Prepare the company's December 31 bank reconciliation. b. Determine the amount at which cash and cash equivalents reported in the company's balance sheet dated December 31. c. Prepare the necessary journal entry to update the accounting records. Complete this question by entering your answers in the table below. Prepare the necessary journal entry to update the accounting records. "Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. The Cash account of Renfro Corporation showed a balance of $21,749 at December 31 prior to preparing a bank reconciliation. The company's bank statement showed a balance of $22,000 at the same date. The only reconciling items consisted of (1) a $5,000 deposit in transit; (2) a bank service charge of $200;(3) outstanding checks totaling $9,000;(4) a $3,000 check marked NSF from Susque Company, one of Renfro's customers; and (5) a check correctly written for office supplies in the amount of $1,832 that was incorrectly recorded by the company's bookkeeper as an increase in Office Supplies of \$1,283, and a reduction in Cash of $1,283. In addition to this information, Renfro owned the following finan $3,000 of high-grade, 120 -day commercial paper; and (3) $5,0C tets at December 3t: (1) a money market account of $60.000;; (2) ighly liquid stock imvestments. a. Prepare the company's December 31 bank reconciliation. b. Defermine the amount at which cash and cash equivolents will be reported in the company's balance sheet dated December 31 c. Prepore the necessary journal entry to update the accounting records. Complete this question by entering your answers in the table below. Prepare the companivis December 31 bank reconcitiation