Bruner Inc. has requested a cash budget for July. The following information was provided: 1. Cash balance on July 1 is $2,800. 2. Actual

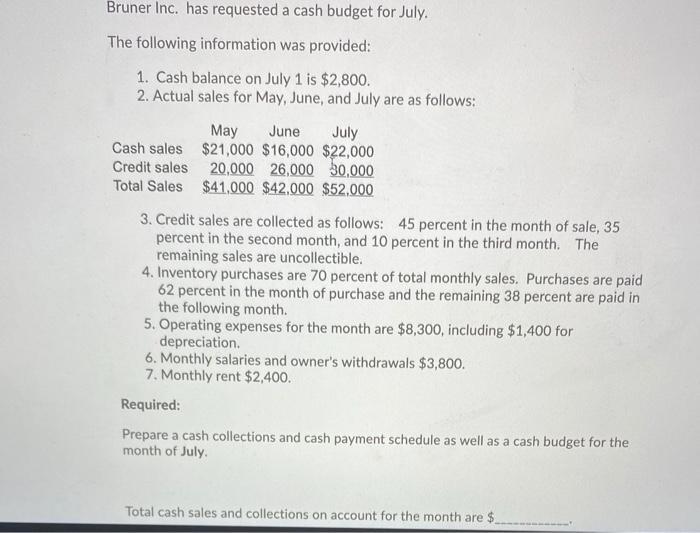

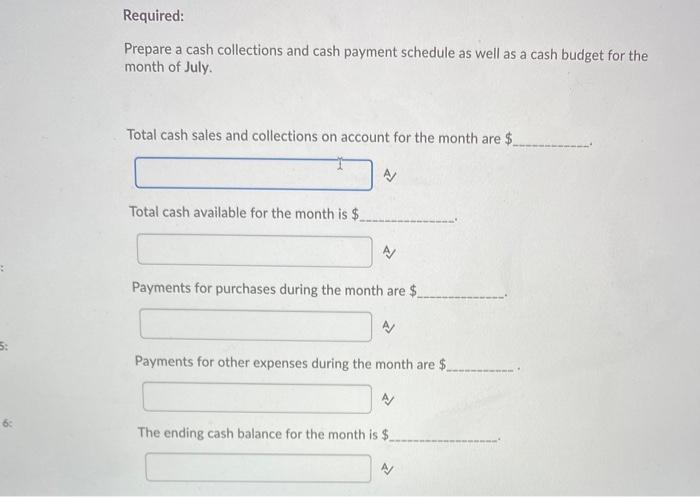

Bruner Inc. has requested a cash budget for July. The following information was provided: 1. Cash balance on July 1 is $2,800. 2. Actual sales for May, June, and July are as follows: May June July Cash sales $21,000 $16,000 $22,000 Credit sales 20,000 26,000 30,000 Total Sales $41,000 $42.000 $52.000 3. Credit sales are collected as follows: 45 percent in the month of sale, 35 percent in the second month, and 10 percent in the third month. The remaining sales are uncollectible. 4. Inventory purchases are 70 percent of total monthly sales. Purchases are paid 62 percent in the month of purchase and the remaining 38 percent are paid in the following month. 5. Operating expenses for the month are $8,300, including $1,400 for depreciation. 6. Monthly salaries and owner's withdrawals $3,800. 7. Monthly rent $2,400. Required: Prepare a cash collections and cash payment schedule as well as a cash budget for the month of July. Total cash sales and collections on account for the month are $ 5: 6: Required: Prepare a cash collections and cash payment schedule as well as a cash budget for the month of July. Total cash sales and collections on account for the month are $ Total cash available for the month is $ A/ Payments for purchases during the month are $. A/ Payments for other expenses during the month are $ The ending cash balance for the month is $.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Schedule of Cash Collections For The Month of July Cash collections From May sales 2000010 F...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started