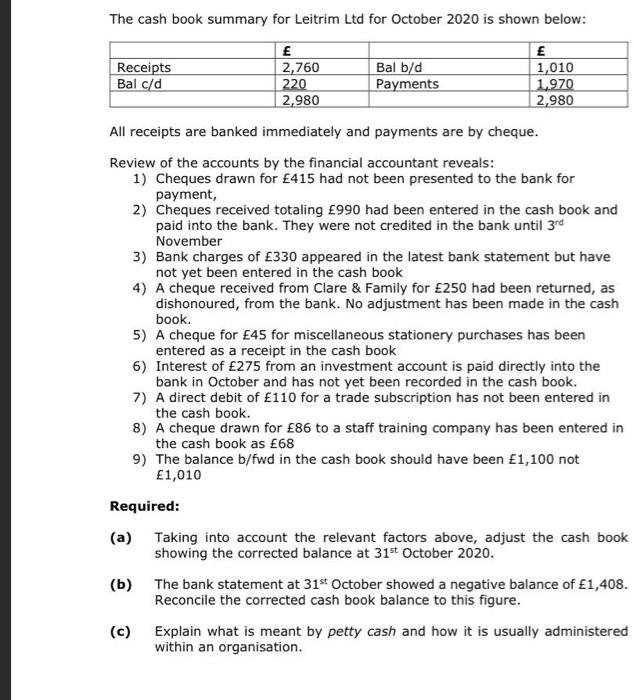

The cash book summary for Leitrim Ltd for October 2020 is shown below: Receipts Bal c/d 2,760 220 2,980 Bal b/d Payments 1,010 1.970 2,980 All receipts are banked immediately and payments are by cheque. Review of the accounts by the financial accountant reveals: 1) Cheques drawn for 415 had not been presented to the bank for payment, 2) Cheques received totaling 990 had been entered in the cash book and paid into the bank. They were not credited in the bank until 3rd November 3) Bank charges of 330 appeared in the latest bank statement but have not yet been entered in the cash book 4) A cheque received from Clare & Family for 250 had been returned, as dishonoured, from the bank. No adjustment has been made in the cash book. 5) A cheque for 45 for miscellaneous stationery purchases has been entered as a receipt in the cash book 6) Interest of 275 from an investment account is paid directly into the bank in October and has not yet been recorded in the cash book. 7) A direct debit of 110 for a trade subscription has not been entered in the cash book. 8) A cheque drawn for 86 to a staff training company has been entered in the cash book as 68 9) The balance b/fwd in the cash book should have been 1,100 not 1,010 Required: (a) Taking into account the relevant factors above, adjust the cash book showing the corrected balance at 31st October 2020. (b) The bank statement at 31st October showed a negative balance of 1,408. Reconcile the corrected cash book balance to this figure. (c) Explain what is meant by petty cash and how it is usually administered within an organisation. The cash book summary for Leitrim Ltd for October 2020 is shown below: Receipts Bal c/d 2,760 220 2,980 Bal b/d Payments 1,010 1.970 2,980 All receipts are banked immediately and payments are by cheque. Review of the accounts by the financial accountant reveals: 1) Cheques drawn for 415 had not been presented to the bank for payment, 2) Cheques received totaling 990 had been entered in the cash book and paid into the bank. They were not credited in the bank until 3rd November 3) Bank charges of 330 appeared in the latest bank statement but have not yet been entered in the cash book 4) A cheque received from Clare & Family for 250 had been returned, as dishonoured, from the bank. No adjustment has been made in the cash book. 5) A cheque for 45 for miscellaneous stationery purchases has been entered as a receipt in the cash book 6) Interest of 275 from an investment account is paid directly into the bank in October and has not yet been recorded in the cash book. 7) A direct debit of 110 for a trade subscription has not been entered in the cash book. 8) A cheque drawn for 86 to a staff training company has been entered in the cash book as 68 9) The balance b/fwd in the cash book should have been 1,100 not 1,010 Required: (a) Taking into account the relevant factors above, adjust the cash book showing the corrected balance at 31st October 2020. (b) The bank statement at 31st October showed a negative balance of 1,408. Reconcile the corrected cash book balance to this figure. (c) Explain what is meant by petty cash and how it is usually administered within an organisation