Question

The Cash Budget Once we see how the components of the cash budget are calculated, it is just a matter of putting together an entire

The Cash Budget

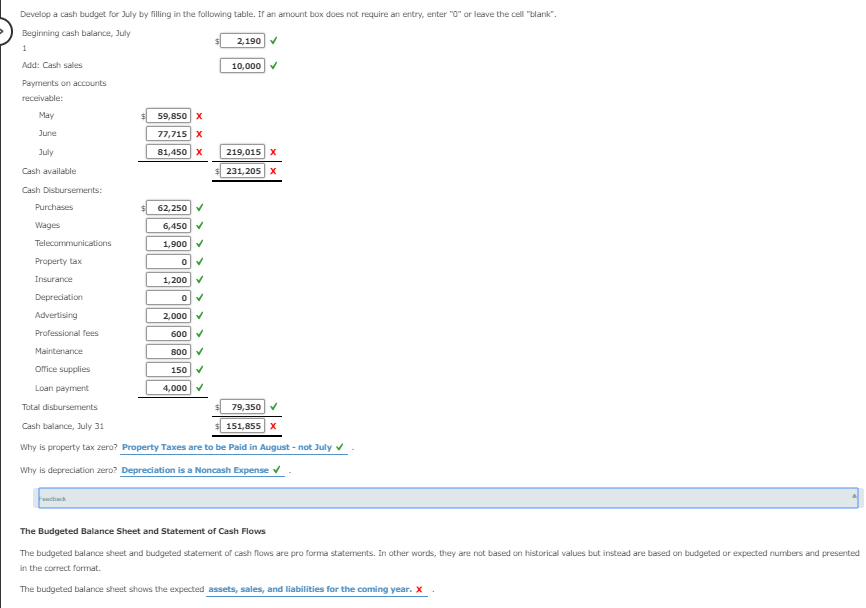

Once we see how the components of the cash budget are calculated, it is just a matter of putting together an entire cash budget. It almost seems redundant to say, but a cash budget includes only cash items. So if a company makes sales on account, those are not included in the cash budget until cash is received on account. Similarly, a company may have non cash expenses. These are not included in the cash budget.

A company expects sales of $100,000 in July and expects sales of $115,000 in August. The company provided the following information:

a. Sales in the previous three months were:

| April | $88,000 |

| May | 90,000 |

| June | 95,000 |

Of the sales, 10% are cash sales, the remaining are on account. The company experiences the following accounts receivable payment pattern: 25% in the month of sale, 50% in the month after sale, 20% in the second month after sale.

b. Purchases of goods are made the month before the anticipated sale at a rate of 60% of sales. Of monthly purchases, 25% are paid in the month of purchase, and the remaining 75% in the following month.

c. Wages for staff total $6,450 per month.

d. Telecommunications and utilities are $1,900 per month.

e. The property tax bill of $6,000 is due in August.

f. Insurance is paid quarterly at $1,200 per quarter. The next payment is due July 15.

g. Depreciation is $2,000 per month.

h. Advertising is budgeted at $2,000 per month in the summer months.

i. Professional fees (legal, bookkeeping, etc.) average $600 per month.

j. Maintenance is $800 per month.

k. Office supplies average $150 per month.

l. The owner took out a loan from her family and is paying it back at the rate of $4,000 per month.

m. The cash balance on July 1 was $2,190.

PLEASE correct the wrong answers. Thank you. For the final question, the options are either: liabilities and owner's equity for the coming year or income and cash flows for the coming year.

PLEASE correct the wrong answers. Thank you. For the final question, the options are either: liabilities and owner's equity for the coming year or income and cash flows for the coming year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started