Answered step by step

Verified Expert Solution

Question

1 Approved Answer

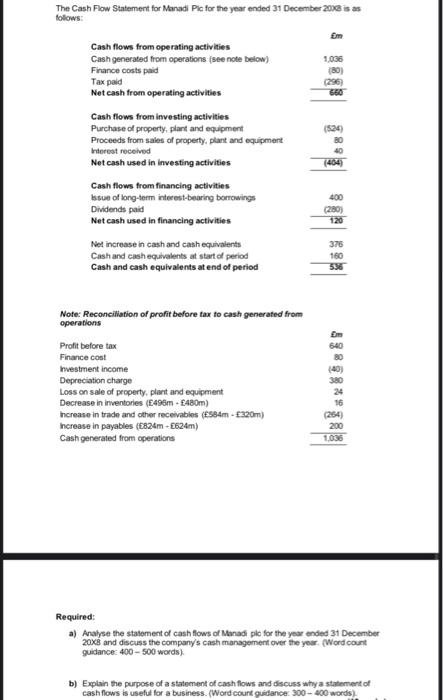

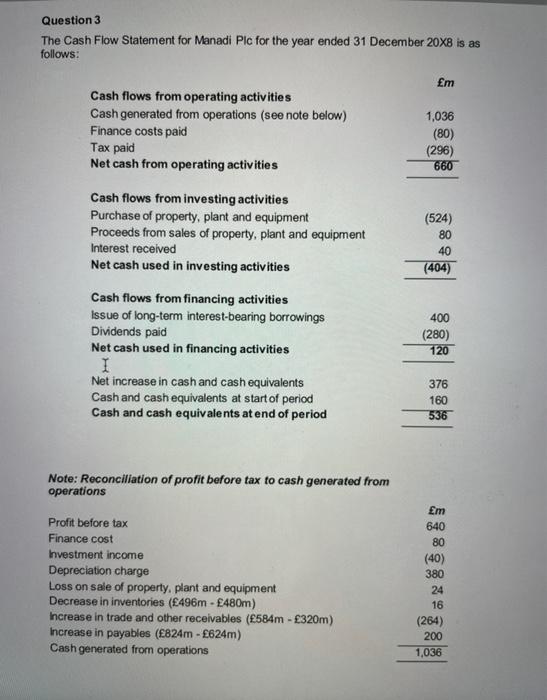

The Cash Flow Statement for Manadi Plc for the year ended 31 December 20X8 is as follows: m Cash flows from operating activities Cash generated

The Cash Flow Statement for Manadi Plc for the year ended 31 December 20X8 is as follows:

m

Cash flows from operating activities

Cash generated from operations (see note below) 1,036 Finance costs paid (80) Tax paid (296) Net cash from operating activities 660

Cash flows from investing activities

Purchase of property, plant and equipment (524) Proceeds from sales of property, plant and equipment 80 Interest received 40 Net cash used in investing activities (404)

Cash flows from financing activities

Issue of long-term interest-bearing borrowings 400 Dividends paid (280) Net cash used in financing activities 120

Net increase in cash and cash equivalents 376 Cash and cash equivalents at start of period 160 Cash and cash equivalents at end of period 536

Note: Reconciliation of profit before tax to cash generated from operations

m

Profit before tax 640 Finance cost 80 Investment income (40) Depreciation charge 380 Loss on sale of property, plant and equipment 24 Decrease in inventories (496m - 480m) 16 Increase in trade and other receivables (584m - 320m) (264) Increase in payables (824m - 624m) 200 Cash generated from operations 1,036

Required:

a) Analyse the statement of cash flows of Manadi plc for the year ended 31 December 20X8 and discuss the companys cash management over the year. (Word count guidance: 400 500 words).

b) Explainthepurposeofastatementofcashflowsanddiscusswhyastatementof cash flows is useful for a business. (Word count guidance: 300 400 words).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started