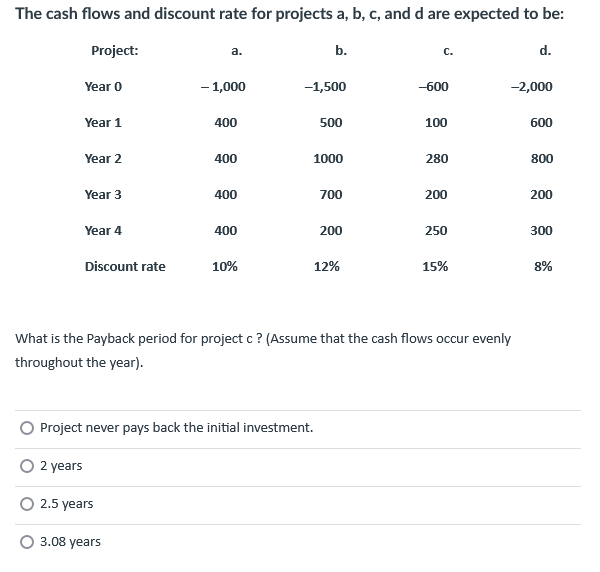

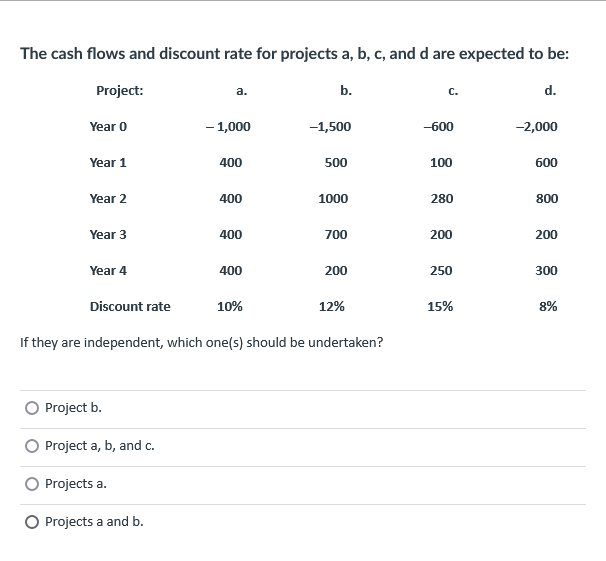

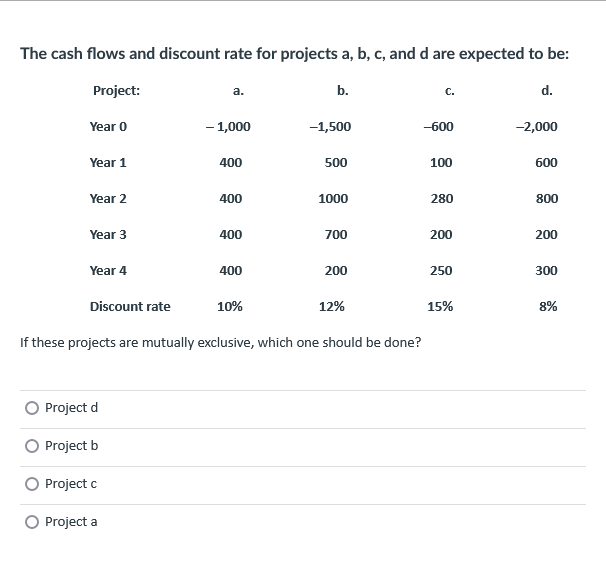

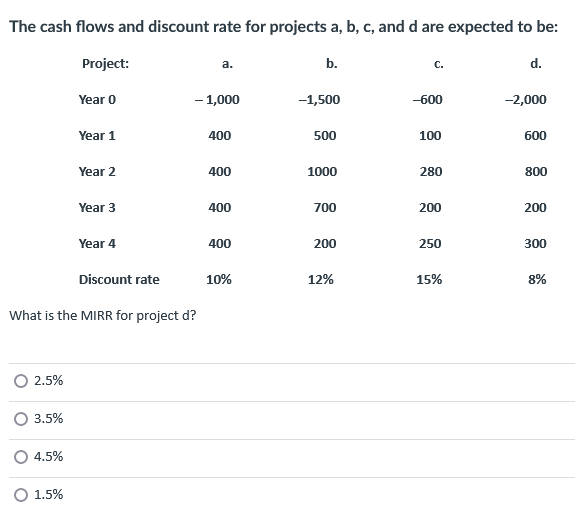

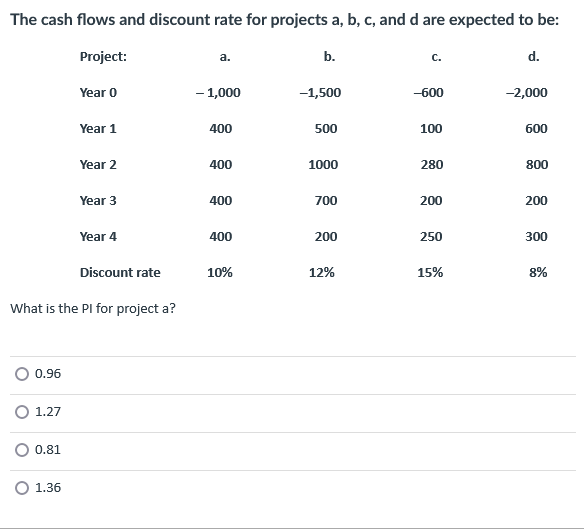

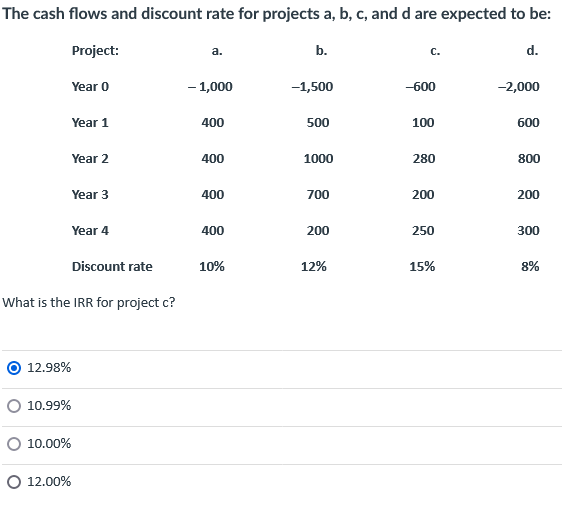

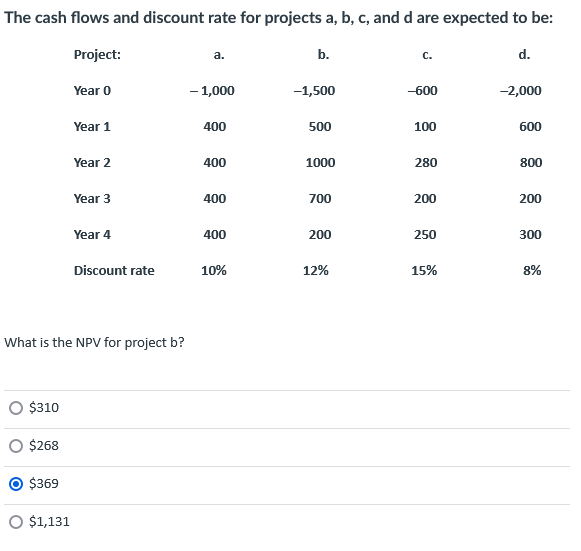

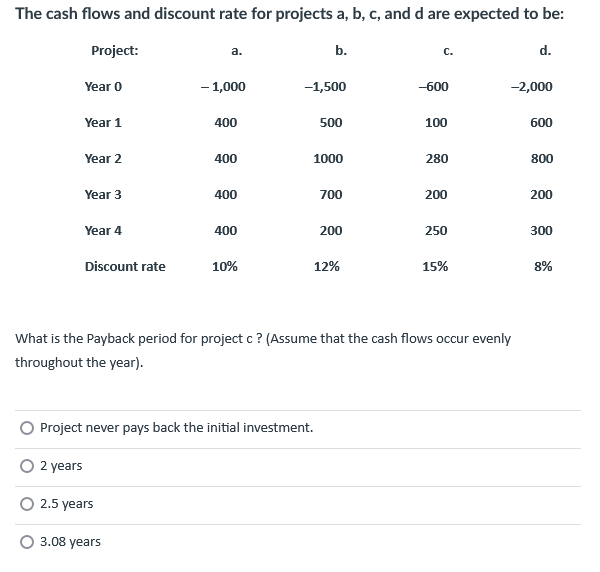

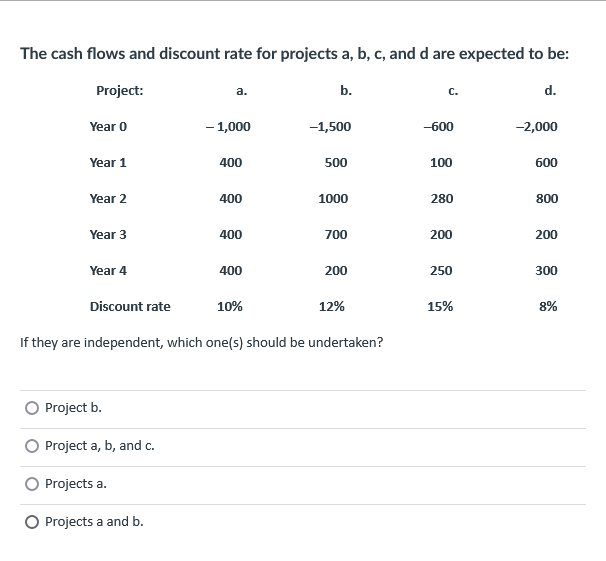

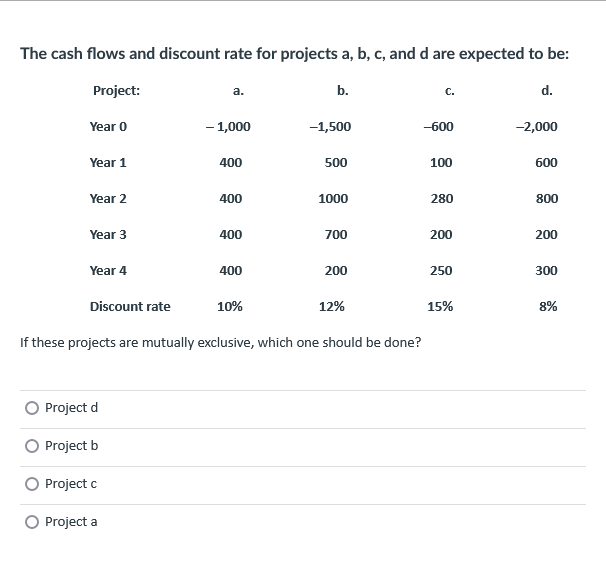

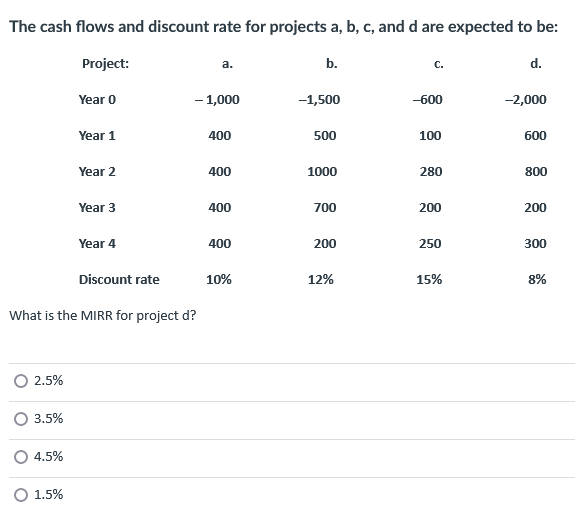

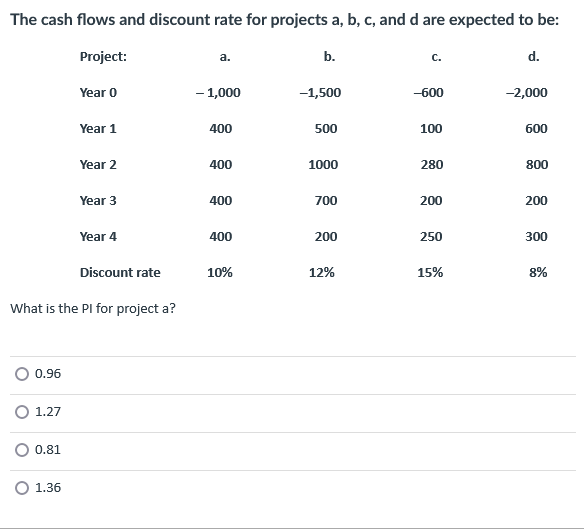

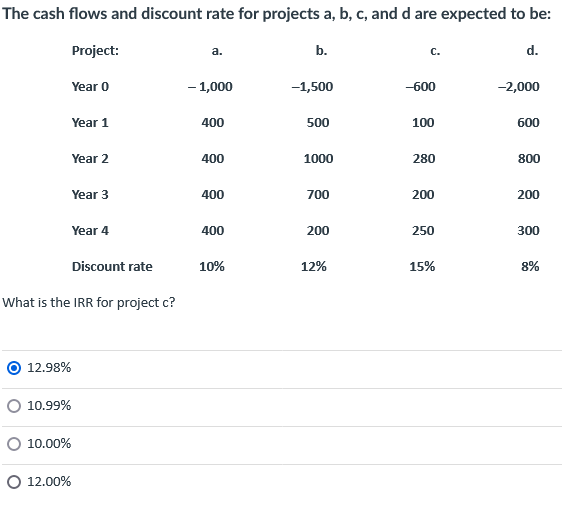

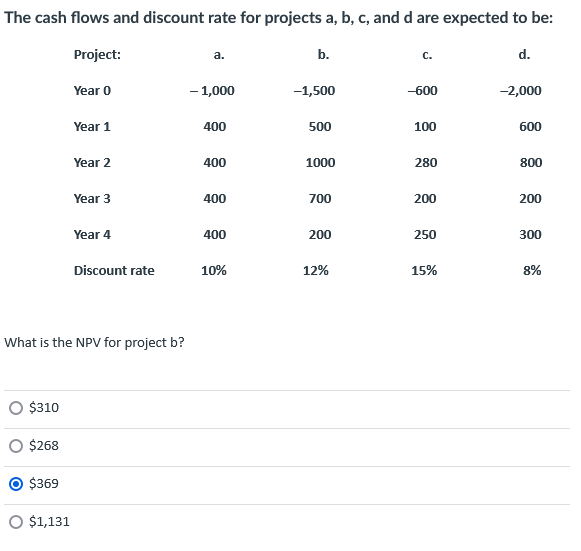

The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year o - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% What is the Payback period for project c ? (Assume that the cash flows occur evenly throughout the year). Project never pays back the initial investment. 2 years 2.5 years 3.08 years The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year 0 - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% If they are independent, which one(s) should be undertaken? Project b. Project a, b, and c. Projects a. O Projects a and b. The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. c. d. Year 0 - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% If these projects are mutually exclusive, which one should be done? Project d Project b Project c O Project a The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year 0 - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% What is the MIRR for project d? 2.5% 3.5% 4.5% 1.5% The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year o - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% What is the Pl for project a? 0.96 O 1.27 0.81 1.36 The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year 0 - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% What is the IRR for project c? 12.98% O 10.99% O 10.00% O 12.00% The cash flows and discount rate for projects a, b, c, and d are expected to be: Project: a. b. C. d. Year 0 - 1,000 -1,500 -600 -2,000 Year 1 400 500 100 600 Year 2 400 1000 280 800 Year 3 400 700 200 200 Year 4 400 200 250 300 Discount rate 10% 12% 15% 8% What is the NPV for project b? O $310 O $268 $369 O $1,131