Answered step by step

Verified Expert Solution

Question

1 Approved Answer

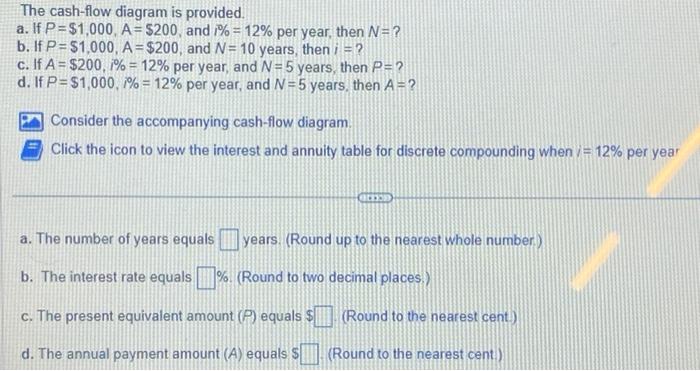

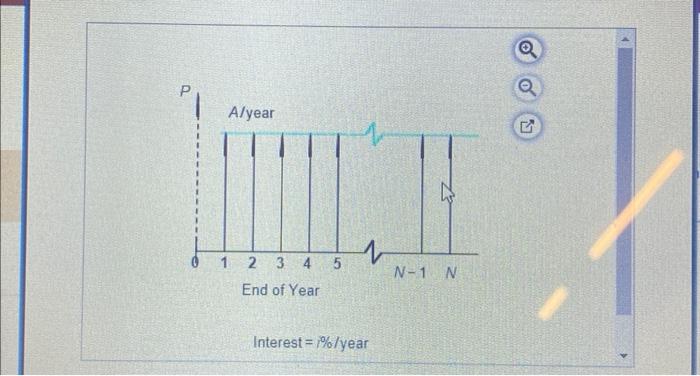

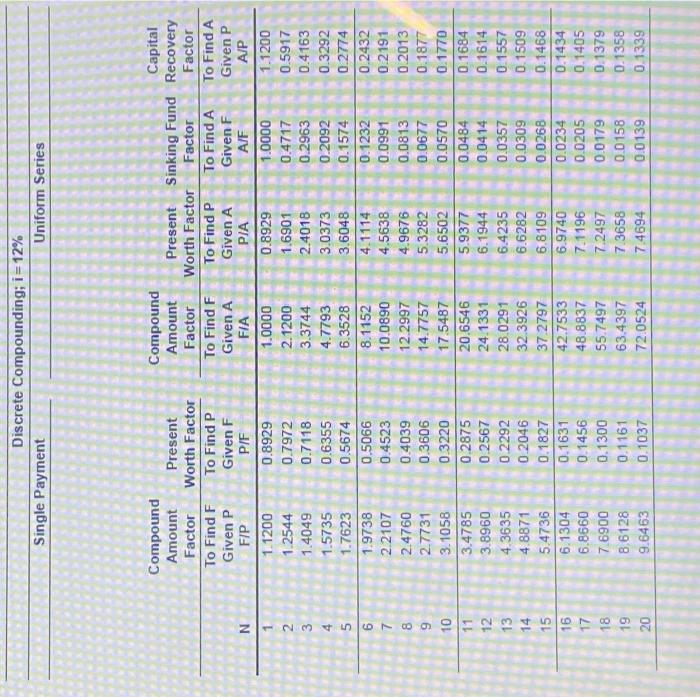

The cash-flow diagram is provided. a. If P=$1,000, A= $200, and 1% = 12% per year, then N= ? b. If P= $1,000, A=$200,

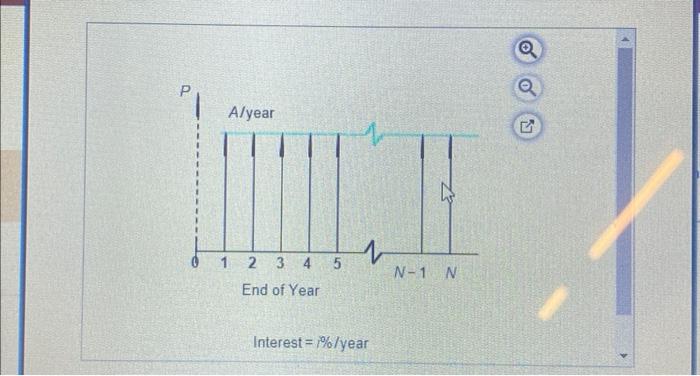

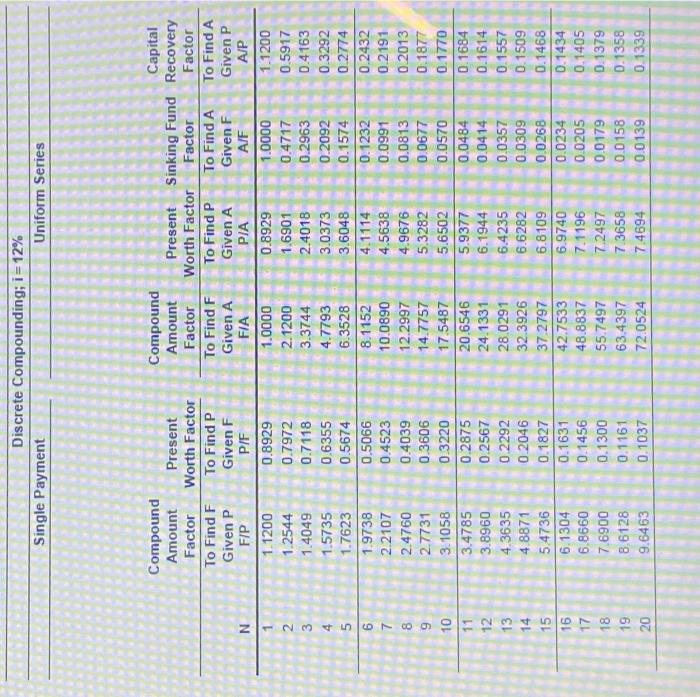

The cash-flow diagram is provided. a. If P=$1,000, A= $200, and 1% = 12% per year, then N= ? b. If P= $1,000, A=$200, and N= 10 years, then i =? c. If A = $200, 1% = 12% per year, and N= 5 years, then P=? d. If P=$1,000, 1% = 12% per year, and N=5 years, then A=? Consider the accompanying cash-flow diagram. Click the icon to view the interest and annuity table for discrete compounding when /= 12% per year BLOOD a. The number of years equals years. (Round up to the nearest whole number) b. The interest rate equals %. (Round to two decimal places.) c. The present equivalent amount (P) equals $ d. The annual payment amount (A) equals S (Round to the nearest cent.) (Round to the nearest cent) A/year 2 3 4 5 End of Year 1 Interest = 1%/year N-1 N Q 5 N 12345 2 5 6 7 8 9 10 12 13 14 15 16 17 18 19 20 Single Payment Compound Amount Factor To Find F Given P F/P 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 3.4785 3.8960 4.3635 4.8871 5.4736 Discrete Compounding; i=12% 6.1304 6.8660 7.6900 8.6128 9.6463 Present Worth Factor To Find P Given F P/F 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 Compound Amount Factor To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 20.6546 24.1331 28.0291 32.3926 37.2797 42.7533 48.8837 55.7497 63.4397 72.0524 Uniform Series Present Sinking Fund Factor To Find A Given F A/F Worth Factor To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 5.9377 6.1944 6.4235 6.6282 6.8109 6.9740 7.1196 7.2497 7.3658 7.4694 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 0.0484 0.0414 0.0357 0.0309 0.0268 0.0234 0.0205 0.0179 0.0158 0.0139 Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339 A/year 2 3 4 5 End of Year 1 Interest = 1%/year N-1 N Q N 12345 2 6 7 8 9 10 12 13 14 15 16 17 18 19 20 Single Payment Compound Amount Factor To Find F Given P F/P 1.1200 1.2544 1.4049 1.5735 1.7623 Discrete Compounding; i =12% 1.9738 2.2107 2.4760 2.7731 3.1058 3.4785 3.8960 4.3635 4.8871 5.4736 6.1304 6.8660 7.6900 8.6128 9.6463 Present Worth Factor To Find P Given F P/F 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 Compound Amount Factor To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 20.6546 24.1331 28.0291 32.3926 37.2797 42.7533 48.8837 55.7497 63.4397 72.0524 Uniform Series Present Sinking Fund Factor To Find A Given F A/F Worth Factor To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 5.9377 6.1944 6.4235 6.6282 6.8109 6.9740 7.1196 7.2497 7.3658 7.4694 1.0000 0.4717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0677 0.0570 0.0484 0.0414 0.0357 0.0309 0.0268 0.0234 0.0205 0.0179 0.0158 0.0139 Capital Recovery Factor To Find A Given P A/P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started