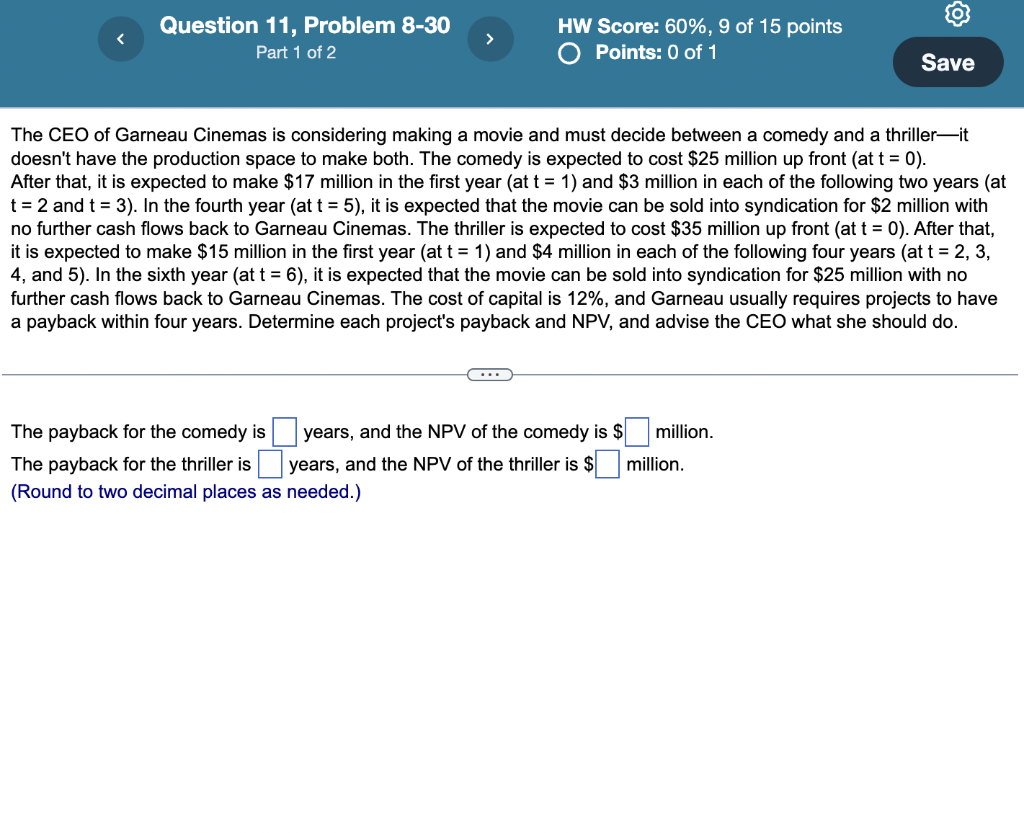

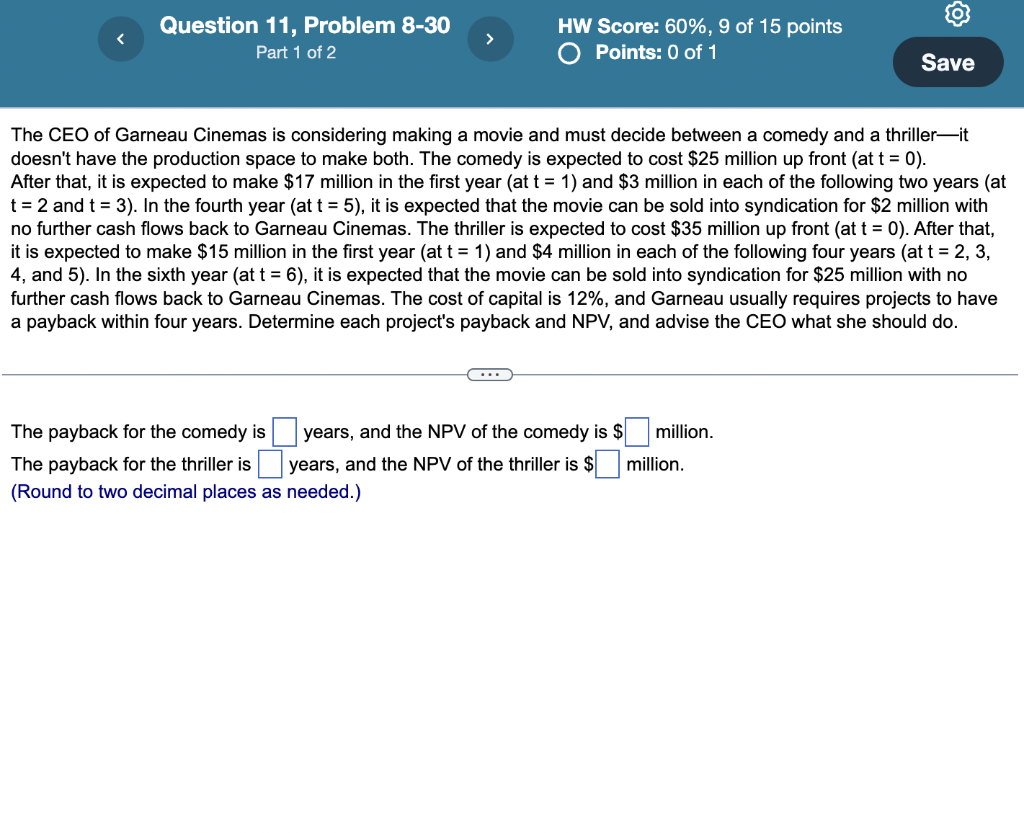

The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thriller-it doesn't have the production space to make both. The comedy is expected to cost $25 million up front ( at t=0 ). After that, it is expected to make $17 million in the first year (at=1) and $3 million in each of the following two years (at t=2 and t=3 ). In the fourth year (at=5), it is expected that the movie can be sold into syndication for $2 million with no further cash flows back to Garneau Cinemas. The thriller is expected to cost $35 million up front (at t=0 ). After that, it is expected to make $15 million in the first year (at t=1 ) and $4 million in each of the following four years (at t=2, 3 , 4 , and 5). In the sixth year (at t=6 ), it is expected that the movie can be sold into syndication for $25 million with no further cash flows back to Garneau Cinemas. The cost of capital is 12%, and Garneau usually requires projects to have a payback within four years. Determine each project's payback and NPV, and advise the CEO what she should do. The payback for the comedy is years, and the NPV of the comedy is $ million. The payback for the thriller is years, and the NPV of the thriller is $ million. (Round to two decimal places as needed.) The CEO of Garneau Cinemas is considering making a movie and must decide between a comedy and a thriller-it doesn't have the production space to make both. The comedy is expected to cost $25 million up front ( at t=0 ). After that, it is expected to make $17 million in the first year (at=1) and $3 million in each of the following two years (at t=2 and t=3 ). In the fourth year (at=5), it is expected that the movie can be sold into syndication for $2 million with no further cash flows back to Garneau Cinemas. The thriller is expected to cost $35 million up front (at t=0 ). After that, it is expected to make $15 million in the first year (at t=1 ) and $4 million in each of the following four years (at t=2, 3 , 4 , and 5). In the sixth year (at t=6 ), it is expected that the movie can be sold into syndication for $25 million with no further cash flows back to Garneau Cinemas. The cost of capital is 12%, and Garneau usually requires projects to have a payback within four years. Determine each project's payback and NPV, and advise the CEO what she should do. The payback for the comedy is years, and the NPV of the comedy is $ million. The payback for the thriller is years, and the NPV of the thriller is $ million. (Round to two decimal places as needed.)