Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CEO of Poirot Enterprises has provided you with the following balance sheet for the years ended 1 and 2. Poirot Enterprises Balance Sheet

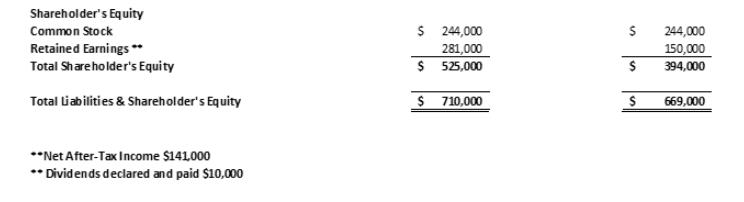

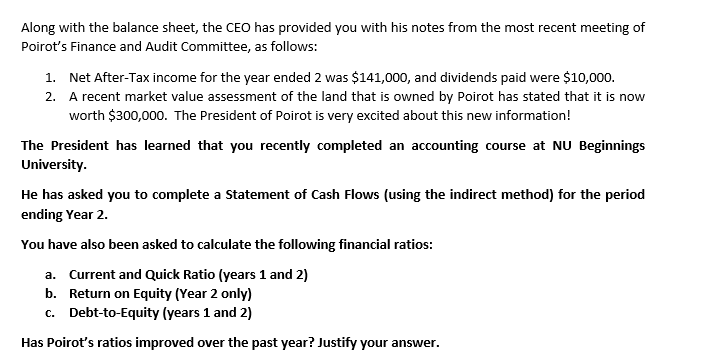

The CEO of Poirot Enterprises has provided you with the following balance sheet for the years ended 1 and 2. Poirot Enterprises Balance Sheet as at December 31, Year 1 and Year 2 Year 2 Year 1 Assets Current Assets Cash $ 115,000 $ 189,000 Accounts Receivable Inventory Total Current Assets 90,000 100,000 105,000 120,000 $ 310,000 $ 409,000 Land $ 190,000 $ 190,000 Buildings $ 295,000 $ 145,000 Less: Accum. Depreciation (85,000) (75,000) Net Buildings Total Fixed Assets 210,000 $ 400,000 70,000 $ 260,000 Total Assets $ 710,000 $ 669,000 Current Liabilities Accounts Payable $ 100,000 $ 125,000 Notes Payable 60,000 Total Current Liabilities $ 100,000 $ 185,000 Long-Term Debts $ 85,000 $ 90,000 $ 185,000 $ 275,000 Total Liabilities Shareholder's Equity Common Stock $ 244,000 $ 244,000 Retained Earnings ** 281,000 150,000 Total Shareholder's Equity $ 525,000 $ 394,000 Shareholder's Equity Common Stock Retained Earnings ** $ 244,000 S 244,000 281,000 150,000 Total Shareholder's Equity $ 525,000 $ 394,000 Total Liabilities & Shareholder's Equity $ 710,000 $ 669,000 **Net After-Tax Income $141.000 ** Dividends declared and paid $10,000 Along with the balance sheet, the CEO has provided you with his notes from the most recent meeting of Poirot's Finance and Audit Committee, as follows: 1. Net After-Tax income for the year ended 2 was $141,000, and dividends paid were $10,000. 2. A recent market value assessment of the land that is owned by Poirot has stated that it is now worth $300,000. The President of Poirot is very excited about this new information! The President has learned that you recently completed an accounting course at NU Beginnings University. He has asked you to complete a Statement of Cash Flows (using the indirect method) for the period ending Year 2. You have also been asked to calculate the following financial ratios: a. Current and Quick Ratio (years 1 and 2) b. Return on Equity (Year 2 only) c. Debt-to-Equity (years 1 and 2) Has Poirot's ratios improved over the past year? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started