Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CEO of UST would like you to prepare a three-to-four page case memo discussing UST's current financial situation and the implications of increasing

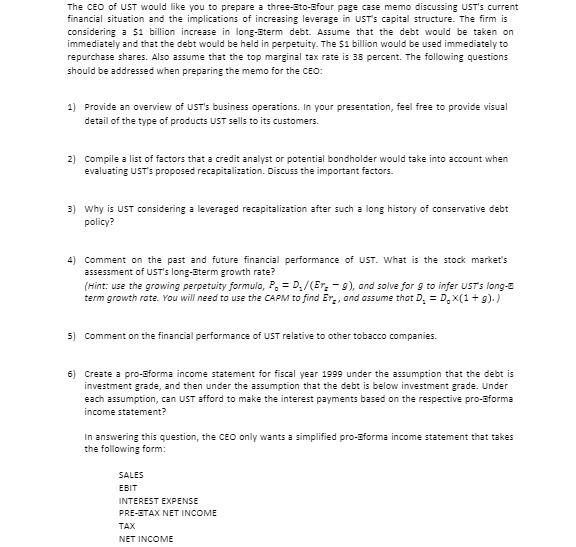

The CEO of UST would like you to prepare a three-to-four page case memo discussing UST's current financial situation and the implications of increasing leverage in UST's capital structure. The firm is considering a $1 billion increase in long-term debt. Assume that the debt would be taken on immediately and that the debt would be held in perpetuity. The $1 billion would be used immediately to repurchase shares. Also assume that the top marginal tax rate is 38 percent. The following questions should be addressed when preparing the memo for the CEO: 1) Provide an overview of UST's business operations. In your presentation, feel free to provide visual detail of the type of products UST sells to its customers. 2) Compile a list of factors that a credit analyst or potential bondholder would take into account when evaluating UST's proposed recapitalization. Discuss the important factors. 3) Why is UST considering a leveraged recapitalization after such a long history of conservative debt policy? 4) Comment on the past and future financial performance of UST. What is the stock market's assessment of UST's long-term growth rate? (Hint: use the growing perpetuity formula, P = D/(Er-9), and solve for 9 to infer UST's long- term growth rate. You will need to use the CAPM to find Er, and assume that D = D. X(1 + g).) 5) Comment on the financial performance of UST relative to other tobacco companies. 6) Create a pro-forma income statement for fiscal year 1999 under the assumption that the debt is investment grade, and then under the assumption that the debt is below investment grade. Under each assumption, can UST afford to make the interest payments based on the respective pro-forma income statement? In answering this question, the following form: SALES EBIT INTEREST EXPENSE PRE-ETAX NET INCOME TAX NET INCOME CEO only wants a simplified pro-Eforma income statement that takes

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Memo To CEO of UST From Your Name Date Date Subject USTs Financial Situation and Implications of Increasing Leverage 1 Overview of USTs Business Operations UST is a company primarily engaged in the ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started