Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CEPE Slope Master RCSM will have the range of features commonly found in the lower-end Chinese models. By sourcing existing subcomponents, but building

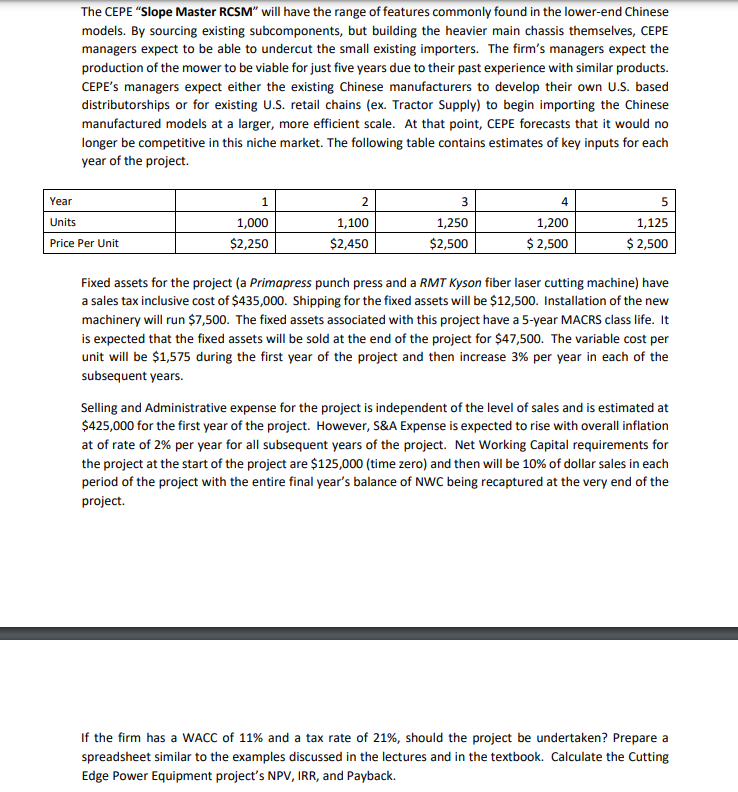

The CEPE "Slope Master RCSM" will have the range of features commonly found in the lower-end Chinese models. By sourcing existing subcomponents, but building the heavier main chassis themselves, CEPE managers expect to be able to undercut the small existing importers. The firm's managers expect the production of the mower to be viable for just five years due to their past experience with similar products. CEPE's managers expect either the existing Chinese manufacturers to develop their own U.S. based distributorships or for existing U.S. retail chains (ex. Tractor Supply) to begin importing the Chinese manufactured models at a larger, more efficient scale. At that point, CEPE forecasts that it would no longer be competitive in this niche market. The following table contains estimates of key inputs for each year of the project. Year Units Price Per Unit 1 2 3 4 1,000 $2,250 1,100 $2,450 1,250 1,200 5 1,125 $2,500 $2,500 $2,500 Fixed assets for the project (a Primapress punch press and a RMT Kyson fiber laser cutting machine) have a sales tax inclusive cost of $435,000. Shipping for the fixed assets will be $12,500. Installation of the new machinery will run $7,500. The fixed assets associated with this project have a 5-year MACRS class life. It is expected that the fixed assets will be sold at the end of the project for $47,500. The variable cost per unit will be $1,575 during the first year of the project and then increase 3% per year in each of the subsequent years. Selling and Administrative expense for the project is independent of the level of sales and is estimated at $425,000 for the first year of the project. However, S&A Expense is expected to rise with overall inflation at of rate of 2% per year for all subsequent years of the project. Net Working Capital requirements for the project at the start of the project are $125,000 (time zero) and then will be 10% of dollar sales in each period of the project with the entire final year's balance of NWC being recaptured at the very end of the project. If the firm has a WACC of 11% and a tax rate of 21%, should the project be undertaken? Prepare a spreadsheet similar to the examples discussed in the lectures and in the textbook. Calculate the Cutting Edge Power Equipment project's NPV, IRR, and Payback.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started