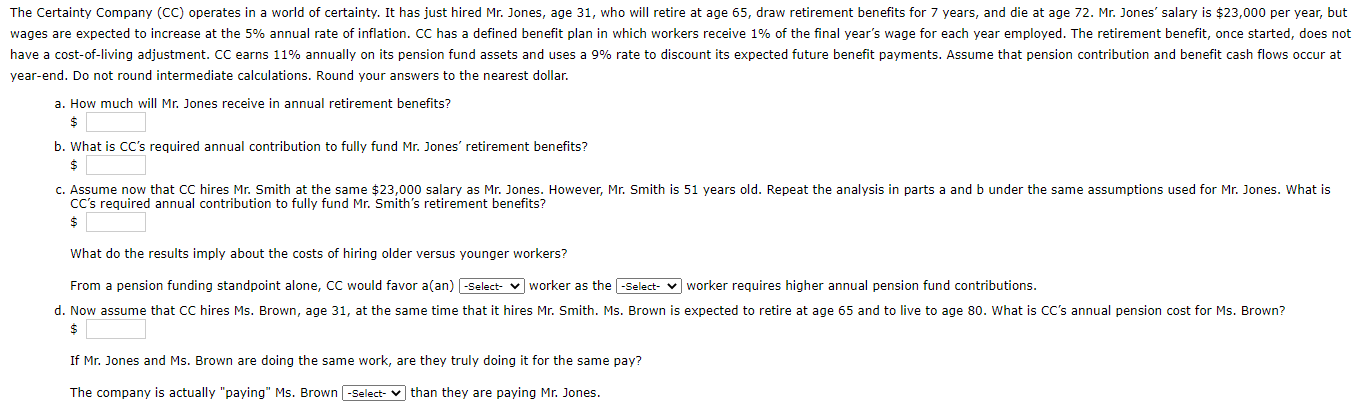

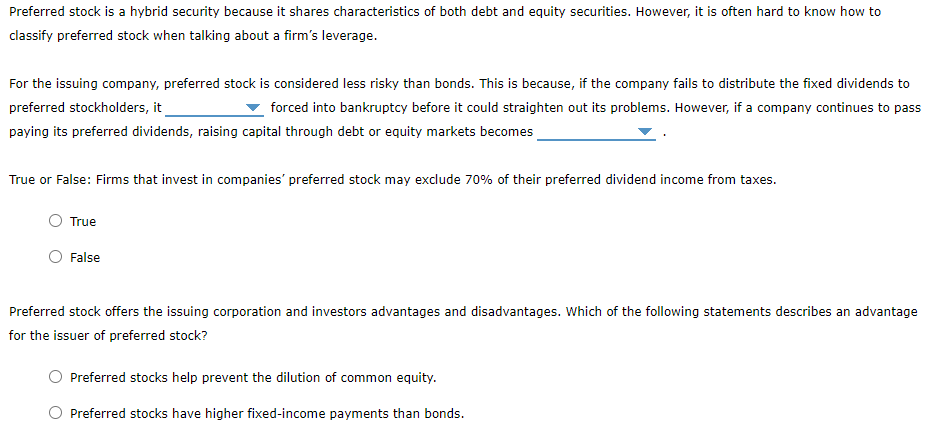

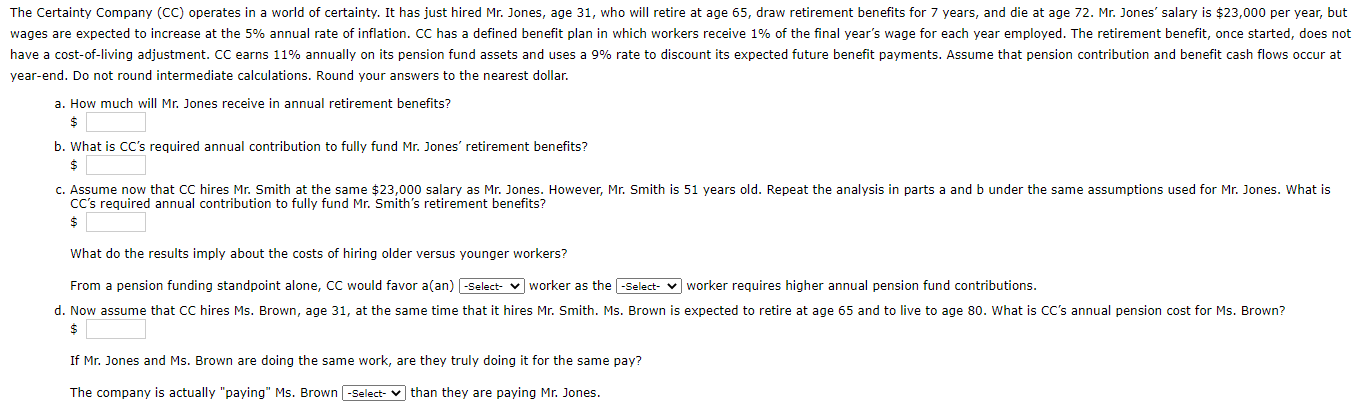

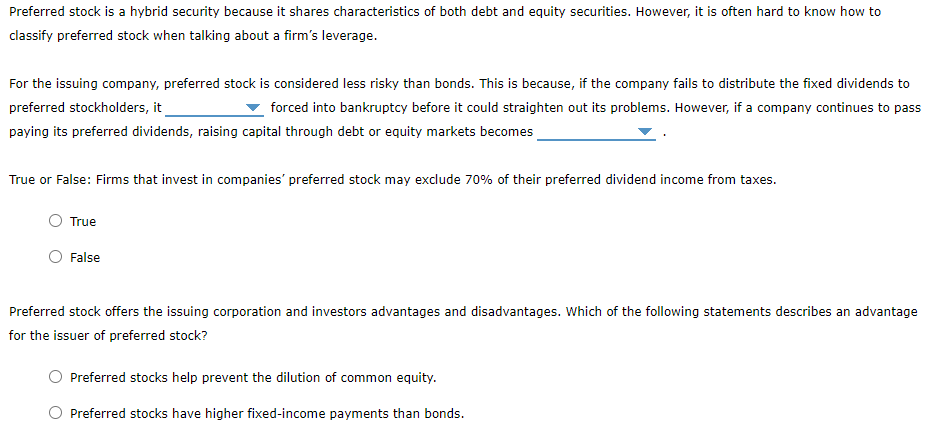

The Certainty Company (CC) operates in a world of certainty. It has just hired Mr. Jones, age 31, who will retire at age 65, draw retirement benefits for 7 years, and die at age 72. Mr. Jones' salary is $23,000 per year, but wages are expected to increase at the 5% annual rate of inflation. CC has a defined benefit plan in which workers receive 1% of the final year's wage for each year employed. The retirement benefit, once started, does not have a cost-of-living adjustment. CC earns 11% annually on its pension fund assets and uses a 9% rate to discount its expected future benefit payments. Assume that pension contribution and benefit cash flows occur at year-end. Do not round intermediate calculations. Round your answers to the nearest dollar. a. How much will Mr. Jones receive in annual retirement benefits? $ b. What is CC's required annual contribution to fully fund Mr. Jones' retirement benefits? S C. Assume now that CC hires Mr. Smith at the same $23,000 salary as Mr. Jones. However, Mr. Smith is 51 years old. Repeat the analysis in parts a and b under the same assumptions used for Mr. Jones. What is CC's required annual contribution to fully fund Mr. Smith's retirement benefits? $ What do the results imply about the costs of hiring older versus younger workers? From a pension funding standpoint alone, CC would favor a(an) -Select- vworker as the -Select- v worker requires higher annual pension fund contributions. d. Now assume that CC hires Ms. Brown, age 31, at the same time that it hires Mr. Smith. Ms. Brown is expected to retire at age 65 and to live to age 80. What is CC's annual pension cost for Ms. Brown? $ If Mr. Jones and Ms. Brown are doing the same work, are they truly doing it for the same pay? The company is actually "paying" Ms. Brown -Select- v than they are paying Mr. Jones. Preferred stock is a hybrid security because it shares characteristics of both debt and equity securities. However, it is often hard to know how to classify preferred stock when talking about a firm's leverage. For the issuing company, preferred stock is considered less risky than bonds. This is because, if the company fails to distribute the fixed dividends to preferred stockholders, it forced into bankruptcy before it could straighten out its problems. However, if a company continues to pass paying its preferred dividends, raising capital through debt or equity markets becomes True or False: Firms that invest in companies' preferred stock may exclude 70% of their preferred dividend income from taxes. True False Preferred stock offers the issuing corporation and investors advantages and disadvantages. Which of the following statements describes an advantage for the issuer of preferred stock? Preferred stocks help prevent the dilution of common equity. Preferred stocks have higher fixed-income payments than bonds. The Certainty Company (CC) operates in a world of certainty. It has just hired Mr. Jones, age 31, who will retire at age 65, draw retirement benefits for 7 years, and die at age 72. Mr. Jones' salary is $23,000 per year, but wages are expected to increase at the 5% annual rate of inflation. CC has a defined benefit plan in which workers receive 1% of the final year's wage for each year employed. The retirement benefit, once started, does not have a cost-of-living adjustment. CC earns 11% annually on its pension fund assets and uses a 9% rate to discount its expected future benefit payments. Assume that pension contribution and benefit cash flows occur at year-end. Do not round intermediate calculations. Round your answers to the nearest dollar. a. How much will Mr. Jones receive in annual retirement benefits? $ b. What is CC's required annual contribution to fully fund Mr. Jones' retirement benefits? S C. Assume now that CC hires Mr. Smith at the same $23,000 salary as Mr. Jones. However, Mr. Smith is 51 years old. Repeat the analysis in parts a and b under the same assumptions used for Mr. Jones. What is CC's required annual contribution to fully fund Mr. Smith's retirement benefits? $ What do the results imply about the costs of hiring older versus younger workers? From a pension funding standpoint alone, CC would favor a(an) -Select- vworker as the -Select- v worker requires higher annual pension fund contributions. d. Now assume that CC hires Ms. Brown, age 31, at the same time that it hires Mr. Smith. Ms. Brown is expected to retire at age 65 and to live to age 80. What is CC's annual pension cost for Ms. Brown? $ If Mr. Jones and Ms. Brown are doing the same work, are they truly doing it for the same pay? The company is actually "paying" Ms. Brown -Select- v than they are paying Mr. Jones. Preferred stock is a hybrid security because it shares characteristics of both debt and equity securities. However, it is often hard to know how to classify preferred stock when talking about a firm's leverage. For the issuing company, preferred stock is considered less risky than bonds. This is because, if the company fails to distribute the fixed dividends to preferred stockholders, it forced into bankruptcy before it could straighten out its problems. However, if a company continues to pass paying its preferred dividends, raising capital through debt or equity markets becomes True or False: Firms that invest in companies' preferred stock may exclude 70% of their preferred dividend income from taxes. True False Preferred stock offers the issuing corporation and investors advantages and disadvantages. Which of the following statements describes an advantage for the issuer of preferred stock? Preferred stocks help prevent the dilution of common equity. Preferred stocks have higher fixed-income payments than bonds