Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The certainty equivalent is the certain income or payment in dollars that makes a decision - maker indifferent between taking a risk and taking the

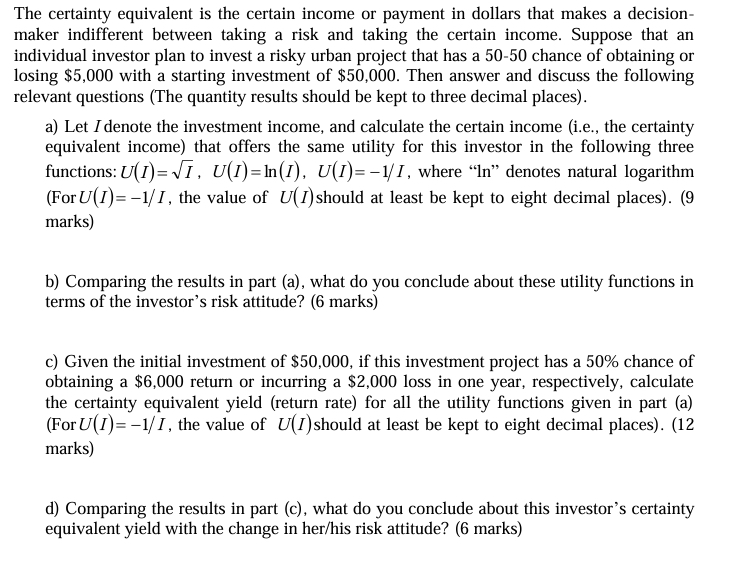

The certainty equivalent is the certain income or payment in dollars that makes a decision

maker indifferent between taking a risk and taking the certain income. Suppose that an

individual investor plan to invest a risky urban project that has a chance of obtaining or

losing $ with a starting investment of $ Then answer and discuss the following

relevant questions The quantity results should be kept to three decimal places

a Let I denote the investment income, and calculate the certain income ie the certainty

equivalent income that offers the same utility for this investor in the following three

functions: where In denotes natural logarithm

For the value of should at least be kept to eight decimal places

marks

b Comparing the results in part a what do you conclude about these utility functions in

terms of the investor's risk attitude? marks

c Given the initial investment of $ if this investment project has a chance of

obtaining a $ return or incurring a $ loss in one year, respectively, calculate

the certainty equivalent yield return rate for all the utility functions given in part a

For the value of should at least be kept to eight decimal places

marks

d Comparing the results in part c what do you conclude about this investor's certainty

equivalent yield with the change in herhis risk attitude? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started