Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The chairman and CEO of Copart Inc., Adib Azhar has agreed to accept a salary of RM1 per year for the next five years.

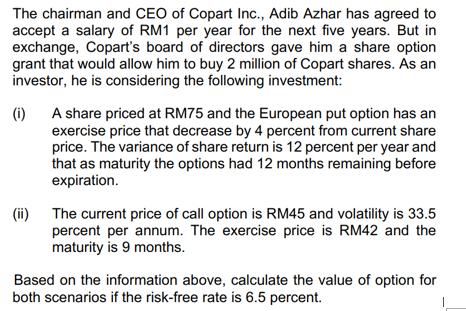

The chairman and CEO of Copart Inc., Adib Azhar has agreed to accept a salary of RM1 per year for the next five years. But in exchange, Copart's board of directors gave him a share option grant that would allow him to buy 2 million of Copart shares. As an investor, he is considering the following investment: (i) A share priced at RM75 and the European put option has an exercise price that decrease by 4 percent from current share price. The variance of share return is 12 percent per year and that as maturity the options had 12 months remaining before expiration. (ii) The current price of call option is RM45 and volatility is 33.5 percent per annum. The exercise price is RM42 and the maturity is 9 months. Based on the information above, calculate the value of option for both scenarios if the risk-free rate is 6.5 percent.

Step by Step Solution

★★★★★

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

i European Put Option Current share price RM75 Exercise price Decreases 4 from current price RM75 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started