Question

The Challenge: Grabbing the SMB opportunity ABC Ads wants to cater to this growing demand of small & medium businesses by solving their needs via

The Challenge: Grabbing the SMB opportunity ABC Ads wants to cater to this growing demand of small & medium businesses by solving their needs via its platform. The aim is to extract at least a 500cr opportunity from this segment. Explore the small and medium business advertising segment and evaluate the following: - What are the advertising needs of players in this segment? - What is the opportunity size for a new platform catering to their demands? - What are competing platforms/ solutions that exist? Based on the strengths of ABC Ads, residing inside a telco giant, create a solution for these SMBs that would satisfy their marketing needs. Also explain the products USP over the existing solutions in market. With low ticket sizes, capturing a meaningful share of this market would require onboarding thousands of such SMBs onto the ABC Ads solution. Keeping your product (or, suite of products) and this share of audience in mind, create a GTM plan that covers the following: 1) What will be the pitch for small time retailers to work with ABC Ads? Create a marketing plan on creating relevant outreach to this segment, and plan to promote the value proposition of the ABC Ads offering. 2) How will the sales and operations effort be organized tackle both the human team structure, and the tools and support teams you will need to acquire and service the clients for this product? 3) What investments will ABC have to make to achieve this ambition? Come up with a high level P&L for the business at the desired scale.

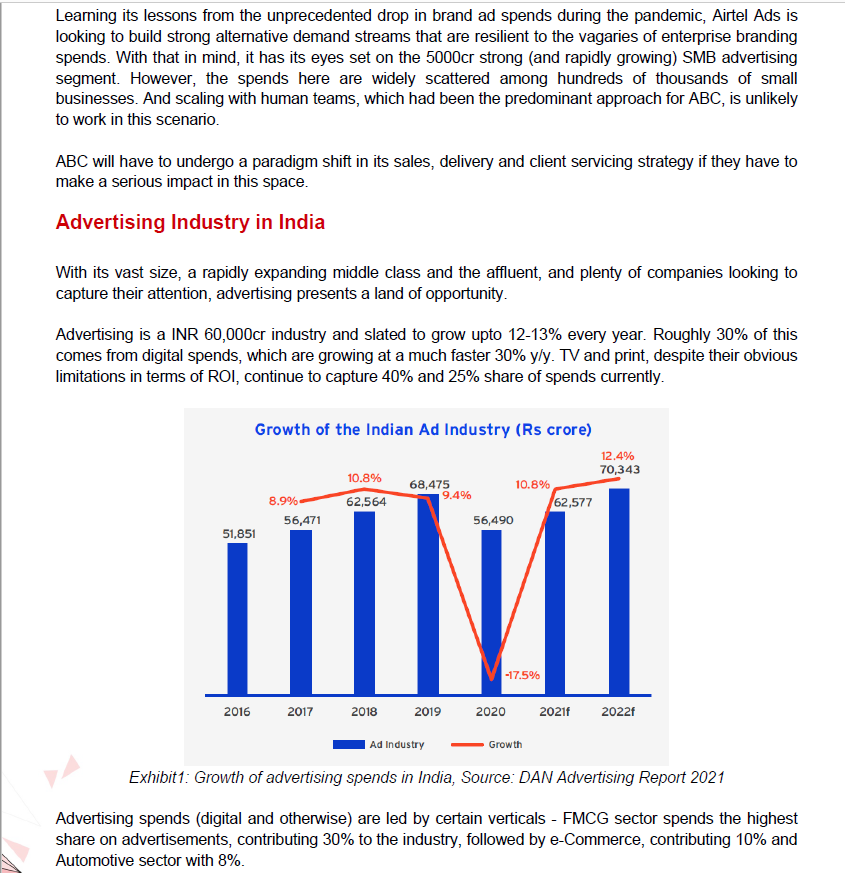

Ads for SMBs ABC: Making large strides in digital-first businesses ABC is a dominant player in telecommunication sector. Few years earlier, ABC faced some tough competition and the industry as a whole was going through turmoil, thus ABC took a major call to go beyond its core competencies of telecom. With telecom as base, ABC decided to expand its source of business and started venturing into digital space. In the wake of the unprecedented scenarios due to COVID pandemic, ABC, doubled down on the digital transformation of its customer acquisition and servicing processes, across all lines of business. While customers who were able to manage their services through ABC's app and web platforms shot up to 100mn, ABC's streaming platforms Wynk and Xstream boast of another 60mn consumers a month. The lockdown drove up the need for connectivity across the country dramatically, and servicing this demand required innovations across ABC's core businesses. A digital first, but operations backed approach helped them accelerate the penetration of broadband to keep homes and offices connected for the country, and DTH to keep those at home informed and entertained. ABC's approach was not just limited to strengthening its digital reach direct to customer but also provide the tools and means to its 1.2mn retailers spread across the country to sustain and grow their business, especially as the restrictions eased over the second half of 2021. While the core businesses were innovating to match the need of the hour, an incubation team inside ABC was charting its way into a new business territory for ABC's 3rd party advertising as a product. The idea had emanated from ABC's own product marketing to its customers - upselling and cross-selling its telco services. If ABC's platforms could promote relevant products from its own catalogue, these could as well enable other brands to advertise their products and services to this audience, using the filter of relevance. However, within a quarter or so of its inception in Dec 2019, ABC Ads, as it brands itself today, faced one of the toughest periods in the advertising industry with sharp cuts in marketing owing to an uncertain economy, broken supply chains and businesses shutting down. With its fair share of highs and lows, within a year the team was able to work with nearly 100 customers clocking an annualized run rate of 100cr. With this first milestone achieved, the business officially launched in Feb 2021 generating a buzz with advertisers and media alike. Riding on the great reviews of its early customers, and word of mouth driven as a result, ABC Ads doubled its revenue numbers achieved in the previous year within the span of just under 6 months. wuy ADU TITOL pray "I CICCOLTIITILITICALON SELLI. I W years Canci, AD Tucu SOIT competition and the industry as a whole was going through turmoil, thus ABC took a major call to go beyond its core competencies of telecom. With telecom as base, ABC decided to expand its source of business and started venturing into digital space. In the wake of the unprecedented scenarios due to COVID pandemic, ABC, doubled down on the digital transformation of its customer acquisition and servicing processes, across all lines of business. While customers who were able to manage their services through ABC's app and web platforms shot up to 100mn, ABC's streaming platforms Wynk and Xstream boast of another 60mn consumers a month. The lockdown drove up the need for connectivity across the country dramatically, and servicing this demand required innovations across ABC's core businesses. A digital first, but operations backed approach helped them accelerate the penetration of broadband to keep homes and offices connected for the country, and DTH to keep those at home informed and entertained. ABC's approach was not just limited to strengthening its digital reach direct to customer but also provide the tools and means to its 1.2mn retailers spread across the country to sustain and grow their business, especially as the restrictions eased over the second half of 2021. While the core businesses were innovating to match the need of the hour, an incubation team inside ABC was charting its way into a new business territory for ABC's 3rd party advertising as a product. The idea had emanated from ABC's own product marketing to its customers - upselling and cross-selling its telco services. If ABC's platforms could promote relevant products from its own catalogue, these could as well enable other brands to advertise their products and services to this audience, using the filter of relevance. However, within a quarter or so of its inception in Dec 2019, ABC Ads, as it brands itself today, faced one of the toughest periods in the advertising industry with sharp cuts in marketing owing to an uncertain economy, broken supply chains and businesses shutting down. With its fair share of highs and lows, within a year the team was able to work with nearly 100 customers clocking an annualized run rate of 100cr. With this first milestone achieved, the business officially launched in Feb 2021 generating a buzz with advertisers and media alike. Riding on the great reviews of its early customers, and word of mouth driven as a result, ABC Ads doubled its revenue numbers achieved in the previous year within the span of just under 6 months. This growth was in part due to the growth in advertisers, but a lion's share came from growing spends from large brands and agencies that had seen signs of success with the platform. Now, ABC Ads needs to grow 10x from here within the next 2 years in order to build a robust, profitable business that is meaningful within the ABC ecosystem. Learning its lessons from the unprecedented drop in brand ad spends during the pandemic, Airtel Ads is looking to build strong alternative demand streams that are resilient to the vagaries of enterprise branding spends. With that in mind, it has its eyes set on the 5000cr strong and rapidly growing) SMB advertising segment. However, the spends here are widely scattered among hundreds of thousands of small businesses. And scaling with human teams, which had been the predominant approach for ABC, is unlikely to work in this scenario. ABC will have to undergo a paradigm shift in its sales, delivery and client servicing strategy if they have to make a serious impact in this space. Advertising Industry in India With its vast size, a rapidly expanding middle class and the affluent, and plenty of companies looking to capture their attention, advertising presents a land of opportunity. Advertising is a INR 60,000cr industry and slated to grow upto 12-13% every year. Roughly 30% of this comes from digital spends, which are growing at a much faster 30% yy. TV and print, despite their obvious limitations in terms of ROI, continue to capture 40% and 25% share of spends currently. Growth of the Indian Ad Industry (Rs crore) 12.4% 70,343 10.8% 62,564 8.9%- 56,471 68,475 10.8% 9.4% 62,577 56,490 51,851 -17.5% 2016 2017 2018 2019 2020 20214 20221 | Ad Industry Growth Exhibit1: Growth of advertising spends in India, Source: DAN Advertising Report 2021 Advertising spends (digital and otherwise) are led by certain verticals - FMCG sector spends the highest share on advertisements, contributing 30% to the industry, followed by e-Commerce, contributing 10% and Automotive sector with 8%. A large share of the spends is dominated by the large conglomerates, vertical majors and, at times, startups plush with funds. Like most other industries, advertising spends also see a skew with over 70% spends driven by the top 20% advertisers. A significant part of these campaigns are directed towards awareness and brand building, eventually resulting in purchase and loyalty for their products. On the other end of this spectrum are small and medium businesses local stores, small city level chains, franchises of larger brands, small D2C brands whose promotions are focused on acquiring new customers and driving up sales, from within their area of 'influence' which usually does not extend beyond a 10-15km radius. Estimates suggest that the spends from this segment total INR 4000-5000cr (extrapolated from gross ad revenues of key classifieds players - Justdial, Indiamart, real estate aggregators like Quikr, Housing, 99acres, car and restaurant classifieds). The overall pie at stake might, however, be much higher. In the past few years, small businesses have taken to advertising over social media platforms, primarily Facebook, Instagram and even Linkedin leveraging their community relevance and context. With the SMB's ability to market with local flavor and also deliver on promises quickly due to proximity, their investments into growth are only likely to swell. The Challenge: Grabbing the SMB opportunity ABC Ads wants to cater to this growing demand of small & medium businesses by solving their needs via its platform. The aim is to extract at least a 500cr opportunity from this segment. Explore the small and medium business advertising segment and evaluate the following: - What are the advertising needs of players in this segment? - What is the opportunity size for a new platform catering to their demands? - What are competing platforms/ solutions that exist? Based on the strengths of ABC Ads, residing inside a telco giant, create a solution for these SMBs that would satisfy their marketing needs. Also explain the product's USP over the existing solutions in market. With low ticket sizes, capturing a meaningful share of this market would require onboarding thousands of such SMBs onto the ABC Ads solution. Keeping your product (or, suite of products) and this share of audience in mind, create a GTM plan that covers the following: 1) What will be the pitch for small time retailers to work with ABC Ads? Create a marketing plan on creating relevant outreach to this segment, and plan to promote the value proposition of the ABC Ads offering. 2) How will the sales and operations effort be organized tackle both the human team structure, and the tools and support teams you will need to acquire and service the clients for this product? 3) What investments will ABC have to make to achieve this ambition? Come up with a high level P&L for the business at the desired scale. Ads for SMBs ABC: Making large strides in digital-first businesses ABC is a dominant player in telecommunication sector. Few years earlier, ABC faced some tough competition and the industry as a whole was going through turmoil, thus ABC took a major call to go beyond its core competencies of telecom. With telecom as base, ABC decided to expand its source of business and started venturing into digital space. In the wake of the unprecedented scenarios due to COVID pandemic, ABC, doubled down on the digital transformation of its customer acquisition and servicing processes, across all lines of business. While customers who were able to manage their services through ABC's app and web platforms shot up to 100mn, ABC's streaming platforms Wynk and Xstream boast of another 60mn consumers a month. The lockdown drove up the need for connectivity across the country dramatically, and servicing this demand required innovations across ABC's core businesses. A digital first, but operations backed approach helped them accelerate the penetration of broadband to keep homes and offices connected for the country, and DTH to keep those at home informed and entertained. ABC's approach was not just limited to strengthening its digital reach direct to customer but also provide the tools and means to its 1.2mn retailers spread across the country to sustain and grow their business, especially as the restrictions eased over the second half of 2021. While the core businesses were innovating to match the need of the hour, an incubation team inside ABC was charting its way into a new business territory for ABC's 3rd party advertising as a product. The idea had emanated from ABC's own product marketing to its customers - upselling and cross-selling its telco services. If ABC's platforms could promote relevant products from its own catalogue, these could as well enable other brands to advertise their products and services to this audience, using the filter of relevance. However, within a quarter or so of its inception in Dec 2019, ABC Ads, as it brands itself today, faced one of the toughest periods in the advertising industry with sharp cuts in marketing owing to an uncertain economy, broken supply chains and businesses shutting down. With its fair share of highs and lows, within a year the team was able to work with nearly 100 customers clocking an annualized run rate of 100cr. With this first milestone achieved, the business officially launched in Feb 2021 generating a buzz with advertisers and media alike. Riding on the great reviews of its early customers, and word of mouth driven as a result, ABC Ads doubled its revenue numbers achieved in the previous year within the span of just under 6 months. wuy ADU TITOL pray "I CICCOLTIITILITICALON SELLI. I W years Canci, AD Tucu SOIT competition and the industry as a whole was going through turmoil, thus ABC took a major call to go beyond its core competencies of telecom. With telecom as base, ABC decided to expand its source of business and started venturing into digital space. In the wake of the unprecedented scenarios due to COVID pandemic, ABC, doubled down on the digital transformation of its customer acquisition and servicing processes, across all lines of business. While customers who were able to manage their services through ABC's app and web platforms shot up to 100mn, ABC's streaming platforms Wynk and Xstream boast of another 60mn consumers a month. The lockdown drove up the need for connectivity across the country dramatically, and servicing this demand required innovations across ABC's core businesses. A digital first, but operations backed approach helped them accelerate the penetration of broadband to keep homes and offices connected for the country, and DTH to keep those at home informed and entertained. ABC's approach was not just limited to strengthening its digital reach direct to customer but also provide the tools and means to its 1.2mn retailers spread across the country to sustain and grow their business, especially as the restrictions eased over the second half of 2021. While the core businesses were innovating to match the need of the hour, an incubation team inside ABC was charting its way into a new business territory for ABC's 3rd party advertising as a product. The idea had emanated from ABC's own product marketing to its customers - upselling and cross-selling its telco services. If ABC's platforms could promote relevant products from its own catalogue, these could as well enable other brands to advertise their products and services to this audience, using the filter of relevance. However, within a quarter or so of its inception in Dec 2019, ABC Ads, as it brands itself today, faced one of the toughest periods in the advertising industry with sharp cuts in marketing owing to an uncertain economy, broken supply chains and businesses shutting down. With its fair share of highs and lows, within a year the team was able to work with nearly 100 customers clocking an annualized run rate of 100cr. With this first milestone achieved, the business officially launched in Feb 2021 generating a buzz with advertisers and media alike. Riding on the great reviews of its early customers, and word of mouth driven as a result, ABC Ads doubled its revenue numbers achieved in the previous year within the span of just under 6 months. This growth was in part due to the growth in advertisers, but a lion's share came from growing spends from large brands and agencies that had seen signs of success with the platform. Now, ABC Ads needs to grow 10x from here within the next 2 years in order to build a robust, profitable business that is meaningful within the ABC ecosystem. Learning its lessons from the unprecedented drop in brand ad spends during the pandemic, Airtel Ads is looking to build strong alternative demand streams that are resilient to the vagaries of enterprise branding spends. With that in mind, it has its eyes set on the 5000cr strong and rapidly growing) SMB advertising segment. However, the spends here are widely scattered among hundreds of thousands of small businesses. And scaling with human teams, which had been the predominant approach for ABC, is unlikely to work in this scenario. ABC will have to undergo a paradigm shift in its sales, delivery and client servicing strategy if they have to make a serious impact in this space. Advertising Industry in India With its vast size, a rapidly expanding middle class and the affluent, and plenty of companies looking to capture their attention, advertising presents a land of opportunity. Advertising is a INR 60,000cr industry and slated to grow upto 12-13% every year. Roughly 30% of this comes from digital spends, which are growing at a much faster 30% yy. TV and print, despite their obvious limitations in terms of ROI, continue to capture 40% and 25% share of spends currently. Growth of the Indian Ad Industry (Rs crore) 12.4% 70,343 10.8% 62,564 8.9%- 56,471 68,475 10.8% 9.4% 62,577 56,490 51,851 -17.5% 2016 2017 2018 2019 2020 20214 20221 | Ad Industry Growth Exhibit1: Growth of advertising spends in India, Source: DAN Advertising Report 2021 Advertising spends (digital and otherwise) are led by certain verticals - FMCG sector spends the highest share on advertisements, contributing 30% to the industry, followed by e-Commerce, contributing 10% and Automotive sector with 8%. A large share of the spends is dominated by the large conglomerates, vertical majors and, at times, startups plush with funds. Like most other industries, advertising spends also see a skew with over 70% spends driven by the top 20% advertisers. A significant part of these campaigns are directed towards awareness and brand building, eventually resulting in purchase and loyalty for their products. On the other end of this spectrum are small and medium businesses local stores, small city level chains, franchises of larger brands, small D2C brands whose promotions are focused on acquiring new customers and driving up sales, from within their area of 'influence' which usually does not extend beyond a 10-15km radius. Estimates suggest that the spends from this segment total INR 4000-5000cr (extrapolated from gross ad revenues of key classifieds players - Justdial, Indiamart, real estate aggregators like Quikr, Housing, 99acres, car and restaurant classifieds). The overall pie at stake might, however, be much higher. In the past few years, small businesses have taken to advertising over social media platforms, primarily Facebook, Instagram and even Linkedin leveraging their community relevance and context. With the SMB's ability to market with local flavor and also deliver on promises quickly due to proximity, their investments into growth are only likely to swell. The Challenge: Grabbing the SMB opportunity ABC Ads wants to cater to this growing demand of small & medium businesses by solving their needs via its platform. The aim is to extract at least a 500cr opportunity from this segment. Explore the small and medium business advertising segment and evaluate the following: - What are the advertising needs of players in this segment? - What is the opportunity size for a new platform catering to their demands? - What are competing platforms/ solutions that exist? Based on the strengths of ABC Ads, residing inside a telco giant, create a solution for these SMBs that would satisfy their marketing needs. Also explain the product's USP over the existing solutions in market. With low ticket sizes, capturing a meaningful share of this market would require onboarding thousands of such SMBs onto the ABC Ads solution. Keeping your product (or, suite of products) and this share of audience in mind, create a GTM plan that covers the following: 1) What will be the pitch for small time retailers to work with ABC Ads? Create a marketing plan on creating relevant outreach to this segment, and plan to promote the value proposition of the ABC Ads offering. 2) How will the sales and operations effort be organized tackle both the human team structure, and the tools and support teams you will need to acquire and service the clients for this product? 3) What investments will ABC have to make to achieve this ambition? Come up with a high level P&L for the business at the desired scaleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started