THE CHANGING SCENE OF AN ANNUAL WORTH ANALYSIS

Answer exercises 1 through 3

Answer Exercise 2 by both Spreadsheet and hand calculations (using appropriate formulae)

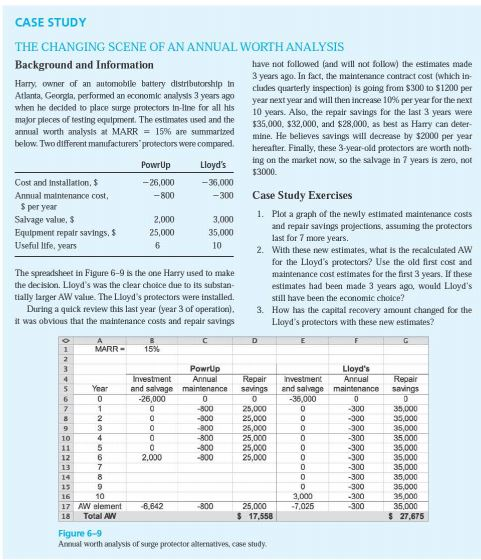

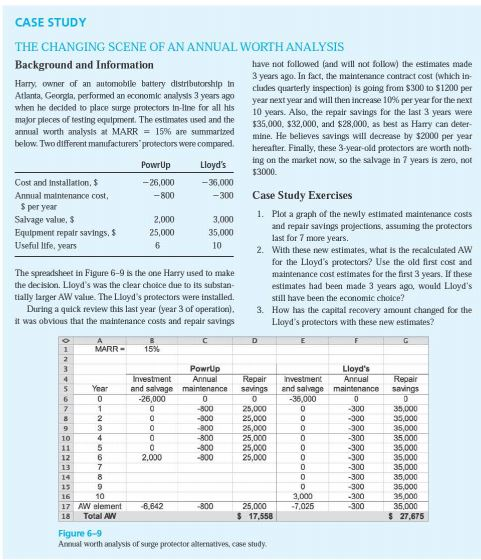

CASE STUDY THE CHANGING SCENE OF AN ANNUAL WORTH ANALYSIS Background and Information Harry, owner of an automoble battery d Atlanta, Georgla, performed an economic analysis 3 years ago when he declded to place surge protectors in-line major pleces of testing equtpmet. The estimates used and the annual worth analysts at MARR = 15% are summartzed below Two dilfferent manufacturers protectors were compared have not followed fand will not follow) the estimates made 3 years ago. In fact, the maintenance contract cost (whichin cludes quarterly inspection) ts going from $300 to $1200 per year next year and will then increase 10% per year for the next 10 years. Also, the repair savings for the last 3 years were for all his 35000, 32.000, and $28,000, as best as Hamy can deter- mine. He believes savings will decrease by $2000 per year hereafter. Finally, these 3-year-old protectors are woth noth ing on the market now, so the salvage in 7 years is zero, not $3000 Cost and Installation Annual maintenance cost -26,000 -800 2,000 25,000 -36,000 Case Study Exercises $ per year Salvage value, $ Equipment repair savings. Useful ltfe, years 1. 3,000 35,000 Plot a graph of the newly estimated maintenance costs and repair savings projections, assuming the protectors las for 7 more years. 10 2. With these new estimates, what is the recalculated AW The spreadsheet in Figure 6-9 is the one Harry used to make the decision. Lloyd's was the clear choice due to its substan- tially larger AW value. The Lloyd's protectors were installed for the Lloyd's protectors? Use the old first cost and maintenance cost estimates for the first 3 years. If these estimates had been made 3 years ago, would Lloyd's still have been the economic chodce? During a quick review this last year (year 3 of operation)3. How has the capital recovery amount changed foe the it was obvious that the maintenance costs and repair savings Lloyd's protectors with these new estimates? MARR nvestment Annual 5 Yea and salvage maintenance savings and savage maintenance savings -26,000 -36,000 -300 800 -900 25,000 25,000 25,000 25,000 25,000 25,000 35,000 35,000 -30035,000 35,000 300 300 -300 -300 300 2,000 35,000 35,000 35,000 35,000 35,000 35,000 12 15 10 3,000 800 17 AW element842 18 Total AW 25,000 17,558 27,875 Figure 6-5 Anemal worth analysis of singe protector alternatives, case study