Answered step by step

Verified Expert Solution

Question

1 Approved Answer

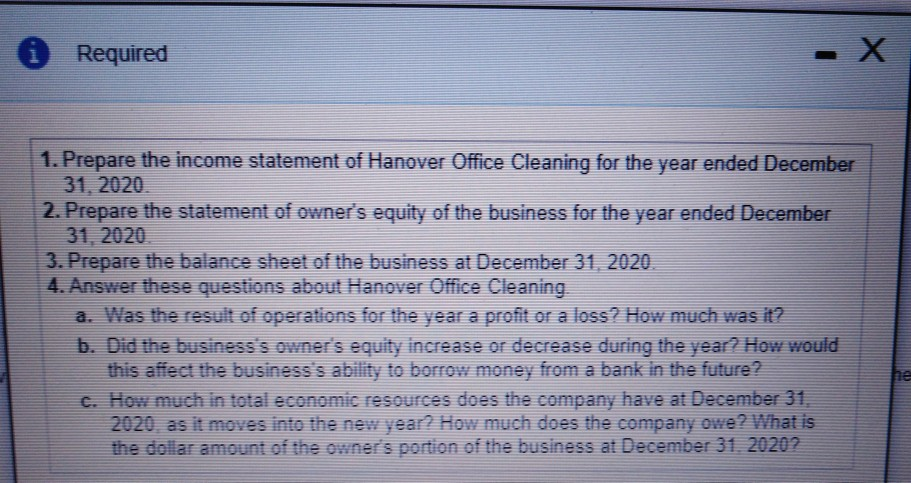

The Changomber 2001. Wethouded on the the Required - X 1. Prepare the income statement of Hanover Office Cleaning for the year ended December 31,

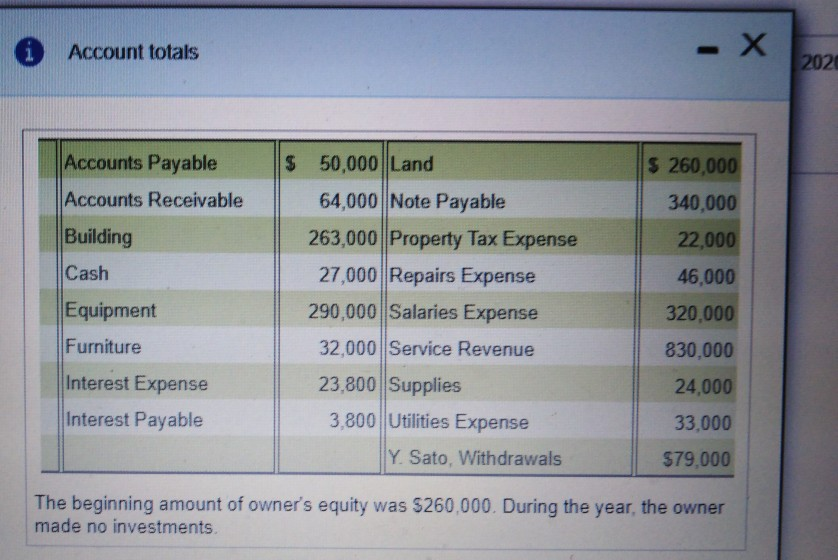

The Changomber 2001. Wethouded on the the Required - X 1. Prepare the income statement of Hanover Office Cleaning for the year ended December 31, 2020 2. Prepare the statement of owner's equity of the business for the year ended December 31, 2020 3. Prepare the balance sheet of the business at December 31, 2020 4. Answer these questions about Hanover Office Cleaning a. Was the result of operations for the year a profit or a loss? How much was it? b. Did the business's owner's equity increase or decrease during the year? How would this affect the business's ability to borrow money from a bank in the future? C. How much in total economic resources does the company have at December 31. 2020. as it moves into the new year? How much does the company owe? What is the dollar amount of the owner's portion of the business at December 31, 2020? he Account totals 2020 Accounts Payable $ 50,000 Land $ 260,000 Accounts Receivable 340,000 Building 22,000 Cash 64,000 Note Payable 263,000 Property Tax Expense 27,000 Repairs Expense 290,000 Salaries Expense 32,000 Service Revenue 46,000 Equipment 320,000 830.000 Furniture 24,000 Interest Expense Interest Payable 23,800 Supplies 3,800 Utilities Expense Y Sato, Withdrawals 33,000 $79.000 The beginning amount of owner's equity was $260.000. During the year, the owner made no investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started