Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The chapter focuses on long-term debt and leasing as a means of growth and capital improvement. Appendix 16A spotlights what happens when firms are financially

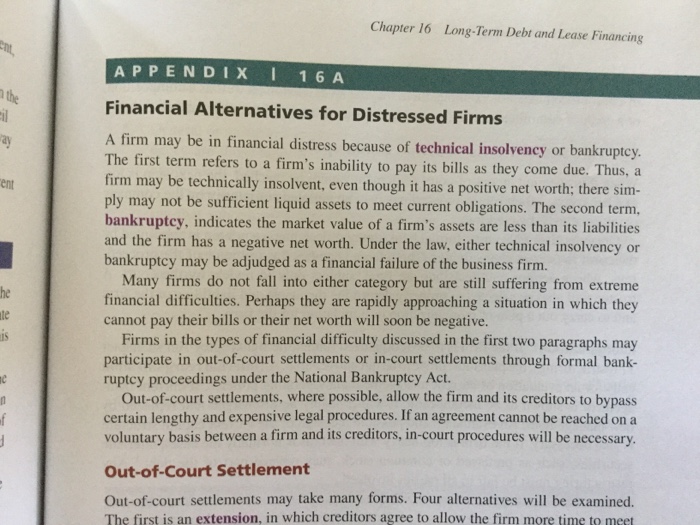

The chapter focuses on long-term debt and leasing as a means of growth and capital improvement. Appendix 16A spotlights what happens when firms are financially distressed due to the burdens of debt payments.

Please consider the following questions:

1. What is the reason an investor would choose bonds or choose stocks for an investment?

2. Read Appendix 16A beginning on page 533.

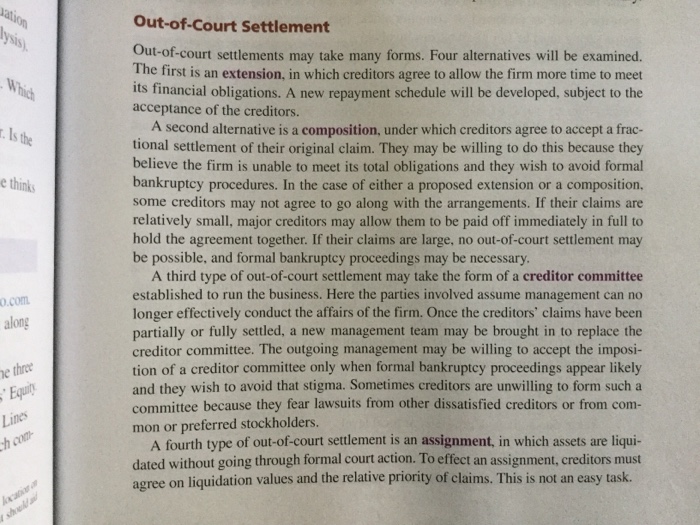

A. Hopefully, your firm or a firm you have invested in will never face financial distress; however, it does happen for various reasons. Briefly articulate in your own words, the different forms of distress/bankruptcy an organization may face (e.g., not all firms that file for bankruptcy will close their doors). What is the difference? Note: the reason this question is asked is that there is always a great deal of confusion surrounding financial distress, bankruptcy, and liquidation and it important that financial managers have knowledge of the risks and rewards of debt and debt management.

B. In your own words, summarize the difference between an internal and external reorganization under formal bankruptcy procedures.

C. What is the order of claims during a bankruptcy? Do you agree with this order? Does it make a difference to you as a prospective investor? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started