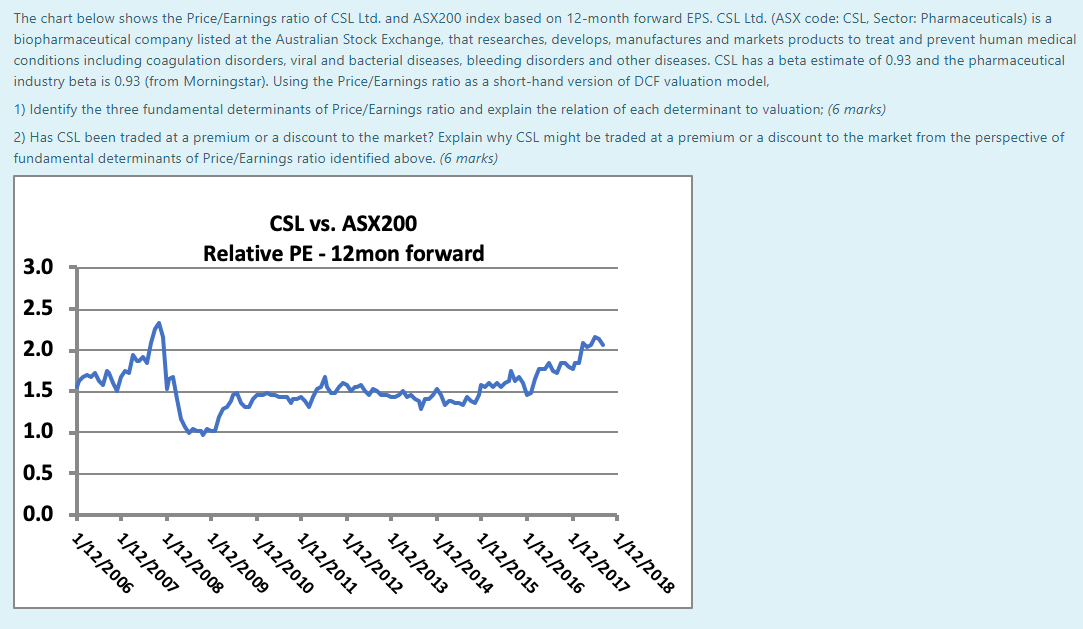

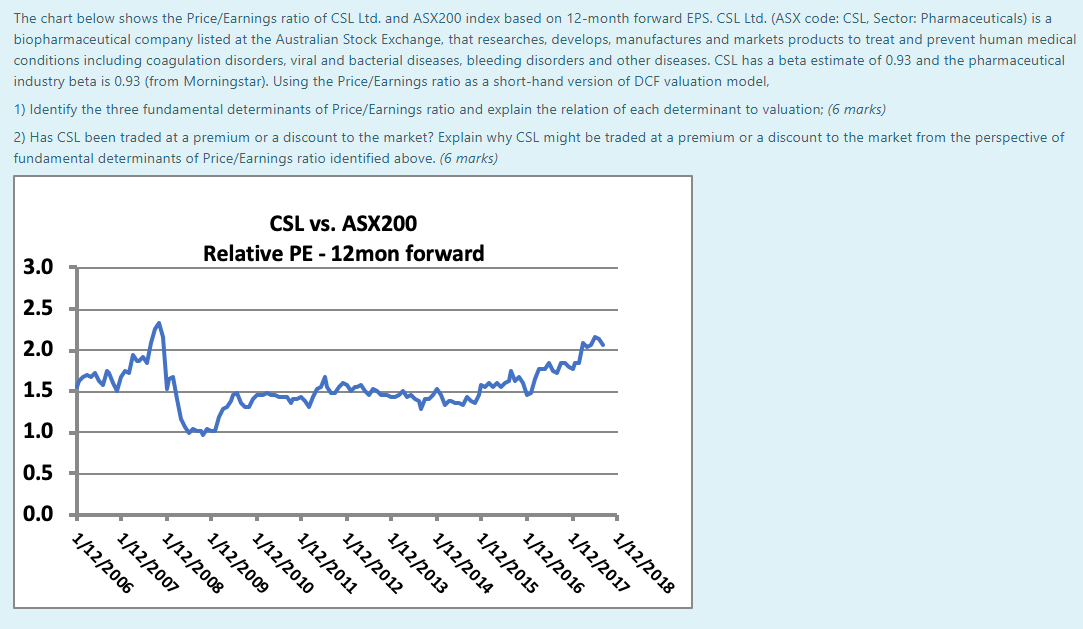

The chart below shows the Price/Earnings ratio of CSL Ltd. and ASX200 index based on 12-month forward EPS. CSL Ltd. (ASX code: CSL, Sector: Pharmaceuticals) is a biopharmaceutical company listed at the Australian Stock Exchange, that researches, develops, manufactures and markets products to treat and prevent human medical conditions including coagulation disorders, viral and bacterial diseases, bleeding disorders and other diseases. CSL has a beta estimate of 0.93 and the pharmaceutical industry beta is 0.93 (from Morningstar). Using the Price/Earnings ratio as a short-hand version of DCF valuation model, 1) Identify the three fundamental determinants of Price/Earnings ratio and explain the relation of each determinant to valuation; (6 marks) 2) Has CSL been traded at a premium or a discount to the market? Explain why CSL might be traded at a premium or a discount to the market from the perspective of fundamental determinants of Price/Earnings ratio identified above. (6 marks) CSL vs. ASX200 Relative PE - 12mon forward 3.0 2.5 2.0 Luma 1.5 nyum 1.0 0.5 0.0 1/12/2010 1/12/2009 1/12/2008 1/12/2007 1/12/2006 1/12/2018 1/12/2017 1/12/2016 1/12/2015 1/12/2014 1/12/2013 1/12/2012 1/12/2011 The chart below shows the Price/Earnings ratio of CSL Ltd. and ASX200 index based on 12-month forward EPS. CSL Ltd. (ASX code: CSL, Sector: Pharmaceuticals) is a biopharmaceutical company listed at the Australian Stock Exchange, that researches, develops, manufactures and markets products to treat and prevent human medical conditions including coagulation disorders, viral and bacterial diseases, bleeding disorders and other diseases. CSL has a beta estimate of 0.93 and the pharmaceutical industry beta is 0.93 (from Morningstar). Using the Price/Earnings ratio as a short-hand version of DCF valuation model, 1) Identify the three fundamental determinants of Price/Earnings ratio and explain the relation of each determinant to valuation; (6 marks) 2) Has CSL been traded at a premium or a discount to the market? Explain why CSL might be traded at a premium or a discount to the market from the perspective of fundamental determinants of Price/Earnings ratio identified above. (6 marks) CSL vs. ASX200 Relative PE - 12mon forward 3.0 2.5 2.0 Luma 1.5 nyum 1.0 0.5 0.0 1/12/2010 1/12/2009 1/12/2008 1/12/2007 1/12/2006 1/12/2018 1/12/2017 1/12/2016 1/12/2015 1/12/2014 1/12/2013 1/12/2012 1/12/2011