Answered step by step

Verified Expert Solution

Question

1 Approved Answer

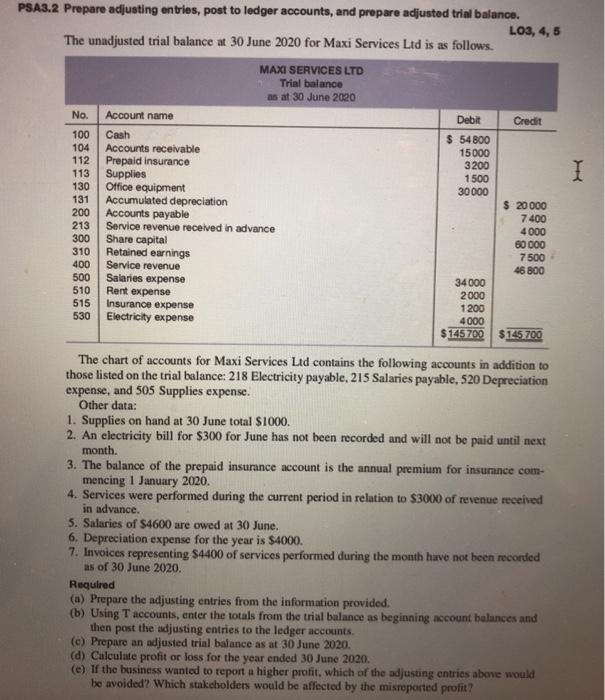

PSA3.2 Prepare adjusting entries, post to ledger accounts, and prepare adjusted trial balance. LO3, 4, 5 The unadjusted trial balance at 30 June 2020

PSA3.2 Prepare adjusting entries, post to ledger accounts, and prepare adjusted trial balance. LO3, 4, 5 The unadjusted trial balance at 30 June 2020 for Maxi Services Ltd is as follows. MAXI SERVICES LTD Trial balance as at 30 June 2020 No. Account name 100 Cash 104 Accounts receivable 112 Prepaid insurance 113 Supplies 130 Office equipment 131 200 213 300 310 400 500 510 515 530 Accumulated depreciation Accounts payable Service revenue received in advance Share capital Retained earnings Service revenue Salaries expense Rent expense Insurance expense Electricity expense Debit $ 54800 15000 3200 1500 30000 34000 2000 1200 4000 $145 700 Credit $ 20 000 7400 4000 60 000 7.500 46 800 $145 700 The chart of accounts for Maxi Services Ltd contains the following accounts in addition to those listed on the trial balance: 218 Electricity payable, 215 Salaries payable, 520 Depreciation expense, and 505 Supplies expense. Other data: 1. Supplies on hand at 30 June total $1000. 2. An electricity bill for $300 for June has not been recorded and will not be paid until next month. 3. The balance of the prepaid insurance account is the annual premium for insurance com- mencing 1 January 2020. 4. Services were performed during the current period in relation to $3000 of revenue received in advance. 5. Salaries of $4600 are owed at 30 June. 6. Depreciation expense for the year is $4000. 7. Invoices representing $4400 of services performed during the month have not been recorded as of 30 June 2020. Required (a) Prepare the adjusting entries from the information provided. (b) Using T accounts, enter the totals from the trial balance as beginning account balances and then post the adjusting entries to the ledger accounts. (c) Prepare an adjusted trial alance as at 30 June 2020. (d) Calculate profit or loss for the year ended 30 June 2020. (e) If the business wanted to report a higher profit, which of the adjusting entries above would be avoided? Which stakeholders would be affected by the misreported profit? I

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTIONS a 1 2 3 Date 2020 June 30 30 30 Account name narratio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started