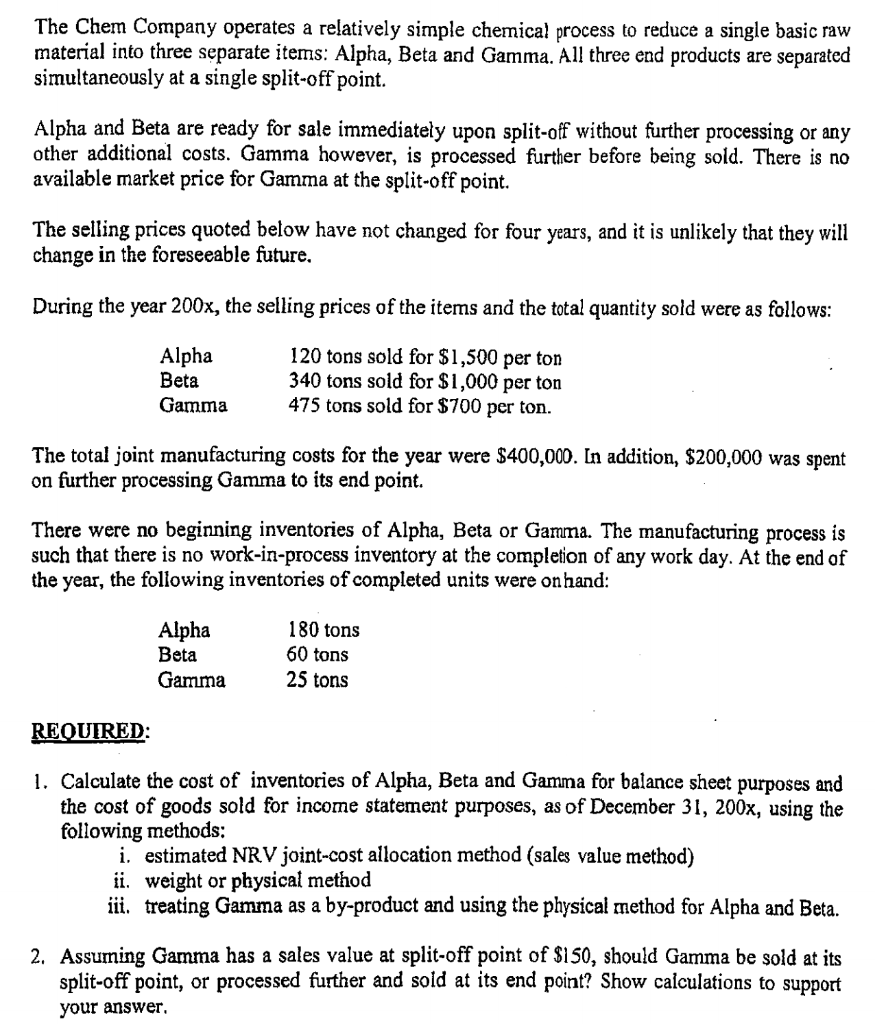

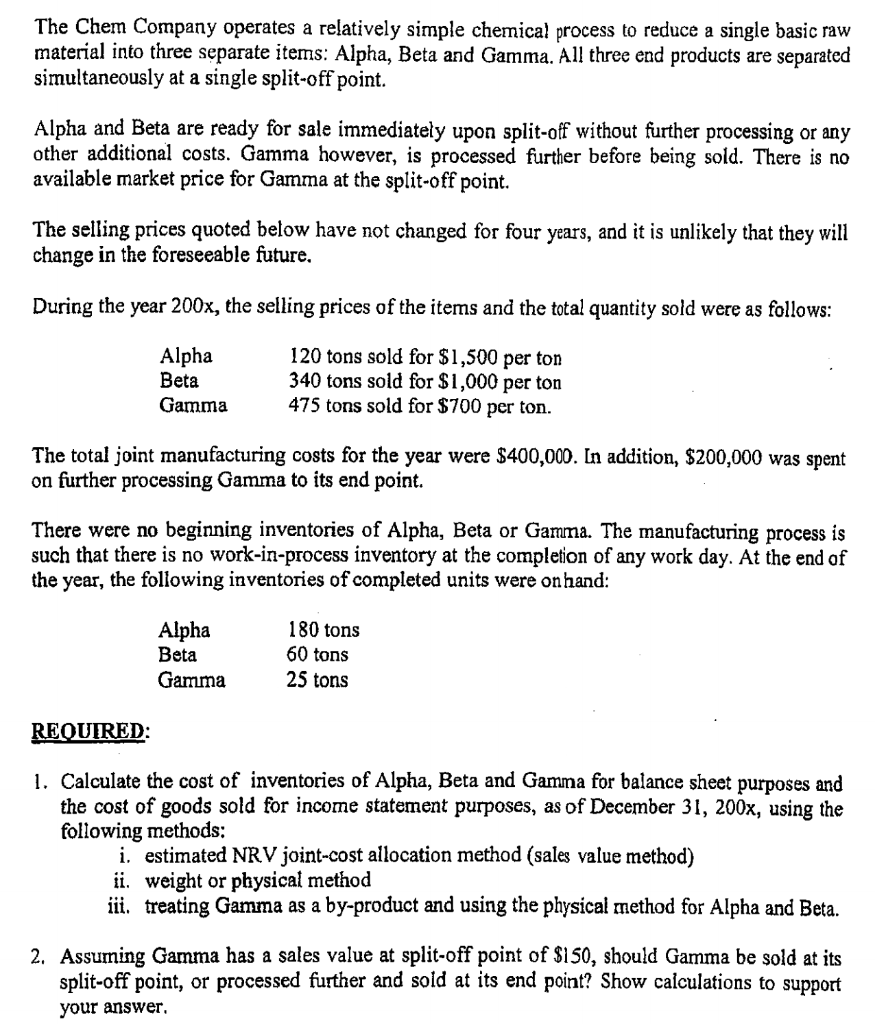

The Chem Company operates a relatively simple chemical process to reduce a single basic raw material into three separate items: Alpha, Beta and Gamma. All three end products are separated simultaneously at a single split-off point. Alpha and Beta are ready for sale immediately upon split-off without further processing or any other additional costs. Gamma however, is processed further before being sold. There is no available market price for Gamma at the split-off point. The selling prices quoted below have not changed for four years, and it is unlikely that they will change in the foreseeable future, During the year 200x, the selling prices of the items and the total quantity sold were as follows: Alpha Beta Gamma 120 tons sold for $1,500 per ton 340 tons sold for $1,000 per ton 475 tons sold for $700 per ton. The total joint manufacturing costs for the year were $400,000. In addition, $200,000 was spent on further processing Gamma to its end point. There were no beginning inventories of Alpha, Beta or Gamma. The manufacturing process is such that there is no work-in-process inventory at the completion of any work day. At the end of the year, the following inventories of completed units were on hand: Alpha Beta Gamma 180 tons 60 tons 25 tons REQUIRED: 1. Calculate the cost of inventories of Alpha, Beta and Gamma for balance sheet purposes and the cost of goods sold for income statement purposes, as of December 31, 200x, using the following methods: i estimated NRV joint-cost allocation method (sales value method) ii. weight or physical method iii. treating Gamma as a by-product and using the physical method for Alpha and Beta. 2. Assuming Gamma has a sales value at split-off point of $150, should Gamma be sold at its split-off point, or processed further and sold at its end point? Show calculations to support your answer. The Chem Company operates a relatively simple chemical process to reduce a single basic raw material into three separate items: Alpha, Beta and Gamma. All three end products are separated simultaneously at a single split-off point. Alpha and Beta are ready for sale immediately upon split-off without further processing or any other additional costs. Gamma however, is processed further before being sold. There is no available market price for Gamma at the split-off point. The selling prices quoted below have not changed for four years, and it is unlikely that they will change in the foreseeable future, During the year 200x, the selling prices of the items and the total quantity sold were as follows: Alpha Beta Gamma 120 tons sold for $1,500 per ton 340 tons sold for $1,000 per ton 475 tons sold for $700 per ton. The total joint manufacturing costs for the year were $400,000. In addition, $200,000 was spent on further processing Gamma to its end point. There were no beginning inventories of Alpha, Beta or Gamma. The manufacturing process is such that there is no work-in-process inventory at the completion of any work day. At the end of the year, the following inventories of completed units were on hand: Alpha Beta Gamma 180 tons 60 tons 25 tons REQUIRED: 1. Calculate the cost of inventories of Alpha, Beta and Gamma for balance sheet purposes and the cost of goods sold for income statement purposes, as of December 31, 200x, using the following methods: i estimated NRV joint-cost allocation method (sales value method) ii. weight or physical method iii. treating Gamma as a by-product and using the physical method for Alpha and Beta. 2. Assuming Gamma has a sales value at split-off point of $150, should Gamma be sold at its split-off point, or processed further and sold at its end point? Show calculations to support your