Answered step by step

Verified Expert Solution

Question

1 Approved Answer

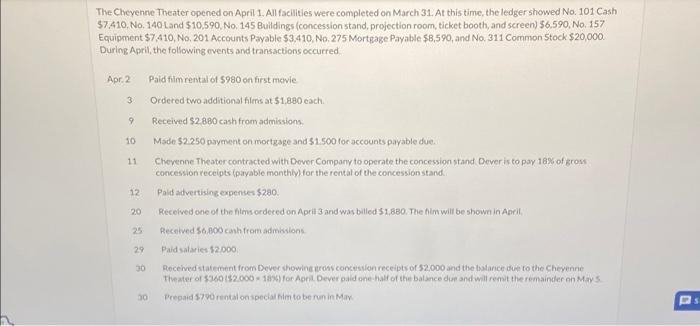

The Cheyenne Theater opened on April 1. All facilities were completed on March 31. At this time, the ledger showed No. 101 Cash $7,410,

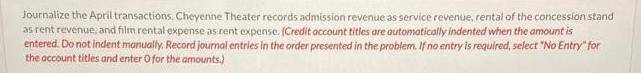

The Cheyenne Theater opened on April 1. All facilities were completed on March 31. At this time, the ledger showed No. 101 Cash $7,410, No. 140 Land $10,590, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $6,590, No. 157 Equipment $7,410, No. 201 Accounts Payable $3,410, No. 275 Mortgage Payable $8,590, and No. 311 Common Stock $20,000. During April, the following events and transactions occurred Apr. 2 3 9 10 11 28228 12 20 25 29 30 30 Paid film rental of $980 on first movie Ordered two additional films at $1,880 each. Received $2.880 cash from admissions. Made $2.250 payment on mortgage and $1.500 for accounts payable due. Cheyenne Theater contracted with Dever Company to operate the concession stand Dever is to pay 18% of gross concession receipts (payable monthly) for the rental of the concession stand. Paid advertising expenses $280. Received one of the films ordered on April 3 and was billed $1,880. The film will be shown in April, Received $6.800 cash from admissions. Paid salaries $2,000 Received statement from Dever showing gross concession receipts of $2,000 and the balance due to the Cheyenne Theater of $360 ($2.000-18%) for April. Dever paid one-half of the balance due and will remit the remainder on May 5 Prepaid $790 rental on special him to be run in May Journalize the April transactions. Cheyenne Theater records admission revenue as service revenue, rental of the concession stand as rent revenue, and film rental expense as rent expense. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The April transactions are journalized below Date Description Debit Credit April 2 Film Rent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started