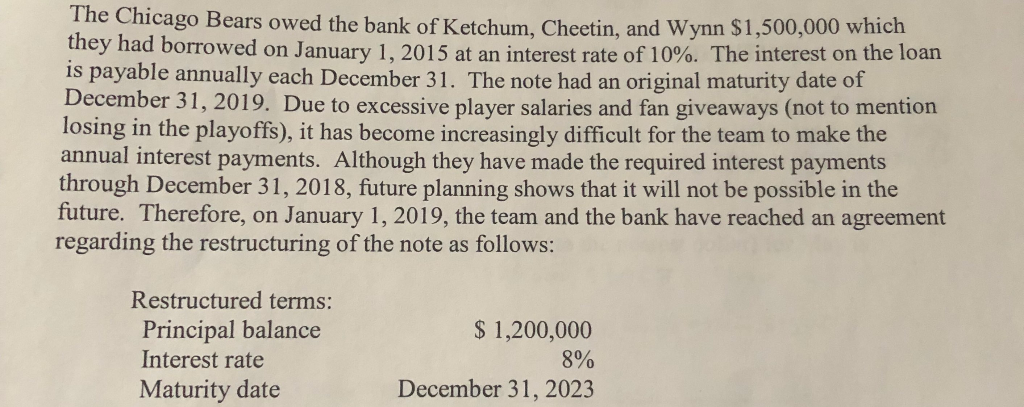

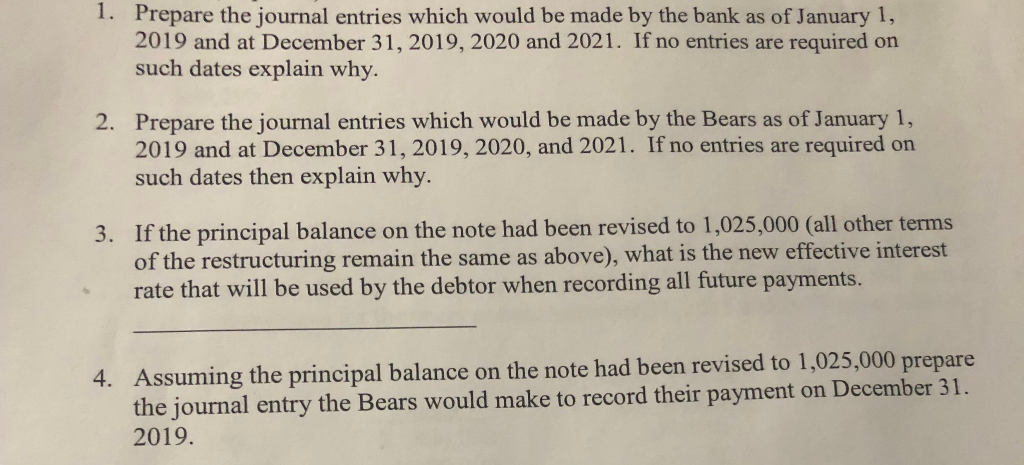

The Chicago Bears owed the bank ofKetchum. Cheetin, and Wynn $1,500,000 which th ey had borrowed on January 1, 2015 at an interest rate of 10%. The interest on the loan is payable annually each December 31. The note had an original maturity date of December 31, 2019. Due to excessive player salaries and fan giveaways (not to mention losing in the playoffs), it has become increasingly difficult for the team to make the annual interest payments. Although they have made the required interest payments through December 31, 2018, future planning shows that it will not be possible in the future. Therefore, on January 1, 2019, the team and the bank have reached an agreement regarding the restructuring of the note as follows: Restructured terms: Principal balance Interest rate Maturity date S 1,200,000 8% December 31, 2023 1. Prepare the journal entries which would be made by the bank as of January 1, 2019 and at December 31, 2019, 2020 and 2021. If no entries are required on such dates explain why. Prepare the journal entries which would be made by the Bears as of January 1, 2019 and at December 31, 2019, 2020, and 2021. If no entries are required on such dates then explain why. 2. If the principal balance on the note had been revised to 1,025,000 (all other terms of the restructuring remain the same as above), what is the new effective interest rate that will be used by the debtor when recording all future payments. 3. Assuming the principal balance on the note had been revised to 1,025,000 prepare the journal entry the Bears would make to record their payment on December 31 2019. 4. The Chicago Bears owed the bank ofKetchum. Cheetin, and Wynn $1,500,000 which th ey had borrowed on January 1, 2015 at an interest rate of 10%. The interest on the loan is payable annually each December 31. The note had an original maturity date of December 31, 2019. Due to excessive player salaries and fan giveaways (not to mention losing in the playoffs), it has become increasingly difficult for the team to make the annual interest payments. Although they have made the required interest payments through December 31, 2018, future planning shows that it will not be possible in the future. Therefore, on January 1, 2019, the team and the bank have reached an agreement regarding the restructuring of the note as follows: Restructured terms: Principal balance Interest rate Maturity date S 1,200,000 8% December 31, 2023 1. Prepare the journal entries which would be made by the bank as of January 1, 2019 and at December 31, 2019, 2020 and 2021. If no entries are required on such dates explain why. Prepare the journal entries which would be made by the Bears as of January 1, 2019 and at December 31, 2019, 2020, and 2021. If no entries are required on such dates then explain why. 2. If the principal balance on the note had been revised to 1,025,000 (all other terms of the restructuring remain the same as above), what is the new effective interest rate that will be used by the debtor when recording all future payments. 3. Assuming the principal balance on the note had been revised to 1,025,000 prepare the journal entry the Bears would make to record their payment on December 31 2019. 4