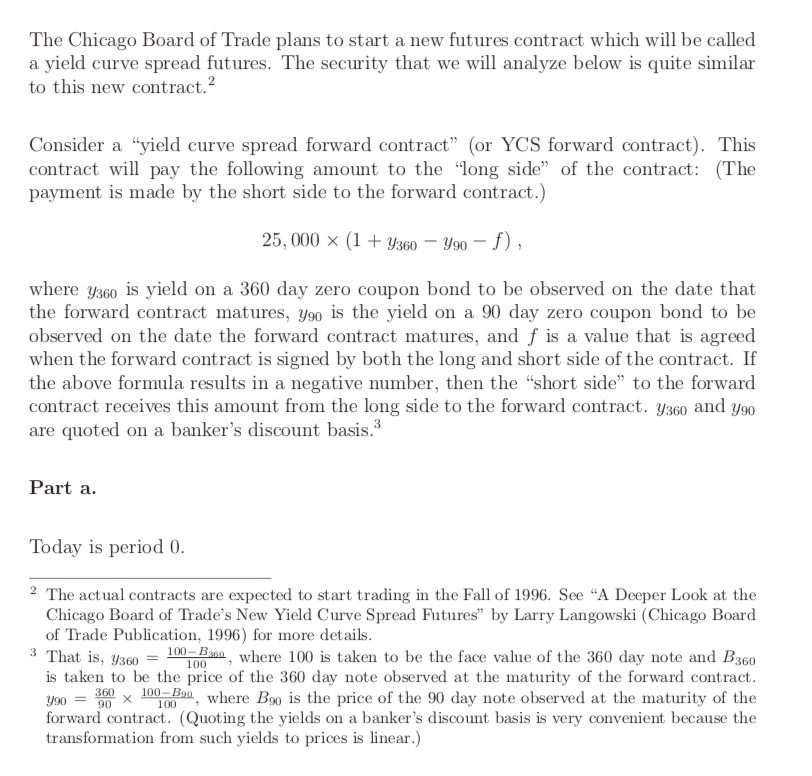

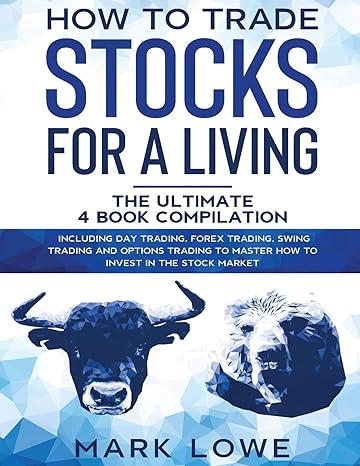

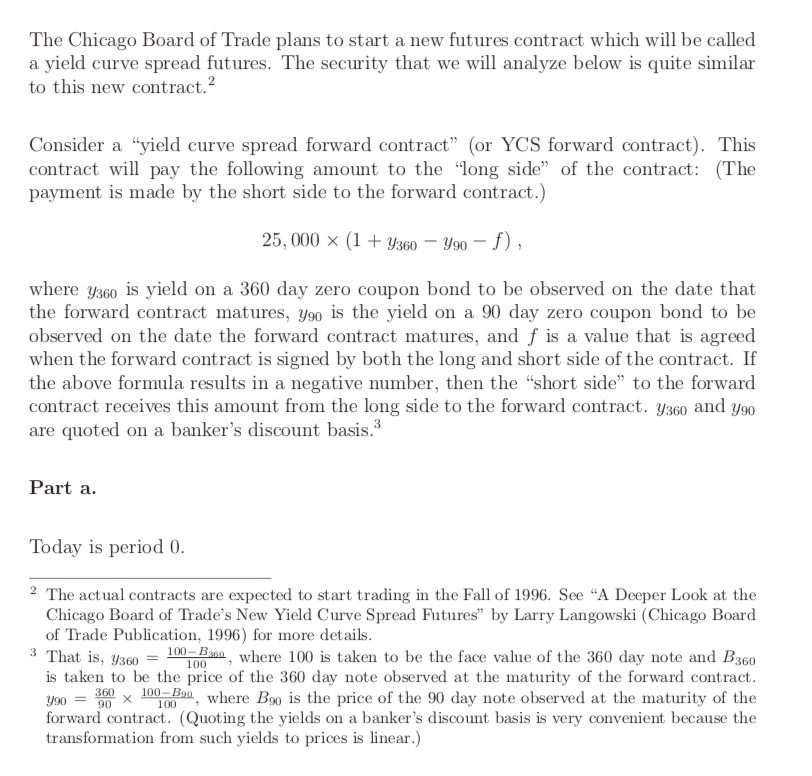

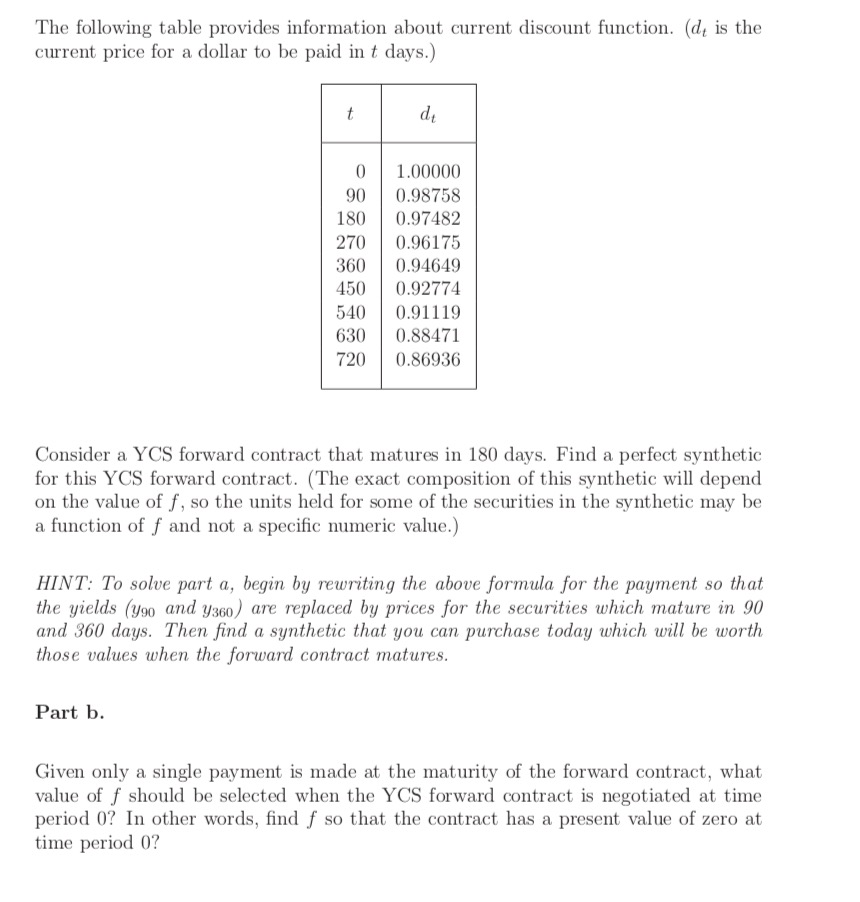

The Chicago Board of Trade plans to start a new futures contract which will be called a yield curve spread futures. The security that we will analyze below is quite similar to this new contract.2 Consider a "yield curve spread forward contract" (or YCS forward contract). This contract will pay the following amount to the "long side of the contract: The payment is made by the short side to the forward contract.) 25,000 x (1 + Y360 - Y90 - f), where Y360 is yield on a 360 day zero coupon bond to be observed on the date that the forward contract matures, Y90 is the yield on a 90 day zero coupon bond to be observed on the date the forward contract matures, and f is a value that is agreed when the forward contract is signed by both the long and short side of the contract. If the above formula results in a negative number, then the "short side" to the forward contract receives this amount from the long side to the forward contract. Y360 and 490 are quoted on a banker's discount basis.3 Part a. Today is period 0. 2 The actual contracts are expected to start trading in the Fall of 1996. See "A Deeper Look at the Chicago Board of Trade's New Yield Curve Spread Futures" by Larry Langowski (Chicago Board of Trade Publication, 1996) for more details. 3 That is, 4360 = 100-B , where 100 is taken to be the face value of the 360 day note and B360 is taken to be the price of the 360 day note observed at the maturity of the forward contract. ygo = 500 x 10000990, where B90 is the price of the 90 day note observed at the maturity of the forward contract. (Quoting the yields on a banker's discount basis is very convenient because the transformation from such yields to prices is linear.) The following table provides information about current discount function. (dt is the current price for a dollar to be paid in t days.) dt 90 180 270 360 450 540 630 720 1.00000 0.98758 0.97482 0.96175 0.94649 0.92774 0.91119 0.88471 0.86936 Consider a YCS forward contract that matures in 180 days. Find a perfect synthetic for this YCS forward contract. The exact composition of this synthetic will depend on the value of f, so the units held for some of the securities in the synthetic may be a function of f and not a specific numeric value.) HINT: To solve part a, begin by rewriting the above formula for the payment so that the yields (Y90 and Y360) are replaced by prices for the securities which mature in 90 those values when the forward contract matures. Part b. Given only a single payment is made at the maturity of the forward contract, what value off should be selected when the YCS forward contract is negotiated at time period 0? In other words, find f so that the contract has a present value of zero at time period 0? The Chicago Board of Trade plans to start a new futures contract which will be called a yield curve spread futures. The security that we will analyze below is quite similar to this new contract.2 Consider a "yield curve spread forward contract" (or YCS forward contract). This contract will pay the following amount to the "long side of the contract: The payment is made by the short side to the forward contract.) 25,000 x (1 + Y360 - Y90 - f), where Y360 is yield on a 360 day zero coupon bond to be observed on the date that the forward contract matures, Y90 is the yield on a 90 day zero coupon bond to be observed on the date the forward contract matures, and f is a value that is agreed when the forward contract is signed by both the long and short side of the contract. If the above formula results in a negative number, then the "short side" to the forward contract receives this amount from the long side to the forward contract. Y360 and 490 are quoted on a banker's discount basis.3 Part a. Today is period 0. 2 The actual contracts are expected to start trading in the Fall of 1996. See "A Deeper Look at the Chicago Board of Trade's New Yield Curve Spread Futures" by Larry Langowski (Chicago Board of Trade Publication, 1996) for more details. 3 That is, 4360 = 100-B , where 100 is taken to be the face value of the 360 day note and B360 is taken to be the price of the 360 day note observed at the maturity of the forward contract. ygo = 500 x 10000990, where B90 is the price of the 90 day note observed at the maturity of the forward contract. (Quoting the yields on a banker's discount basis is very convenient because the transformation from such yields to prices is linear.) The following table provides information about current discount function. (dt is the current price for a dollar to be paid in t days.) dt 90 180 270 360 450 540 630 720 1.00000 0.98758 0.97482 0.96175 0.94649 0.92774 0.91119 0.88471 0.86936 Consider a YCS forward contract that matures in 180 days. Find a perfect synthetic for this YCS forward contract. The exact composition of this synthetic will depend on the value of f, so the units held for some of the securities in the synthetic may be a function of f and not a specific numeric value.) HINT: To solve part a, begin by rewriting the above formula for the payment so that the yields (Y90 and Y360) are replaced by prices for the securities which mature in 90 those values when the forward contract matures. Part b. Given only a single payment is made at the maturity of the forward contract, what value off should be selected when the YCS forward contract is negotiated at time period 0? In other words, find f so that the contract has a present value of zero at time period 0