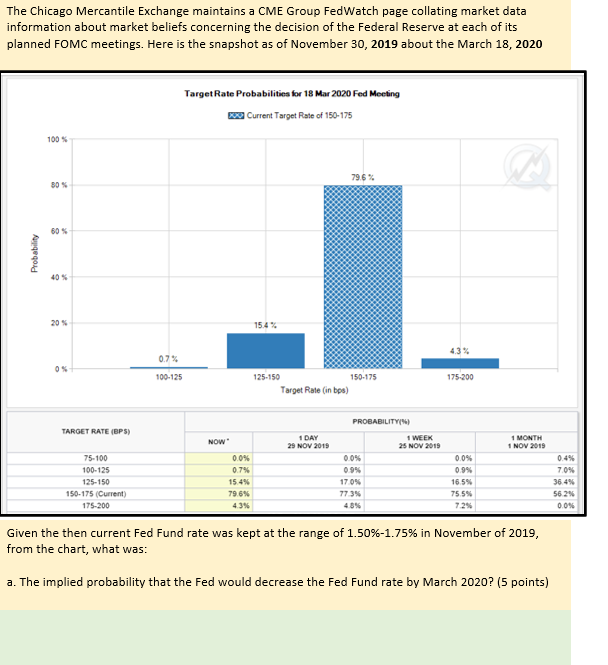

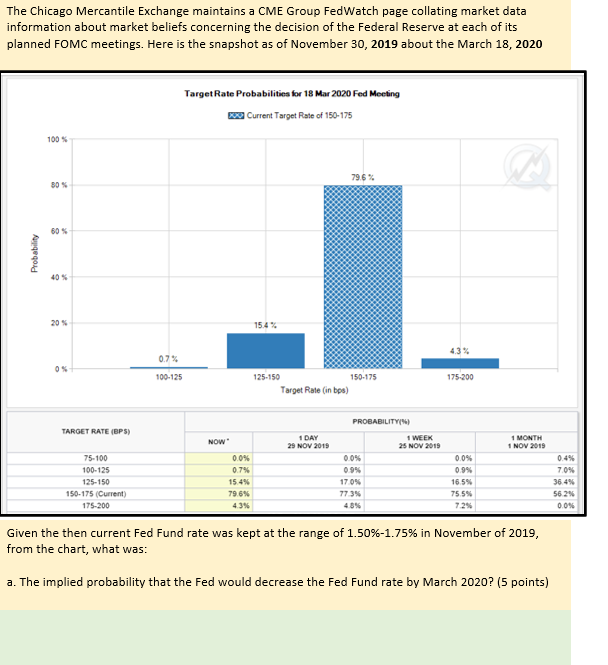

The Chicago Mercantile Exchange maintains a CME Group FedWatch page collating market data information about market beliefs concerning the decision of the Federal Reserve at each of its planned FOMC meetings. Here is the snapshot as of November 30, 2019 about the March 18, 2020 Target Rate Probabilities for 18 Mar 2020 Fed Meeting w Current Target Rate of 150-175 100 79.6% 805 60 % Probability 40 % 20 % 15.4% 0.7% 100-125 175-200 125-150 150-175 Target Rate (in be) TARGET RATE (BPS) PROBABILITY 1 WEEK 25 NOV 2019 NOW 1 DAY 29 NOV 2017 1 MONTH 1 NOV 2019 75-100 100-125 125-150 150-175 (Current 175-200 0.0% 0.7% 15.4% 79 69 17 0% 773% 43% 0.0% 0.9% 16.5% 755 7.2% 0.4% 70% 36.4% 562 0.0% Given the then current Fed Fund rate was kept at the range of 1.50%-1.75% in November of 2019, from the chart, what was: a. The implied probability that the Fed would decrease the Fed Fund rate by March 2020? (5 points) b. Given that the likelihood of an interest rate cut was greater than the likelihood of an interest rate hike, how would you have changed the position of your fixed income portfolio? (5 points) The Chicago Mercantile Exchange maintains a CME Group FedWatch page collating market data information about market beliefs concerning the decision of the Federal Reserve at each of its planned FOMC meetings. Here is the snapshot as of November 30, 2019 about the March 18, 2020 Target Rate Probabilities for 18 Mar 2020 Fed Meeting w Current Target Rate of 150-175 100 79.6% 805 60 % Probability 40 % 20 % 15.4% 0.7% 100-125 175-200 125-150 150-175 Target Rate (in be) TARGET RATE (BPS) PROBABILITY 1 WEEK 25 NOV 2019 NOW 1 DAY 29 NOV 2017 1 MONTH 1 NOV 2019 75-100 100-125 125-150 150-175 (Current 175-200 0.0% 0.7% 15.4% 79 69 17 0% 773% 43% 0.0% 0.9% 16.5% 755 7.2% 0.4% 70% 36.4% 562 0.0% Given the then current Fed Fund rate was kept at the range of 1.50%-1.75% in November of 2019, from the chart, what was: a. The implied probability that the Fed would decrease the Fed Fund rate by March 2020? (5 points) b. Given that the likelihood of an interest rate cut was greater than the likelihood of an interest rate hike, how would you have changed the position of your fixed income portfolio? (5 points)